Bitcoin financing rates continue to decrease – short pressure?

The price of Bitcoin was on a trip over the past seven days, as it has risen from the Blues early in the week, which was an accident to less than $ 100,000. The leading currency has returned to life, reaching $ 108,000 in the past few days.

This last recovery was not particularly reflected on Blockchain, with the latest data on the series that indicates that merchants are not ready to bet on the Bitcoin price. The famous market analysis platform has now evaluated this scenario, as it has put the potential effect on the price.

Low financing rates reflect the increase in short sites: Glassnode

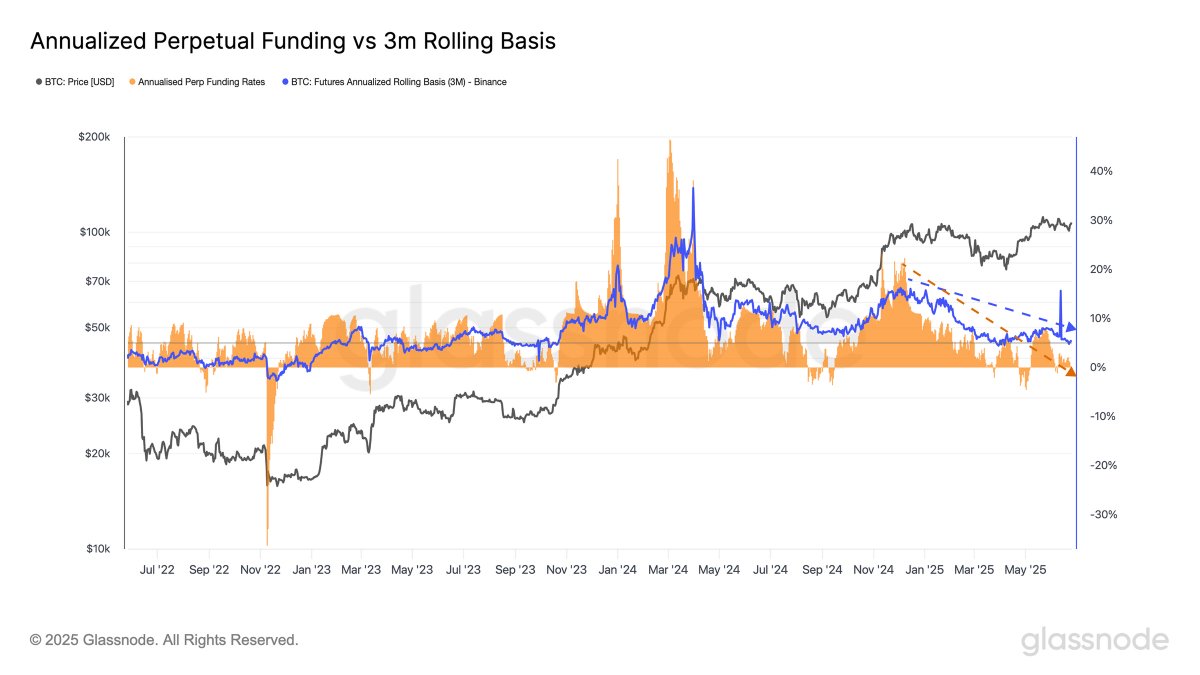

In a post on June 27 on the X platform, the Series Analysis Company open Bitcoin financing, which has been declining over the past few months, appears to be stuck in a declining direction. The relevant indicators here are “PERP) and” Binance for 3 months (3M) (3M) of the standards.

The annual Perp financing rates are a major scale that tracks periodic payments between long and short traders in the derivative market (permanent future). This indicator offers timely visions about the feelings and leverage in the coded currency derivative market.

When the financing rate is high or positive, it means that long traders are pushing merchants in short positions. Usually, this trend for periodic payment indicates strong upward upward feelings in the market. Meanwhile, the negative value of the scale means that short traders pay the long traders – indicating the presence of the morale of the descending market.

On the other hand, the annual rotation basis is estimated for a period of 3 months (3M) annual return from purchasing an encrypted currency in the instant market and selling a future encryption contract simultaneously in 3 months. Future contracts are usually traded at a price higher than instant assets – a difference that traders can exploit for profit.

Source: @glassnode on X

As shown in the above graph, the annual zebra financing rates and the annual basis of futures contracts decreased for 3 months (3M) since last November. “Despite the high future activity, the appetite for long exposure fades, which reflects the increased caution and perhaps more neutral or short topical,” Glassnode noted.

In essence, low and basic financing rates indicate for 3 months that short traders are constantly flourishing in the derivative market. While there was a cautious approach towards the market from merchants, the institutional flows to the US -based Bitcoin exchange funds and the improvement of the macroeconomic climate were silver lining.

Thus, even if the financing rates continue to decline, but the macroeconomic environment and institutional capital flow are still fixed, the market can witness short pressure – as short traders are forced to close their locations. This potential scenario is supported even the fact that the market tends to move in the opposite direction of the crowd.

Bitcoin price at a glance

From writing these lines, the BTC price is about 107,180 dollars, and no significant movement appears in the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Distinctive image from Istock, tradingvief chart

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.