There is no short -term rally, Bitcoin Bull: Warning CEO cases

The price of Bitcoin was stuck in a domain, as his last trade, which exceeded $ 90,000 on March 7. By the end of the previous year, Bitcoin exceeded a brand of $ 100,000, but this landmark was short -term with the price drop quickly. Since then, Bitcoin has been in a declining direction, until less than $ 80,000 decreased.

In addition to market struggles, President Trump’s announcement was targeted with additional pressure on the encryption space, causing most of the cryptocurrencies to Bitcoin.

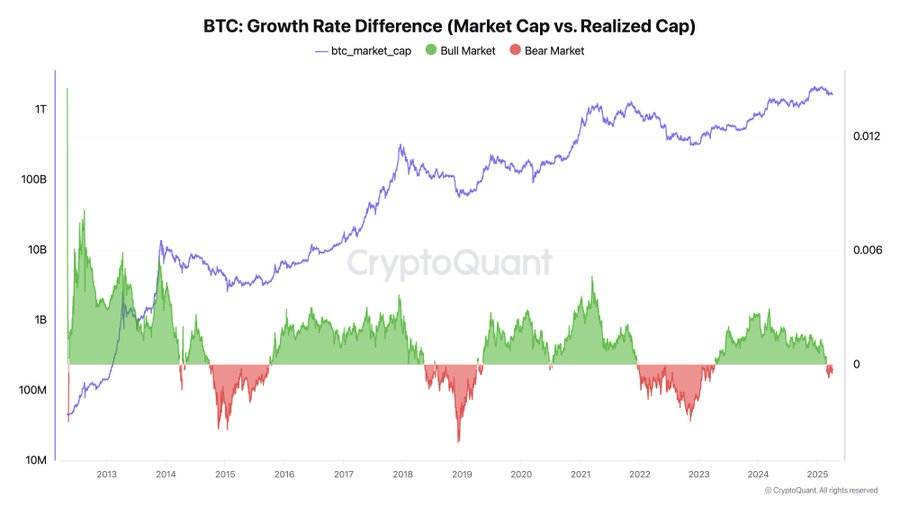

According to the CEO of Tocryptoquant, Ki Jong Go, Bitcoin Bull seems to have ended, based on the analysis of data on the chain. The main scale is the maximum achieved, which measures the actual capital that enters the market by tracking when purchasing BTC (a portfolio has been inserted) and sold (leaving a portfolio).

“But when the pressure pressure is high, the large purchases fail to move the price. There is simply a lot of sellers. For example, when bitcoin was trading near $ 100,000, the market witnessed huge sizes, but the price barely moved.”

When the maximum achieved, the maximum market (based on the latest trading price) remains flat or low, it indicates that the money flows, but the prices do not respond – this is a landmark. Now, this is exactly what is happening.

On the contrary, if small amounts of new capital prices rise, it is a bullish market. But at the present time, it is not enough even large quantities of capital to move the Bitcoin price, indicating the presence of the bear market. Historically, the real market repercussions take at least six months, so it is unlikely to be a rapid recovery.

“In short: When small capital leads to high prices, it is an emerging market. When big capital cannot raise prices up, it is a bear. The current data clearly indicates the latter. The pressure pressure may be reduced at any time, but historically, the real repercussions take at least six months-so it seems that the short-term gathering is unlikely.”