Most likely a recovery from the lowest level Friday

The S&P 500 is scheduled to open the highest despite the escalation of the Middle East – but is the correction ended?

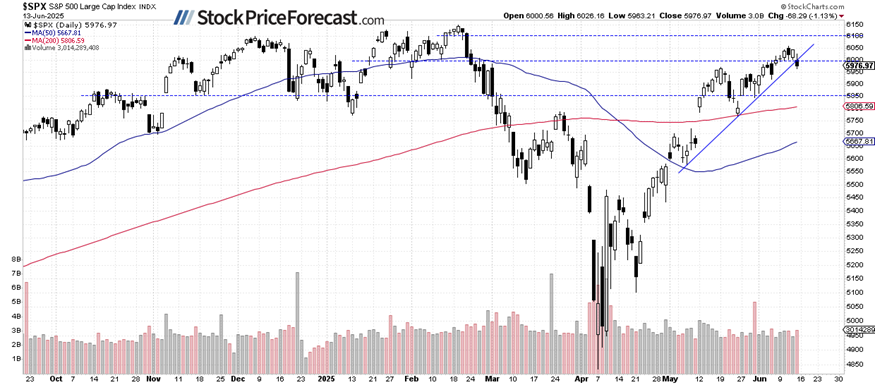

The shares fell on Friday, with the closure of the S&P 500 lower by 1.13 %, as tensions escalated in the Israeli conflict. The index restored some recent gains, as it fell to less than 6000 levels. However, the S&P 500 is expected to open today 0.6 % higher after dipping it at the beginning and extending the decline in late Friday.

In my opinion, this still is a short -term unification, with no clear and clear negative signals. In addition to the Middle East conflict, investors will wait for the main interest rate of FOMC to be released on Wednesday.

Investors’ morale improved, as shown in AIII’s morale surveying on Wednesday, which stated that 36.7 % of individual investors are optimistic, while 33.6 % of the decline.

The S&P 500 has violated the bullish trend line on Friday, which sparked some technical concerns.

S & P 500: Less less than last week

The S&P 500 closed 0.39 % less last week after reaching the highest new local level of 6,059.40 – the highest level since February. However, unification was extended a month ago when the index reached about 5,960.

The index continues to circulate higher than early May, the weekly gap, which is a bullish technical signal. However, the resistance is still about 6100.

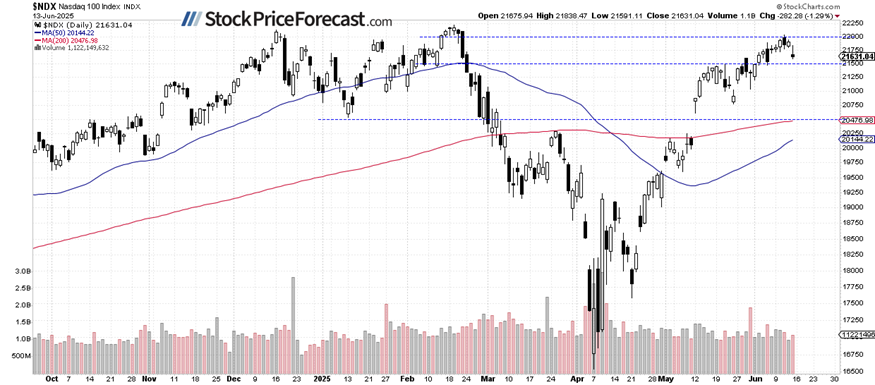

Nasdak 100: a deeper withdrawal

NASDAQ 100 fell by 1.29 % on Friday, which led to twice the broader market due to the weakness of the technology sector. Initially, the Nasdaq 100 Futures retreated from its lowest levels at night, but bers finally benefited later in the day, prompting the Nasdaq 100 support below about 21,700.

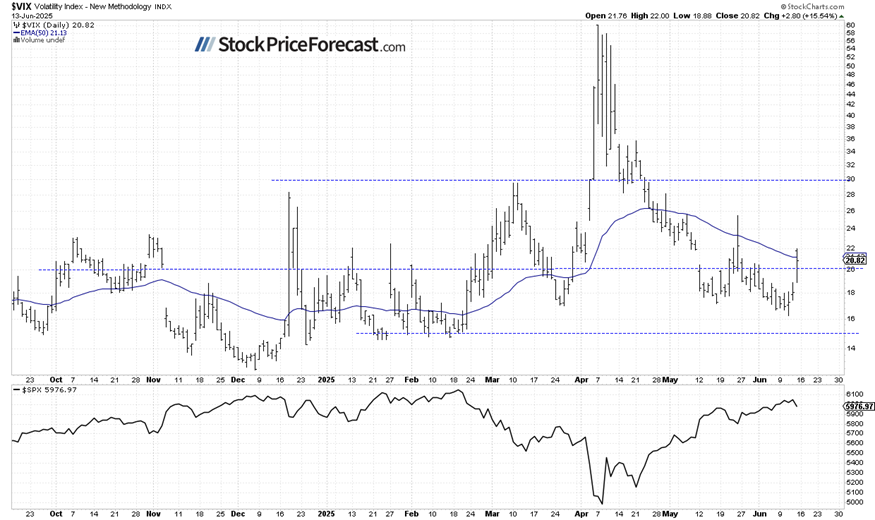

VIX jumps over 20 on geopolitical concerns

Last Wednesday, the VIX index decreased to the lowest local level of 16.23, indicating a decrease in investor’s fear. However, on Friday, it turned to the highest local level of 22.00 amid Middle East tensions.

Historically, the VIX decrease indicates less fear in the market, and the VIX height accompanies the shrinkage market shrinkage. However, the higher the Vix, the higher the impact of the declining market. On the contrary, the higher the Vix, the higher the impact of the upward market.

S & P 500 futures: try to restore the land

This morning, the future S& P 500 nodes are recovering and extending short -term unification. The resistance level is about 6100-6,120, characterized by its highest local levels, while support remains 6000.

Currently, this seems to be uniform and flat correction within the upward trend.

conclusion

On Friday’s sale was driven by increasing geopolitical tensions, especially concerns about possible weekend developments in the Middle East. Futures opened less but soon wore local declines, and S&P is expected to open up 0.6 % today – extension of its unification.

The market will wait for a series of economic data this week, including the FOMC monetary policy update on Wednesday.

This is the collapse:

-

S&P 500 is scheduled to recover some losses on Friday despite the ongoing tensions in the Middle East.

-

There are no clear significant signals yet, but a deeper correction of the bottom is not out of some point.

Do you want a free follow -up of the above article and the details are not available for 99 % investors+? Subscribe to the free newsletter today!