XRP for explosion? The expert says that the circulating investment funds can ignite the increase to $ 15

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Crypto Pundit Zach Rector’s has published a bold projection that XRP could rise to $ 15 once the institutional flows of the stock exchanges on the stock exchange (ETFS) is increasingly reshaping the market dynamics. In his analysis, the university president claims that the expected flows of the boxes circulating in the XRP (ETFS) exchange can transform the assessment scene.

Its dropping is rooted in the conservative assumptions and is supported by Previous jpmorgan expectationsThis indicates that ETFS XRP has secured between $ 4 billion and 8 billion dollars in the new capital during their first year. Retor focuses its model on the number of $ 4 billion, on the pretext that even this modest amount can pave the way for the dramatic market to expand.

To what extent can XRP rise with ETF spot?

Centrality thesis It is what a “maximum market double” describes. This scale, which he describes as “the rate of change in the market value of assets to the net flows that it receives”, is the engine behind its upscale scenario. The President of the University avoided this concept during one of his shows: “When you witness a short -term event where the XRP market rises significantly with relatively low flows, he highlights the sensitivity of the evaluation to enter the capital to the market.”

Related reading

This was made clear with an amazing example as of April 12, 2025. On that day, over eight hours, the maximum XRP market increased by $ 7.74 billion although the net flows were only $ 12.87 million – a phenomenon that was translated into an extraordinary double of 601X. “That moment was an invitation to wake up,” the President of the University pointed out, “clear evidence of how to benefit from the digital asset market in the appropriate circumstances.”

Despite this explosive example, the President of the University practiced caution by choosing a more conservative double than 200x for his primary analysis. With this double, the $ 4 billion flow assumption would generate an increase of $ 800 billion in the market value. When adding to the maximum Corrent Corter market at the time is about $ 125 billion, the total theoretical evaluation can accommodate approximately 925 billion dollars.

Looking at an estimated 60 billion XRP symbols, this scenario will lead to the price of nearly $ 15. “Even the preservation of market trends indicates a level of appreciation that is no less than the transformation,” the university president explained.

In discussing the basic assumptions, the university president was unambiguous on the limits of his model. “There are two things that are not included in this equation that plays a factor is the futures market, then the Leder LEDERDER LEDERD is also an activity.”

Related reading

In addition to the technical aspects of a multiplier methodology, the context of the broader market gives weight to the expectations of the president’s optimistic president. Institutional momentum is evident, as evidenced by an increase in the regulatory deposits of the Spot XRP qualifiers. Nine prominent financial institutions – including gray, Vanc, the investment corner, and Wisdomtree – have sought the approval of the American Securities and Exchange Committee.

“The fact that the principals of the assets in place are leading forward to presenting ETF XRP is a sign in itself,” the university president commented. SEC has strengthened with these deposits, along with the teeth on the legal settlement, market morale. “There is a tangible feeling of optimism in the air,” Rikor added.

Despite the supportive environment, the university president is still measured in his outlook. He referred to the amazing performance of Ethereum ETFS for the context. Since its presentation in July 2024, Ethereum ETFS has only attracted about $ 2.28 billion in flows. “This is a reminder that even with strong institutional interest, the transition from traditional financing to digital assets is not always clear,” the university president said.

International developments have strengthened the narration. In March 2025, Brazil took an important step by approving the Spot XRP ETF, while NYSE Arca recently appeared for the first time at Teucrium Investment Advisors XRP ETF. “Global organizational acceptance is the key,” as the President of the University stressed, “Since more judicial states heat digital assets, we can expect a more vibrant and dynamic market.”

He concluded by saying: “Although there are no guaranteed expectations, the trends we are witnessing today indicate that a milestone like $ 15 per XRP is not just a wishful thinking – it may be within reach.”

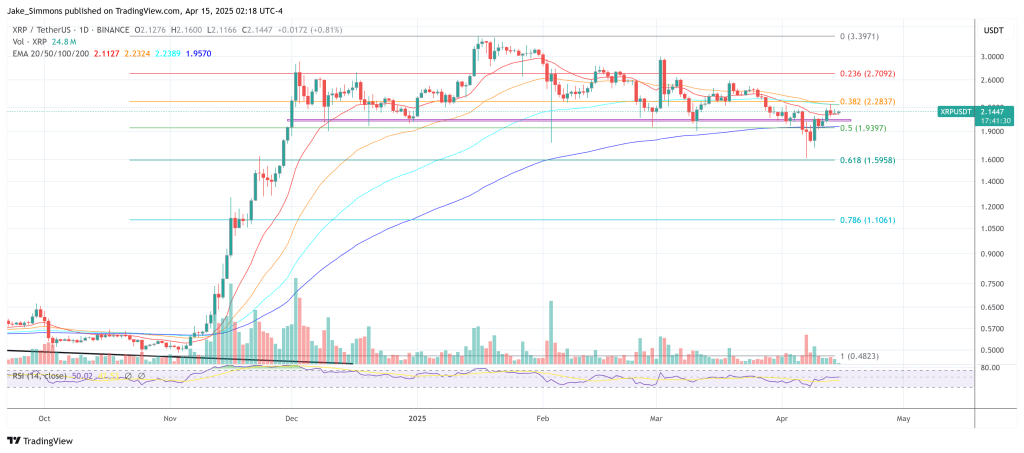

At the time of the press, XRP was traded at $ 2.14.

Distinctive image created with Dall.e, Chart from TradingView.com