Bitcoin miners show confidence after $ 95,000

The decisive Bitcoin Rest injection over the $ 95,000 brand of psychological importance is new optimism in the market, at least among miners.

This main teacher has sparked a shift in the feelings of miners, as data on the series showed a remarkable rise in BTC MINER reserves during the past few days.

Miners are betting on BTC’s bullish trend with reserves from the lowest annual level

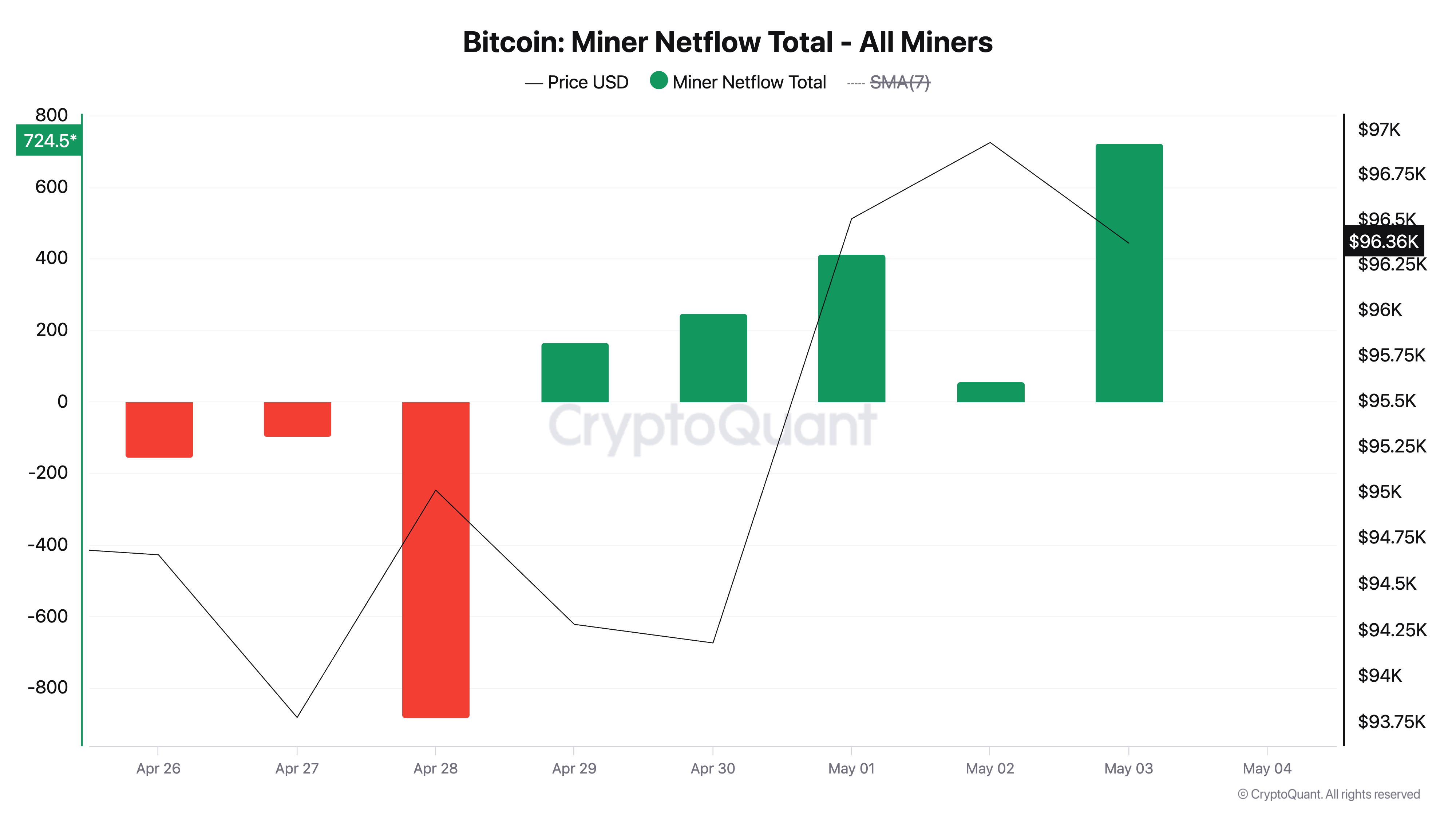

According to Cryptoquant, the Bitcoin Mines Reserve, which was in the direction of a constant decline, started to rise on April 29, shortly after the BTC closed over the $ 95,000 threshold.

