TON Network strikes new heights with a USDT supply of $ 71 billion

- Tron now hosts $ 71 billion in Usdt, with GAP closed with ETAREM at $ 74.5 billion.

- The network exceeds 2.66 million long -term reservation addresses.

- TRN is 29 % facilitates all Stablecoin transactions in the world.

TON has achieved a landmark in the Stablecoin sector, where the USDT (Tether) has reached Blockchain’s highest new level ever at $ 71 billion. This growth is placed in a position of only $ 3.5 billion behind ETHEREUM, which currently hosts $ 74.5 billion in Usdt, according to the latest data from Cryptoquant.

The increasing USDT supplies on TON has followed a steady escalating path over recent years, which narrows the gap with ETHEREUM in terms of the use of Stablecoin. When considering the total market value of $ 242 billion, TON now facilitates smooth transactions for approximately 29 % of all Stablecoin value worldwide and 47 % of the total market value in the United States worth $ 149 billion.

“This teacher enhances TON’s position as one of the main Blockchains in the DEFI space”.

Tron secures the main position in the user’s active participation

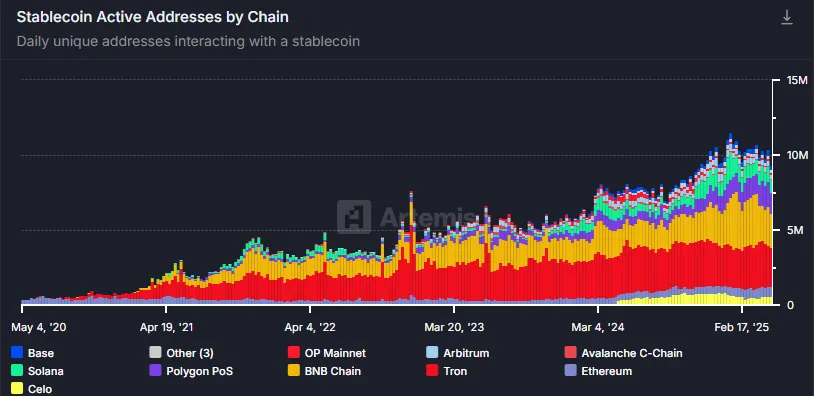

Beyond the size of raw transactions, TON got a pioneering position in the active user sharing. According to the data from Artemis, Tron is the most common Blockchain in its analysis, representing 28 % of all addresses of the active Stablecooin portfolio. This high level of Tron activity in the upper chain in terms of fee revenues from Stablecoin transactions.

The growth of the network comes at a time when experts expect a significant expansion in the Stablecoin sector. In addition to growth in USDT trading, TON has seen increasing the commitment of the distinguished symbol holder. Based on Cryptoquant, 2.66 million TRX retained its profits for more than a year without selling them.

This portfolio contains balances for more than 10 TRX, indicating that retail investors are ready for TRO’s long period of time despite the presence of limited capital.

Crazzyblockk analyst explains this figure as a sign of user and long -term meat, taking into account that “long -term enhanced reinforcement sometimes is in line with stronger beliefs in the basic network and liquidity.”

But this growth story comes with connected chains. In the opinion of some analysts, the network activity depends on USDT deals. Sandin dune analyzes data indicate that although more than 3 million TRX Portets are active on a typical day, the majority of which are traded only in USDT.