The scheme predicts a sharp decrease forward

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

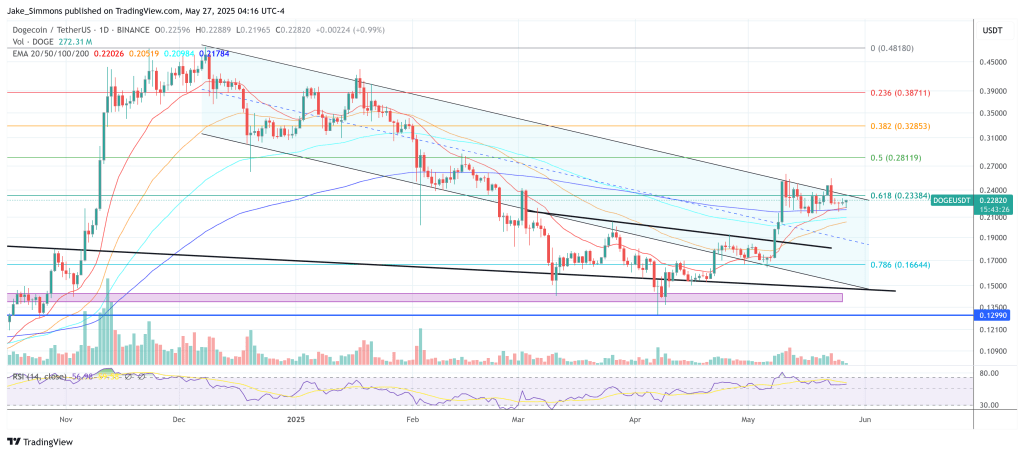

Dogecoin slipped towards the lower end of its month, which lasted for a month on Tuesday, as the independent rise in the graph achieved a popular collapse of the reason he believed that Coin Meme is on its way through a corrective chain that could end in the high teenage area. In the middle of the afternoon in Europe, the distinctive symbol hovers at $ 0.228, or approximately 12 % of the peak May 11 and nursing losses during the day.

Dogecoin enters the danger zone

Daily plan, analyst Re -rewind To this explosive step, which started on May 8 and produced an increase of 50 % of three sessions: “The last time we scored here on May 8, when we got this large green candle, as we said, we seem to start the fifth microwave here,” the viewers mentioned. He added that his initial upward drop was a modest extension 2.36 Vibonacci, however “has already rose much up”, which is a sign of strong retail momentum but also with a pattern that it seems to have ended now.

The quantum ascension since then deported its wave census to show that the trend was just the fifth sub -wave within the progress of the first largest wave. He said: “We are in the middle of ABC and we are talking … These blue waves will move here.” In the Elliott-WAVE language, the C-LG must be equal to the A-LG, and around the presentation of that rule into the account: “Eighteen points of there … This is one of our goals, about 20.5 cents.”

Related reading

He said that the deepest penetration is not only possible, but statistically common, because “it often makes it in this third or fourth wave.” It measures from the mid-May summit to mid-May, he drew 0.500, 0.618 and 0.702-tape that extends from approximately 19.5 cents to 17 cents-and described the “logical zone to reset the first and second wave”. Small stopped at 0.382, about 21.8 cents, in his opinion, “somewhat shallow correction.”

One of the attempts to a higher fracture has already stopped in what he described as a “danger zone” between 0.618 and 0.786 hasty: “We took a stab to go out, but we did not close … We have made us evil over him, and ended up there in 702, and rejection, and now this has become a kind of rolling again.” This failure leaves the level of the nearby trigger: “We cut this depression here at 21 cents, then we want to see 20.5 cents.”

He added that performing the tape is similar to the structure of Wyckoff: “Wyckoff is frankly, and we build a sign of strength here before we set out.” However, if the bullish payment, if it comes, it is likely to lie several weeks ago. He said that the ongoing correction coincides with “Macro, two we are working on now,” stressing that the subsequent third wave will be decisive: “Thirties of the total wave – that is the fathers. This is adults.

Related reading

The context of the macro admires any enthusiasm in the short term. Bitcoin-whose fifth wave summit has arrived urgently and overcame the previous session-has already rolled in ABC on its own, and the quantum climb expects to “settle” alongside Belwether. “Whether it’s fast in the C wave or we are continuing to zigzag, we will have to wait and see,” and concluded that their followers urge to watch the sized profiles and closing levels instead of the wick inside the day.

As is always the case, the Elliott-WAVE census remains interpretative, not prediction, and merchants must fit any position with the limits of personal risks. Dogecoin maintains the eighth market with a market value in encryption, but high fluctuations mean that minor price gaps can be translated into two degrees of two degrees.

At the time of the press, Dog was traded at $ 0.228.

Distinctive image created with Dall.e, Chart from TradingView.com