For the context, the reserve decreased to its lowest level on the basis of 1.80 million BTC just one day before the reversal of the training course and showing signs of accumulation.

The Miner Bitcoin Reserve tracks the number of metal currencies held in the governor of miners. It represents miners that mines have not been sold. When it falls, miners transport metal currencies from their wallets, and they usually sell, confirming the increasing homosexuality against BTC.

On the contrary, when this scale rises, as it is now, it indicates that miners hold more with more mineral currencies, and often reflects the increasing confidence in the future price of BTC.

Moreover, the bullish shift in the feelings of miners is more supported by Netflow the positive factor since April 29. These signals until more coins are placed in a mine governor instead of discharged exchanges.

This behavior reflects confidence in more bullish direction, where miners, which are often selected as long -term holders, are chosen to accumulate it instead of filtering.

There is hunting

However, feelings are not upward globally. While BTC miners return from selling, derivative data tells a different story.

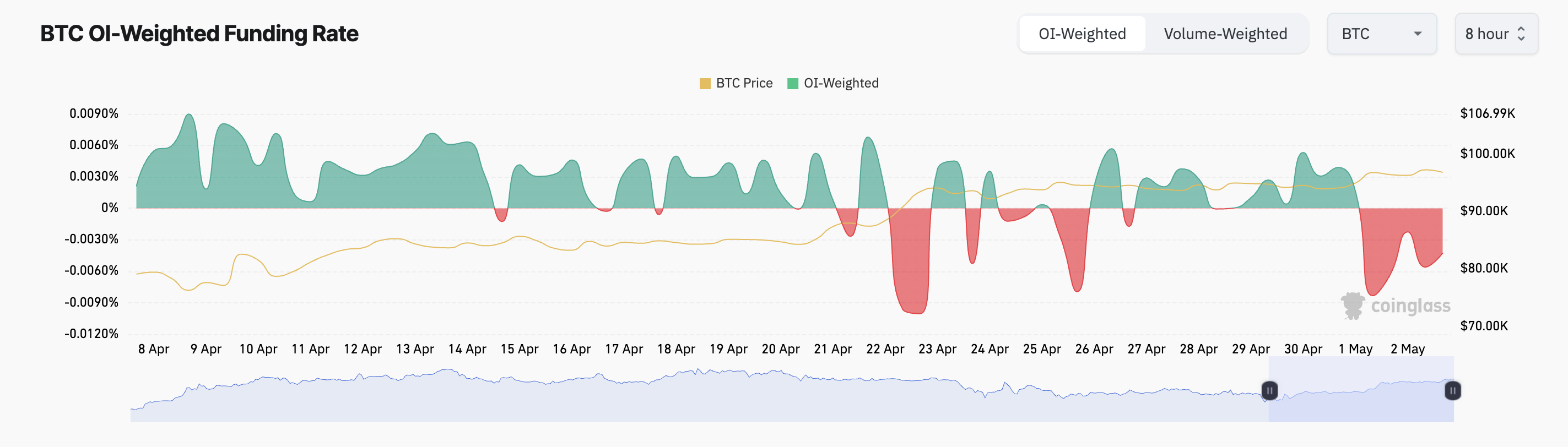

In the futures market, the BTC financing rate has been negative since the beginning of May, a sign that a large part of traders are betting on correcting prices in the short term. At the time of the press, the currency financing is the -0.0056 %.

The financing rate is a periodic payment that is exchanged between long and short traders in permanent future contracts to maintain the contract price with the immediate price.

When this is positive, this means that traders who hold long positions pay those who have short positions, indicating that the upward feelings dominate the market.

On the other hand, a negative financing rate such signals is the most short bets of long bets, indicating a decreased pressure on the BTC price.

Collapse or collapse

While the behavior of mines may indicate the renewal of confidence, the fixed and fixed feelings in the derivatives indicate that merchants are still cautious about the potential withdrawal.

In the event that the accumulation of coin is enhanced, BTC can extend its gains, break the resistance at $ 98,515, and try to restore the price of $ 102,080.

However, if the declining bets against the leading currency victory and witnessed a decrease in demand, its price may decrease to less than 95,000 dollars to reach 92,910 dollars.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.