This is the effect on ETH price

After many ads related to the definitions by Donald Trump, the encryption market faced increasingly volatile fluctuations. As a result, the price of ETHEREUM (ETH) decreased to less than 2000 critical dollars, which led to an increase in the long qualifiers. Amid this, various standards on the series of Ethereum have turned into a decline, indicating a decrease in accumulation. However, analysts expect a strong recovery in the ETH price before the upcoming coding top.

Low whale pressure amid ETH decline

Modern data from Coinglass shows equal trading activity where ETHEREUM remains under a brand of $ 2,500. Within the past 24 hours, ETHEREUM faced a total liquidation of $ 47.87 million, as buyers settled $ 28.1 million, and sellers closed $ 19.7 million in short positions.

Meanwhile, the main investors use the opportunity to buy ETHEREUM at lower prices, especially before the next White House encryption. Merchants are particularly focused on the activity of wallets associated with the addresses of World Liberty Financial (WLF).

Also read: Trump’s WLFI WLFI buys $ 10 million in Ethereum despite losses – here’s the reason

According to the arrows of Intel, an intelligence company on the series, WLF’s Wallet has multiplied three times the Ether’s possessions in just one day. WLF was bought with Ethereum activity during recent price declines. Reports from Arkham Intel reveal that from Thursday, WLF has about 7100 ETAREUM code, with a value of more than $ 80 million. This large increase of 2500 symbols in only 24 hours highlights a strong accumulation strategy.

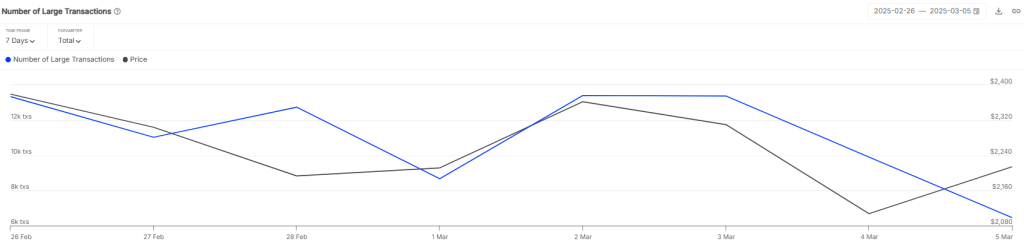

InTotheblock data reveals a significant decrease in the ETHEREUM whale activity, corresponding to significant losses due to the low ETHEREUM prices. The number of whale transactions decreased significantly, as it decreased from a height of 13.4K to only 6.46 thousand. Moreover, there was a fundamental decrease in the volume of large transactions, which decreased from $ 11 billion to $ 5.5 billion.

This decrease in the pressure of whales came after a negative direction in the profit of the non -investigators. Cryptoquant data indicates that the ETH whales, specifically those that have holdings ranging from 1000 to 10,000 ETH and from 10,000 to 100,000 ETH, have seen a shift into unrealistic negative profits.

What is the following for the price of ETH?

The price of ETH was recovered about 2300 dollars as it faced purchase pressure. However, it failed to rise more as the bears strongly defended the level of resistance. As of the writing of these lines, the ETHEREUM price is trading at $ 2200, as more than 0.9 % decreased in the past 24 hours.

The ETH/USDT trading pair is struggling to deal with the immediate resistance line at $ 2530. This level may be a major obstacle as STHS may continue to liquidate here. However, buyers may soon break this level with high demand.

If the price is less than the EMA20 direction line on the graph for one hour, the sellers are likely to try to pay it to $ 2,000.

However, as the RSI level continues to trade around the midfield at level 45, this may lead to re -testing the resistance channel. If the price can seize more than $ 2530, this will prefer buyers. The trading pair can increase to $ 2,935.