The short-term Solana Index refers to potential risks-reflection or temporary suspension?

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Solana shows signs of strength because it is pushing above the main resistance level, indicating that the bulls began to restore some control after weeks of weakness. The broader encryption market is still volatile, driven by the constant certainty of the macroeconomic economy and the increasing commercial tensions between the United States and China. Despite these risks, investor morale appears to be slightly improving, causing hopes to enter Solana and other altcoins in the recovery process.

Related reading

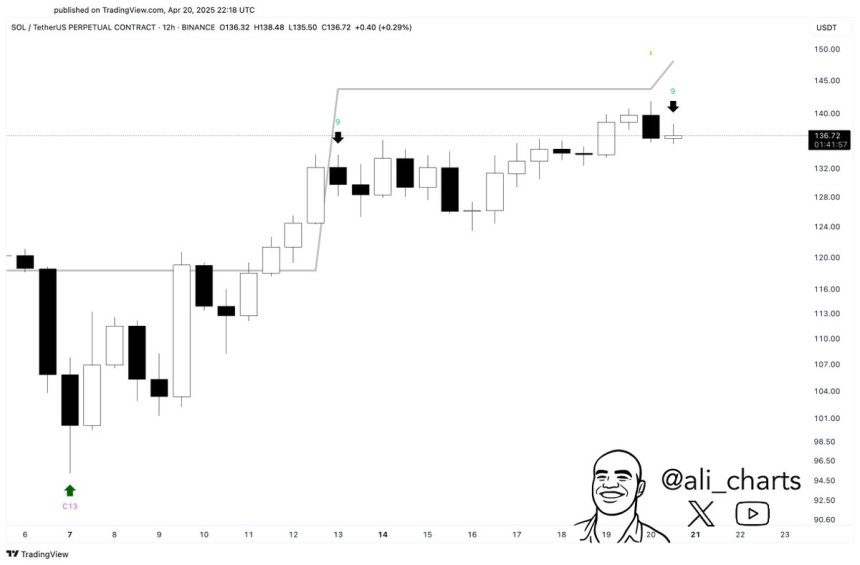

However, caution is still justified. Supreme analyst Ali Martinez participated in a technical signal that prevents recent optimism-with his analysis, may be Solana due to the withdrawal in the short term. The signal signal on the graph has been over 12 hours using the TD Series Index, which historically carries local tops and the stages of price exhaustion.

Although Solana’s recent outbreak is encouraged, the presence of this descending sign indicates that the assembly may lose steam in the short term. Investors will closely monitor to see if Sol can get higher support than the reclaimed levels or if it is declining under the pressure pressure. Currently, the market is discovered between early recovery marks and the permanent risks of another risk.

Solana faces major resistance with a short -term withdrawal sign

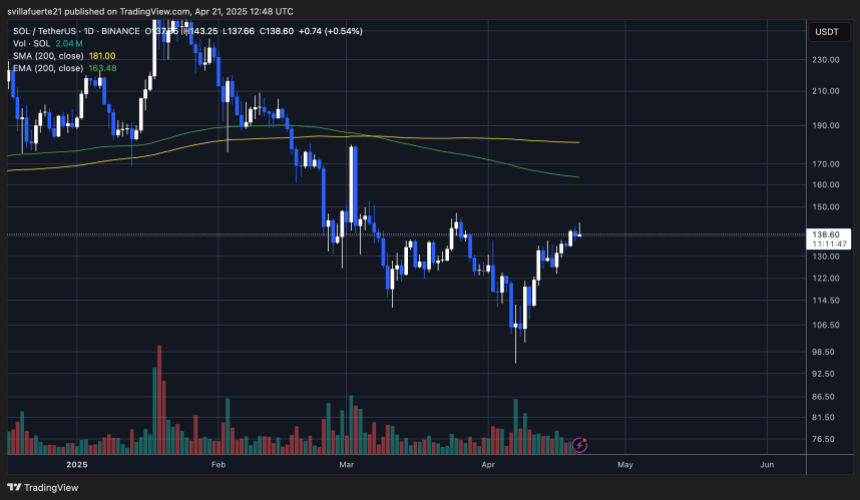

Solana has increased more than 48 % since April 7, indicating a renewed momentum after a long period of intense sale pressure. The bulls are now a decisive test as the price approaches the level of $ 150 – a major resistance area that has prepared more progress in the past.

Despite the latter recovery, Solana is still one of the most affected assets during the lower direction of 2025, after losing more than 65 % of its value since its peak in January. This stresses the importance of the current step and the importance of maintaining higher levels to emphasize a real reflection.

However, there is a justification for caution. Martinez shared the data on x Highlighting the TD serial sales signal on the graph for 12 hours-an artistic index often precedes the exhaustion of the direction in the short term or reflections. The serial TD works by determining a sequence of price movements that can indicate excessive conditions in peak or sale. If the signal is turned on, Solana may face a temporary decline before any continuous lapse direction.

There are still macroeconomic factors in playing, as ongoing trade tensions between the United States and China are still feelings across global markets. However, the hopes of a possible agreement between the two countries and the expansion of global liquidity gives bulls some optimism, especially in the altcoin sector.

Related reading

Sol Price hovering in the axial area: What next?

Solana (Sol) is currently trading at critical levels, as the main resistance area of $ 150 is tested after a sharp recovery from its lowest levels. The bulls must restore and keep this level to confirm the penetration and verify the beginning of the ongoing emerging translation. The decisive step of more than $ 150 will lead to an increase in the power to buy momentum, which leads to a re -test of higher goals that have not been seen since early March.

However, if Sol fails to break this barrier in the short term, the unification period between 130 and 120 dollars still indicates signal strength. The contract of this region may indicate that the bulls are building a base for continuing the movement of upward prices and absorbing the sale of the sale without great restoration. These stages of monotheism are often considered healthy in the ups of the upward market, which allows momentum to rebuild before the next stage rise.

Related reading

On the negative side, failure to retain the support level of $ 120 may expose Sol to deeper losses, with a $ 100 area as a required field of the following demand. A break below this level would nullify the current ups and and may re -ignite the broader downward trend. Currently, all eyes are on the Sol reaction about the $ 150 sign.

Distinctive image from Dall-E, the tradingView graph