The 5 best metal currencies to see this week

Meme coins have recently witnessed mixed shows, as some symbols are gathered while others continue to struggle. Wojak and Pengu tries to restore momentum, while SPX6900 is still in sharp correction, trading less than one dollar for two weeks.

Meanwhile, projects focusing on artificial intelligence such as ARC and AI16Z show signs of recovery, and benefit from renewed interest in Crypto AI. With the presence of main resistance levels and support levels in focus, these symbols are among the most prominent in the market this week.

Artificial Intelligence Platform (ARC)

ARC is a Solana -based artificial intelligence symbol, which was originally launched on Pumpfun. The main product innovation is the RIG Framework, a system designed to create and manage a lightweight Crypto AI.

The distinctive symbol has increased by 72 % in the past seven days as it tries to pay attention to Crypto AI, apostasy. This renewed attention sparked strong pressure to buy, pushing the price of ARC up. If the momentum continues, the additional gains can be followed with the increased demand for Blockchain solutions on behalf.

The ARC can soon test the $ 0.31 resistance, and the penetration can be led by about $ 0.44. If the upward force remains, the distinctive symbol may rise to $ 0.63, which is its highest level since late January. However, failure to maintain momentum may lead to a decline, which puts the recent gains.

Wojak (wojak)

Wojak was one of the best coins last week, with nearly 25 % in seven days. After this gathering, the EMA lines began to be rapprochement, which may indicate a shift in the direction. If the upward trend is reflected in the declining direction, Wojak may test $ 0.24 support, and if this level fails, it may decrease to $ 0.138.

This would indicate poor momentum and possible correction.

If Wojak is able to keep its bullish momentum, it can push the resistance of $ 0.318. The collapse above this level may lead to more gains, with goals at $ 0.44 and possibly $ 0.63 if the upward trend remains strong.

This would represent its highest price since late January.

Spx6900

SPX6900 has been in sharp correction, as it has decreased by 48 % over the past thirty days, similar to many other coins. Its price remains less than one dollar for two weeks, and its EMA lines appear a declining look, with short -term lines less than long -term lines.

Despite the recession, the seventh SPX6900 is still the largest Mimi currency depending on the maximum market, at a value of 668 million dollars currently. This indicates that, while struggling, it still holds a strong position in the meme’s currency sector.

If SPX6900 regains momentum, this may rise to a $ 0.80 resistance test, with other targets at $ 0.97 and $ 1.38 in case of promoting the upward trend.

However, if the declining direction continues, it may decrease to $ 0.64, and if this support fails, a decrease to $ 0.54 may follow. The coming days will determine whether SPX6900 can install or extend its losses.

AI16Z

AI16Z is one of the most prominent Crypto AI’s agents, which gains more than 13 % in the past seven days as it tries to recover from a severe decrease of 66 % in the last 30 days. Despite the short -term reflux, it is still in a declining direction, and is fighting to restore the lost momentum.

The maximum market is currently $ 438 million, but EMA lines indicate that the trend is still a decline. If the declining direction continues, AI16Z can test $ 0.26 support, which increases pressure on its price. Failure to keep this level can indicate more from the downside of the distinctive symbol.

If the Crypto Ai agent recounts the noise since the previous months, AI16Z can test the resistance of $ 0.47. The penetration can pay about $ 0.62 and $ 0.92, and if the momentum strengthens, the distinctive symbol may rise over one dollar for the first time since January 23, and it may reach $ 1.26.

