Today’s encryption prices: Bitcoin decreased after inflation data in the United States; Floki leads daily gains

Bitcoin for a short period of $ 95,000 earlier today, but it failed to keep it, and corrected it to $ 93,000 as the pressures that were installed during the late Asian trading hours.

The total cryptocurrency market has decreased more than 3 % throughout the day, but it managed to stay over the 3 trillion dollar sign with cautious optimism in the formation of investor morale.

The market feeling cools slightly, with fear and greed index sliding to 56, still is good in the greedy area.

Meanwhile, Altcoins had a quiet session, with minimal gains across the best 99 symbols at the time of writing this report.

Will Bitcoin rise?

Bitcoin continued trading sideways throughout the day in a narrow range ranging between $ 9333 and 95,443 dollars as merchants are waiting for the launch of the main economic data.

Two main points of data, the numbers of inflation in the United States of America and the Jolts opportunity, were released during the day, monitoring both merchants about the evidence for the next step for the Federal Reserve.

The inflation in PC (PCE) expenses came by 2.3 % on an annual basis, with a change of 0 % month.

Meanwhile, the PCE Core, which comes out of food and volatile energy, has decreased and is the preferred inflation of the Federal Reserve, to 2.6 % on an annual basis, the slightest reading of it since June 2024.

Bitcoin fell to 93,000 dollars shortly after the release, as traders re -assessed the probability of interest rates in the short term.

Although inflation numbers were stable, they did not give the Federal Reserve a great reason for roaming towards mitigation.

In addition to uncertainty, the latest Jolts report showed us job opportunities at the lowest level of 4 years, in which some market monitors argue strengthens the issue.

Future traders clearly agree. The CME Fedwatch Tool data shows 92.2 % that prices will remain unchanged at the FOMC meeting from 6 to 7 May.

Currently, the uncertainty in the macro continues to influence the origins of risk such as Bitcoin, maintain Range Range Range and Traders on the edge of the abyss before the final call of the thigh next week.

However, some of the upscale signs are still providing hope for merchants, as some expect a gathering towards the upward trend.

One of these signals comes from the MacI series, a complex index that combines long -term economy standards in the long run.

RSI only crossed the 52 -week -old moving average, a historical style for the start of Bitcoin Bull.

The last three transitions occurred before the Bitcoin marches in 2015, 2019 and Oras 2022.

This is the first ups of MCI since the bottom of the 2022 market, and analysts from Alpha Extract believe that it can put a sign of the early stages of the other penetration, which is likely to pay for a level of $ 100,000.

Among other signs, Bitcoin’s open interest on Binance was steadily climbing, increasing about 30 % from mid -April to 9.7 billion dollars, an increase of $ 7.5 billion only weeks ago.

This increase in OI, associated with constantly positive financing rates, indicated the renewal of confidence in the market, as traders open new long jobs.

However, both open interest rates and financing have seen a slight decrease after issuing macro data.

However, the broader upward trend in the criteria of derivatives is still intact, which suggests that the upscale momentum can be resumed quickly if the total conditions are stabilized.

In addition to the broader image, the weekly Bitcoin volatility has now decreased to its lowest level in more than 500 days, according to the K33 research.

This decrease in price fluctuations is seen as a sign of the growing bitcoin maturity as a financial asset, as traders explain stability as a transformation towards the behavior of the most measured and institutional market.

Likewise, many analysts resonated with a bullish tone.

According to Andrew Crypto, Bitcoin is currently trading within a narrow range ranging from $ 92,750 and 95,564 dollars.

It monitors a potential step higher than the range levels to stir up upside down.

Source: Andrew Chipiro

Another encouraging brand came from heat map data subscriber By CW, which shows Bitcoin a liar again after getting rid of long situations with high procedures.

The sharp bounce indicates that the last DIP helped reset the market situation, and may pave the way for a cleaner movement up.

It is worth noting that the heavy short interest remains around the mark of $ 96,000, which leads to a possible short scenario for pressure if the bulls regain control.

However, others did not rule out like the Ezzy Bitcoin, the opportunity to make a correction to an area between 88,000 to 90,000 dollars from the current levels, although this step was not considered declining.

The CROSSX index is just a signal signal and a higher reflection (TR) $ BTC On the daily time frame. There is a need to correct but do not panic. This withdrawal is not necessarily a decline – it represents a healthy correction. Such corrections are necessary to climb,

At the time of writing this report, Bitcoin has been trading at 94,019 dollars, a decrease of 1 % over the past 24 hours.

For a declining momentum to fade, the bulls will need to restore 95,000 dollars.

Altcoins set small gains

With the presence of bitcoin stuck in a domain, the broader Altcoin market witnessed a range.

The total maximum Altcoin market fell from $ 1.19 trillion to about 1.12 trillion dollars, a decrease of 5.8 % per day.

The Altcoin season, which measures whether Altcoins has surpassed Bitcoin over the past ninety days, in 15 years, much lower than the 75 threshold that is usually associated with the real Altseason.

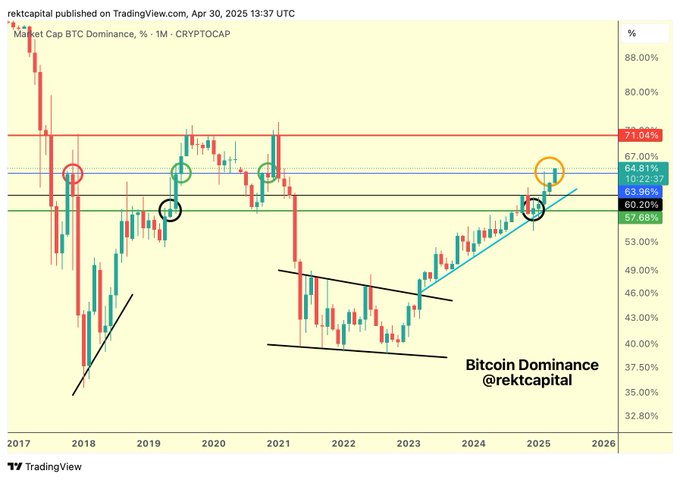

According to Rekt Capital, traders who hope to get Altseass to wait until Bitcoin’s dominance moves near the level of 71 %, as historical rejection sparked sharp escape in Altcoin.

#BTC Hegemony if history is repeated, the real altseason that everyone awaits will start as soon as the Bitcoin dominates near or directly from 71 % (red)

$ BTC #Altseason #Bitcoin

Over the past day, the gains remained limited and mostly focused on Memecoins, known to be separated from wider trends but often short -term.

Floki led a 7.67 % daily increase, followed by MONERO (XMR) with an increase of 2.76 %, and the Fartcoin 2.6 % climbing.

source: Coinmarketcap

Post -encryption prices today: Bitcoin decreased after inflation data in the United States. Floki tops daily gains first on Invezz