The price of XRP decreased with the Trump tariff for the encrypted currency markets

XRP decreased by 2.36 % over the past 24 hours, as it was traded at $ 2.43, as market participants charged the comprehensive tariffs of former US President Donald Trump.

Digital assets decline are in line with fluctuations in the broader market after Trump’s protection renovation position, which includes a 25 % tariff on steel imports and additional aluminum fees.

This step has sparked risk feelings, as investors have withdrawn capital from speculative assets, including cryptocurrencies.

The total marketing of the market with the evaluation of traders is the long -term effects of escalating commercial tensions, especially in sectors such as technology, energy and raw materials.

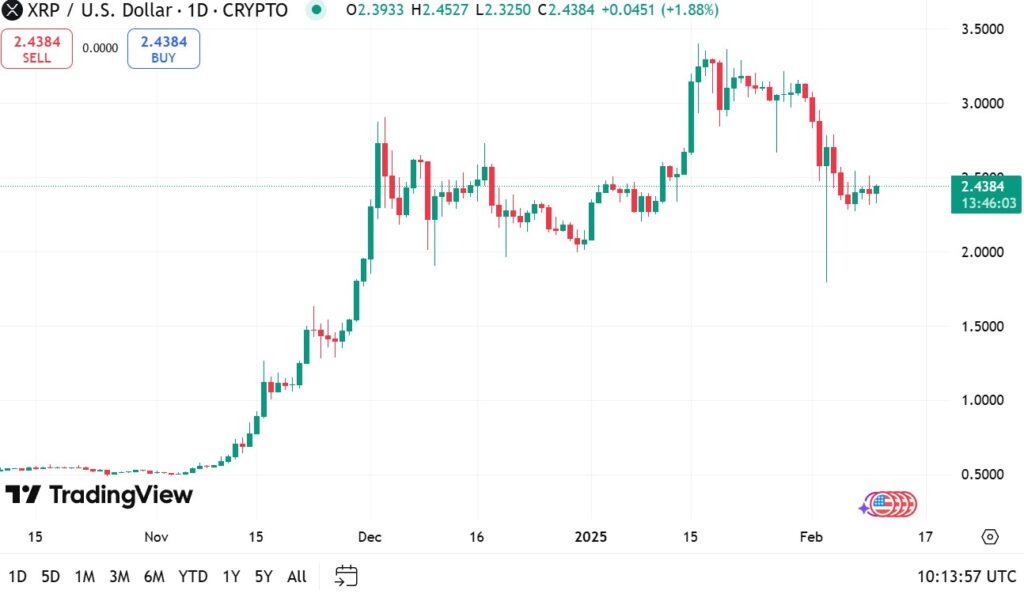

XRP graph By TradingView

The latest announcement led to comparisons with the US -Chinese trade war during the previous Trump term, which had a significant impact on global trade flows and investment morale.

This time, digital assets have not been avoided, as XRP shows an increased sensitivity to macroeconomic developments.

The price of XRP is struggled as a fluctuation traders

It was placed by a decrease in XRP prices near critical technical levels, as traders closely monitor support at $ 2.25.

The level of Fibonacci’s re -imitation is in line with 38.2 % with this region, providing the possibility of short -term recovery.

The price procedure indicates caution, because failure to keep this level can open the door for more declines about $ 2.00.

The last declining pressure follows a wide sale of risk assets, as cryptocurrency currencies are particularly affected by their association with the macroeconomic economy.

The XRP price scheme reflects the frequency among merchants, with a long removal of February 3, indicating an attempt to defend support.

However, the lack of a strong purchase indication indicates that investors are still cautious about the possible negative risks.

If the pressure continues, the XRP 1.60 dollars can be re -tested, which coincides with the 61.8 % Fibonacci level.

The collapse at the bottom of this point can indicate a deeper landing direction, especially if the morale of the broader market remains weak.

Will XRP recover after the Trump tariff shock?

Despite the opposite winds in the short term, the long -term XRP view remains associated with adoption and institutional interests.

Merging Ripple into global payment networks is still a decisive driver, as financial institutions explore the role of asset in border transactions.

Organizational clarity is another major factor that affects the XRP price track.

The cryptocurrency market has faced increased scrutiny, with the results of organizational developments that play a major role in forming institutional participation.

Positive organizational developments can provide the back winds of XRP, which supports recovery towards the previous highlands.

Technical models indicate a possible trading range between $ 3.50 and 5.00 dollars by 2025, provided that adoption is accelerated and improving the wider market conditions.

Constant geopolitical risks, commercial policy transformations, and global economic uncertainty can lead to fluctuations, making XRP price movements in the short term.

Trump’s commercial policies add uncertainty to encryption

Trump’s latest tariff plans extend beyond steel and aluminum, with potential duties on high conductors, energy products and critical raw materials.

The impact of these policies can be far -reaching, which affects not only traditional industries but also digital asset markets.

The cryptocurrency sector remains a very reaction to macroeconomic events, with organizational and political changes that often affect market morale.

Traders are now monitoring whether Trump’s economic policies can lead to transformations in the wider capital, especially if the risk hate increases.

For XRP and other encrypted currencies, the following main price movement is likely to depend on how to absorb the markets for the impact of these tariff decisions in the coming weeks.

While some traders expect relief, others warn that prolonged uncertainty can maintain digital assets under pressure.

POST XRP price decreased as Trump’s tariff appeared first on Invezz