The XRP price is broken? Traders are betting on $ 67 million on short pants

Amid the constant uncertainty in the market, the XRP record, the original distinctive symbol of Ripple Labs, a decrease in prices, similar to other major assets such as Bitcoin (BTC) and Ethereum (ETH). However, it appears in control, and its price may not decrease.

On March 20, 2025, after sudden shifts in feelings, the total market decreased significantly. Amid this, XRP recorded a 4 % decrease in prices and has now reached a decisive level.

Xrp technical analysis and upcoming levels

According to expert technical analysis, XRP recently witnessed a bullish outbreak of a cup and a handle pattern, along with a descending triangle.

Due to the continuous decrease in the market, the original has succeeded in re -testing the penetration area at the level of $ 2.40 and moving again. However, this penetration area also corresponds to the EMA on the time frame for four hours.

Based on modern procedures for historical prices and patterns, if the original exceeds the level of $ 2.38, there is still hope that XRP will increase significantly and may reach a level of $ 3.50. Meanwhile, if the original fails to keep this level and close a four -hour candle less than $ 2.38, it may decrease by 13 % to reach $ 2.05 in the future.

Current price momentum

XRP is currently trading near $ 2.42 and a decrease in prices by more than 4 % over the past 24 hours. However, during the same period, due to the morale of the Haboodi market, traders and investors participated in the first place, causing a 20 % decrease in trading volume.

Bibles of $ 67 million for merchants on the short side

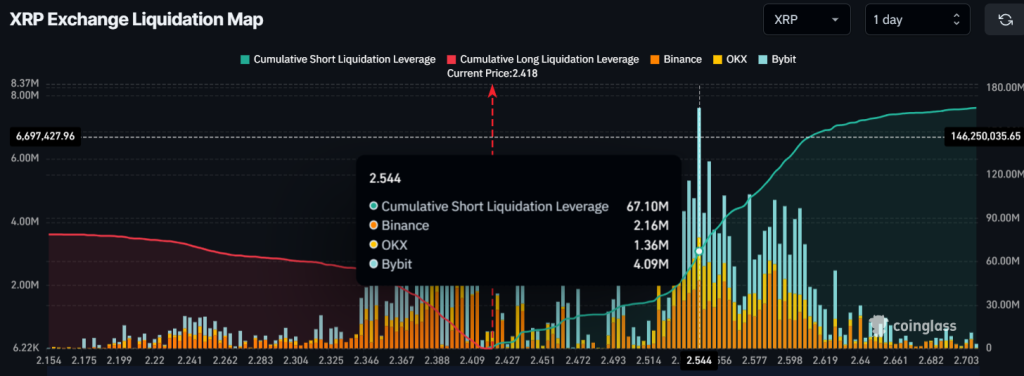

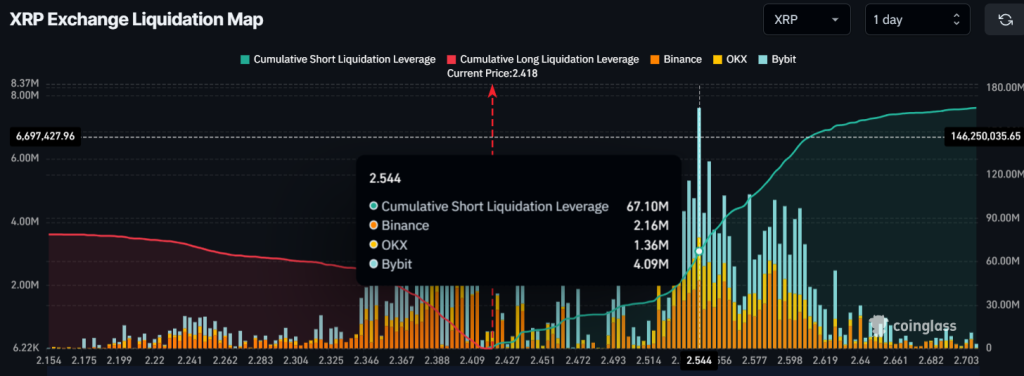

Despite the bullish penetration and the continuous re -testing, the merchants inside the day seem to follow the direction of the current market and are betting strongly on the short side, as stated by the Analysis Company on the series. Coinglass.

Data reveals that traders are currently being overlooked at $ 2.40, and hold $ 26 million in long positions. Meanwhile, $ 2.54 is another level of the record, as merchants have a value of $ 67 million in short positions. This clearly indicates that trading morale is downward, and there is a strong possibility that the original may be combined near this level.