Penguins (Penguins)

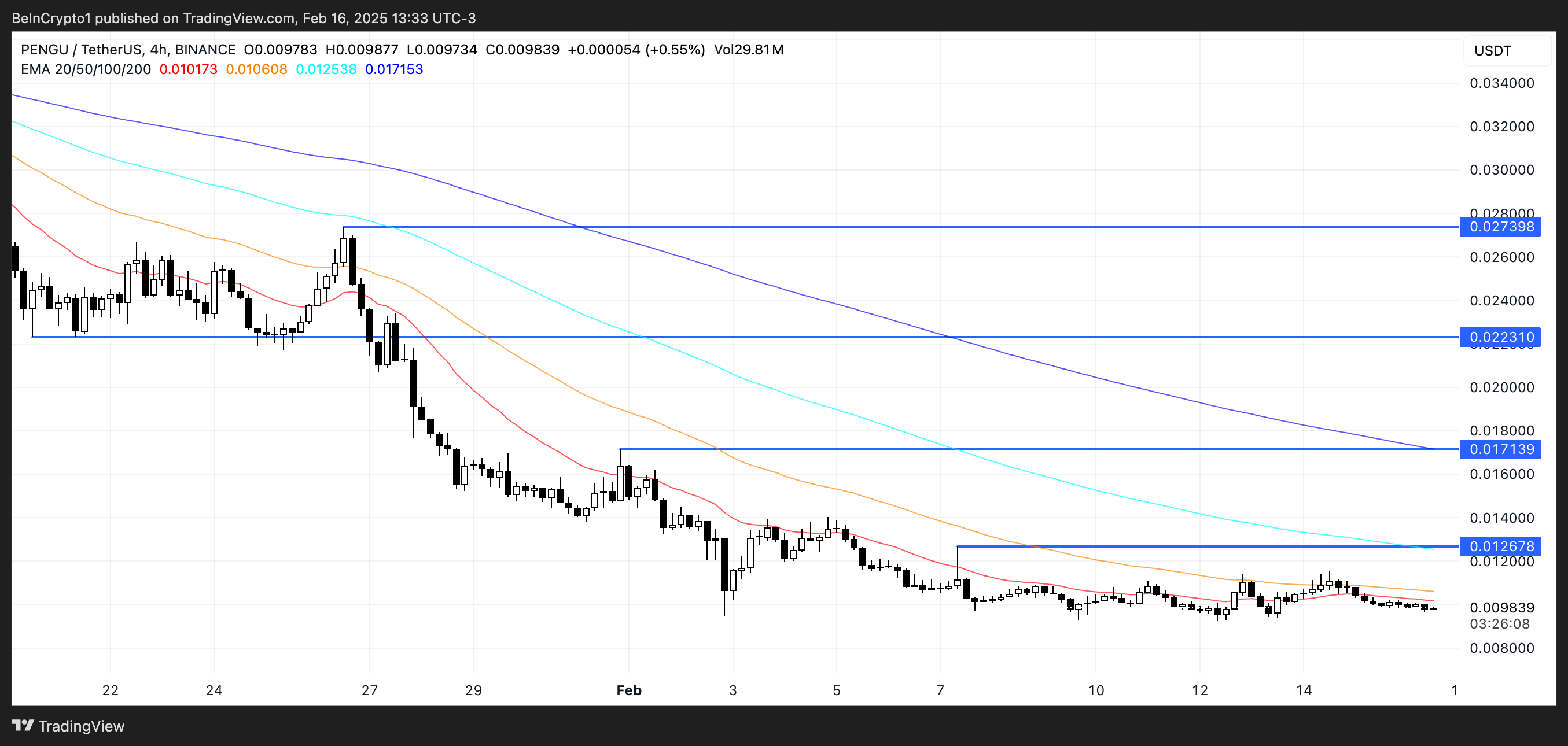

Pengu is currently trading at its lowest levels ever after it has become the largest Mimi currency in Solana. The market ceiling has now decreased to $ 617 million. Despite this decline, one of the most famous assets is still in the Solana Meme ecosystem.

Pudgy Penguins is one of the most famous brands in NFT, and if you see MeMe coins a strong return, Pengu may restore momentum.

The penetration can first test the resistance levels at $ 0.0126 and $ 0.017, which will be a key to reflect the declining direction. Continuous bullish momentum can pay the penguin about $ 0.022 and up to $ 0.027.

Currently, the penguin is still under pressure at its lowest levels, and it needs to turn morale to stimulate recovery. The total strength of the Meme currency sector will determine whether it can be bounced or continuing to struggle near its lowest levels.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.