Solana Expike flows, which are likely to pull the price to less than $ 140, while the target of $ 250 remains active

Solana again returns to the main support levels, as the sales volume causes the price to rise towards decisive support approximately $ 140. Sol price procedure shows a correction after a rejected summit and may now approach the previous demand base. The decrease to less than 151 dollars, which is the axis, has led to a decrease of less than 150 dollars, which may lead to a deeper decline towards the area between 141 to 145 dollars.

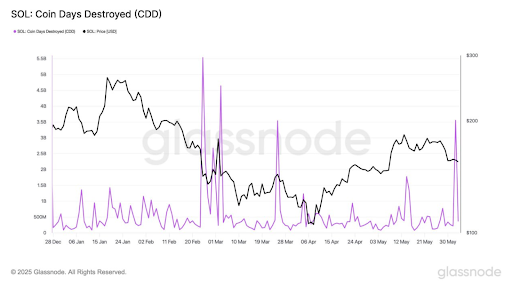

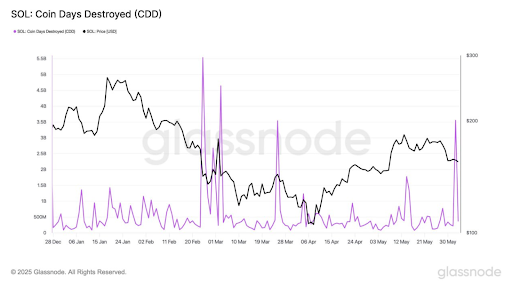

The market feeling around Solana as full metal currencies are in a state of transportation. According to the data from Glassnode, the platform witnessed the third largest currency destroyed or CDD, a measure that tracks the movement of coins based on the period in which it remained asleep. A huge height of about 3.5b CDD, indicating either the profit or re -placed.

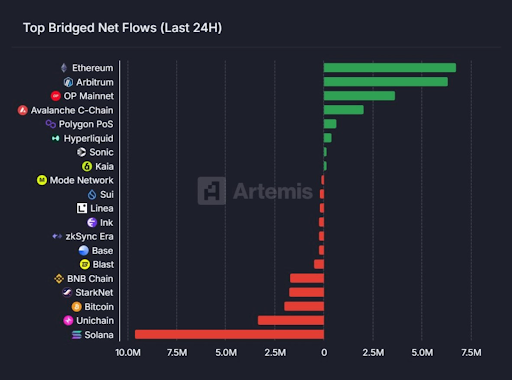

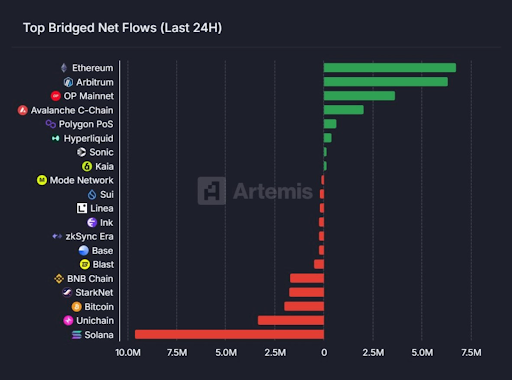

Second, another data point indicates that the huge flow is the flow and external flows of stereotypes. This is the encryption that is transferred from Blockchain to another, and thus the data indicates that investors are moving from Solana. According to the data from Artemis, Solana is the upper chain that faced huge output flows.

The above chart shows a significant flow of Solana Blockchain, while Ethereum tests a huge flow of about $ 7.5 million compared to more than $ 10 million in external flows. This indicates a possible flow of liquidity between these two blocks, while the race of excellence has gained great attention.

What is the next for Solana (Sol) – will decrease to less than $ 140 or a bounce to $ 160?

Since the Sol price represented the highest level in 300 dollars, it has been traded in a sharp descending trend. The recovery from its lowest annual levels indicated a higher increase in the declining effect, but the current basic procedure indicates that a deeper correction could be possible. The price has indicated huge losses since the beginning of the month, which could withdraw levels close to pivotal support levels, and perhaps less than $ 140.

Sol’s weekly graphic chart indicates that the distinctive symbol is subject to recovery, but it is stuck in the cup and handle style. The distinctive symbol is directed towards decisive support at 141 dollars, and since the weekly relativity index is declining to low support for the condolences, the price may also decrease to the handle support. However, levels may flourish and rise along the pattern support and reach $ 160 in the coming days.