The technical analyst predicts the heating of Bitcoin from top to 325,000 dollars – the schedule will shock you

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

As bitcoin price Skyrockkets previously previous (ATH)A technical analyst ignited a wave of excitement through the encryption community with A bold new prediction. According to expectations, Bitcoin can explode to an amazing peak price of $ 325,000 – and the most traumatized aspects of this analysis are not only the goal of the price but the accelerated schedule of this meteorological height.

Related reading

Bitcoin price to peak at 325 thousand dollars?

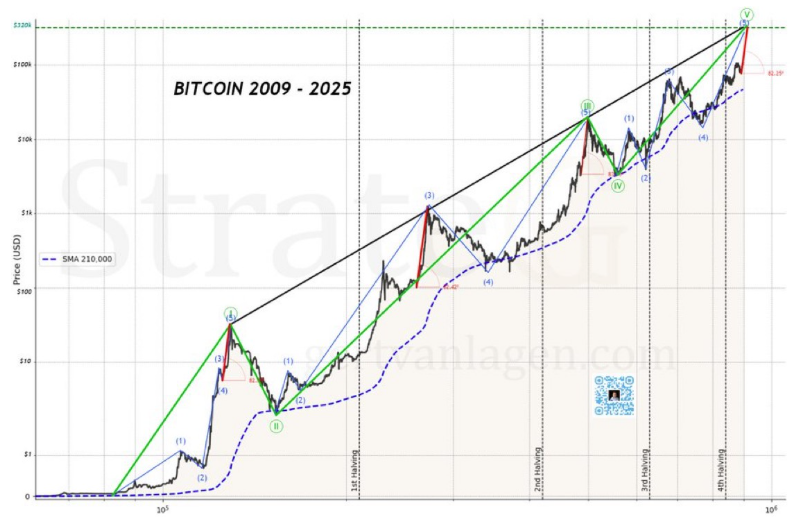

Bitcoin price 325,000 dollars Climate Written by Gert -Lagin, a prominent encrypted analyst on X (previously Twitter) depends on a technical analysis scheme that extends on BTC movements from 2009 and 2025. The graph applies. Elliot wave theory On a high time frame (HTF), huge tracking Five -wave defender brownWith each wave represents a major emerging cycle led by half.

Lagin revealed this Bitcoin is currently in the wave 5The last wave of this huge cycle, indicating that the market is about to the final equivalent explosion.

Both Pre -bull markets for BitcoinAccording to the analysis, it ended with a semi -explosive increase, as the price accelerates quickly before it collides Corrective. This increase has always been defined at a price angle of at least 82 degrees of the bottom.

The encryption analyst has drew a directional line connecting the wave tops 1 and 2, creating an up -to -wheel drive pattern. The lower boundaries of this string actor Through 210,000 SMA block, which works as long -term support.

In addition, the upper trend line of this string intersects with The highest expected market From the 5 wave, which is located at about 325,000 dollars. It is worth noting that this prediction is highly dependent on maintaining bitcoin Momentum Complete the wave 5 as one clean step, without any deviation or elongation, just like previous sessions.

And bold price expectations of $ 325,000 for Bitcoin come with an exceptionally short -term schedule. The market expert expects that BTC can reach this ambitious goal as soon as July 5, 2025, which slightly more than a month.

Interestingly, this schedule is based on the movements that were previously noticed After half -sessions. The path of the expected bitcoin to the market summit is closely corresponding to the previous patterns that followed each half of the Bitcoin.

These half -events raised the strong bull markets during the previous sessions. The current assembly also follows Bitcoin fourth and the most recent half, That occurred on April 20, 2024, which enhances the repeated and periodic nature of bitcoin price movements.

A historical correction can follow this increase in prices

Besides the dramatic prediction of $ 325,000, Bitcoin, Lagine’s analysis also carries a vow Habboudi expectations. It warns that after Bitcoin arrives at this expected market, what comes after that may be Low price of the high time frameIt may last for several years.

Related reading

Once the five wave structure is complete, Lagen expects Bitcoin to enter the first real Wave 2 correction in the highest degree. Historically, the wave 2nd recovers are deep, and given the current background of Global tightening And the risk of stagnation, it can challenge the post -peak environment even the most monsoon owners.

Distinctive image from Unsplash, tradingvief chart