The sale of Bitcoin leads to external flow

An increase from new investors rushed to Bitcoin after Donald Trump’s victory in the US presidential election, expecting more gains with the high encryption markets to the highest level ever.

However, excitement quickly turned into disappointment.

Six weeks after Trump’s presidency, Bitcoin fell to the bear market, threw nearly a quarter of its value since January.

The sudden recession struck the most difficult investor, especially those who entered the market at its peak or used the leverage to inflate their bets.

The largest cryptocurrency in the world, which amounted to $ 109.071 in January, is now trading of about $ 80,000.

The sales process is operated with a wider decrease in global stocks, concerns about American tariff policies, and high economic uncertainty.

Meanwhile, the money circulating in Bitcoin exchange (ETFS) has recorded huge external flows, with a withdrawal of $ 1.1 billion in one day.

Bitcoin retreat displays profitable merchants

Bitcoin’s Bull Run attracted millions of new participants, many of whom have been a little experience in moving in the volatile Crypto sessions.

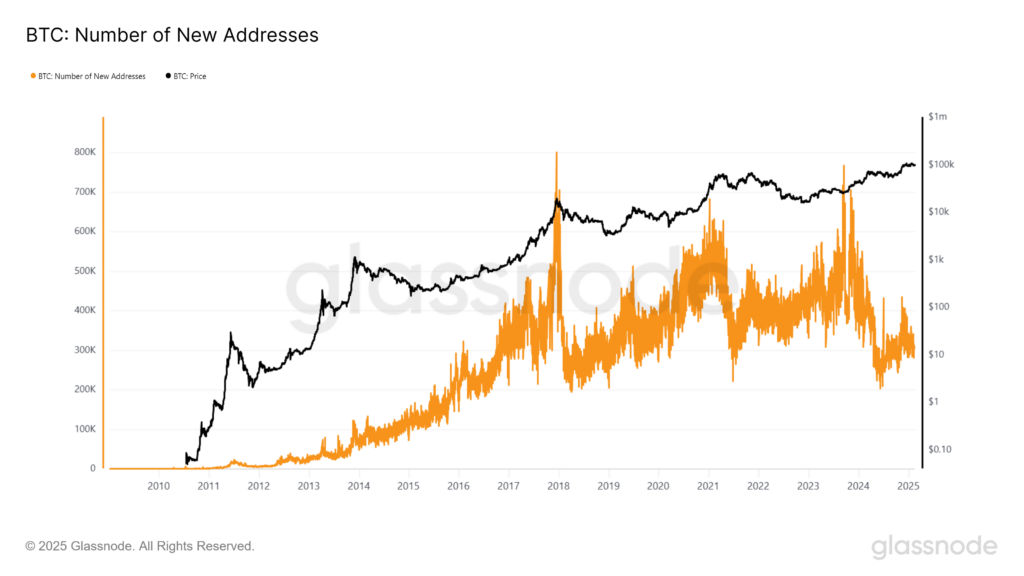

Glassnode data shows that 20 million new Bitcoin addresses – 1.5 % of all the addresses – created in the past three months, reflecting the size of the new investor participation.

source: Glassnode

However, new buyers now face sharp losses.

SOPR, which measures whether bitcoin holders are selling with profit or loss, has decreased to 0.95 – less than a level for more than a year.

This indicates that many investors have been confused for the first time since October.

Reformer traders bear the weight of the sharp decrease in Bitcoin.

Data from Bitfinex indicates that the losses achieved between this group exceeded $ 800 million per day, as it recorded February 28 and March 4 of the largest losses for one day.

This wave of the qualifiers has increased from the declining pressure on the price of bitcoin.

ETFS sees $ 1.1 billion in one day flows

Investment products that follow digital assets have suffered from external flows for the fourth week in a row, According to Coinshares.

The assets subject to management in the encryption funds decreased by $ 4.75 billion, up to a total of $ 142 billion-the lowest level since mid-November 2024.

The investment funds circulated in the United States of America, which witnessed record flows earlier in the year, reflected their path.

On February 25, these funds witnessed $ 1.1 billion in external flows – the largest daily withdrawal since its launch in January 2024.

This indicates that institutional investors, who initially led in the Bitcoin gathering behind $ 100,000, may now transfer capital in another place amid risk morale.

Market fluctuations nails where bitcoin tracks stocks

Bitcoin price movements have increasingly reflected the movements of traditional financial markets.

The recent fluctuations in American stocks, especially in the technology sector, erupted to the encryption markets, causing severe fluctuations in bitcoin and ethereum.

Details of the derivatives from Amberdata show that the implicit fluctuations of Bitcoin have risen to 69 % over the past 24 hours, while the implicit ETHEREUM fluctuation has jumped from 65 % to 90 % since Monday.

This indicates Merchants are preparing For more disturbance in the future.

Despite the current sale, some analysts remain optimistic.

Historical patterns indicate that bitcoin has often recovered from similar declines in the past.

However, with total economic uncertainty, regulatory concerns, and a feeling of prevailing dangers, expectations close to the range remain inaccurate.

The post -sales sales leads to $ 1.1 billion, ETF external, and the most difficult experience struck the most difficult to appear first on Invezz