ETH, and Sol after Bitcoin half

- summary:

- Bitcoin rotation half in the market – will Ethereum and Solana lead the next gathering? Home price levels, BTC, ETH and Sol expectations.

Bitcoin has held more than 94,000 dollars after the very expected half was translated, but the explosive merchants who have been hoping to be achieved yet. Instead, the market feels roll – calm before the next direction wave.

Ethereum offers mixed signals, hovering less than $ 1,800, while Solana continues to attract capital in the mad coin madness, approaching the market ceiling from the 80 billion dollar sign. In all fields, feelings of encryption remain optimistic with caution.

Bitcoin enhances the gains after half – is it coming?

Bitcoin is traded at $ 94,603, holding near its highest levels in half with signs of elasticity but not after energy. The relative strength index is pushed on the graph for two hours above 65, and MacD momentum remains to the upward trend. But the bulls stop clearly when resistance near an area between 95,000 to 96,000 dollars.

This side chopping is not uncommon after half. Historically, bitcoin is strengthened before doing it continues, often after months. The display shock is remained intact, but price procedures are now highly dependent on the wider liquidity, ETF flows, and whether the total risk assets remain prosperous.

Bitcoin scheme analysis

- Support levels: 91200 dollars / 88,000 dollars

- Resistance levels: 96400 dollars / 100,000 dollars

A clean step above 96 thousand dollars can open about six numbers. But now, BTC ranges, not raging.

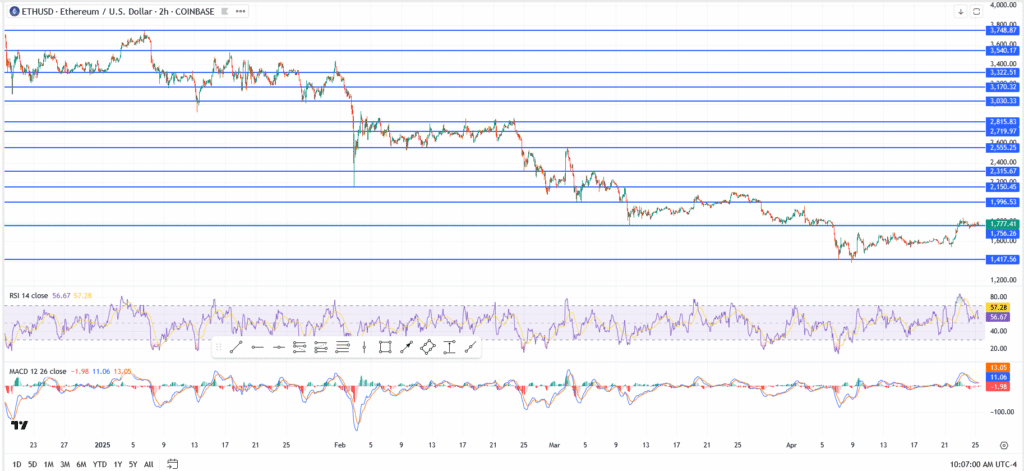

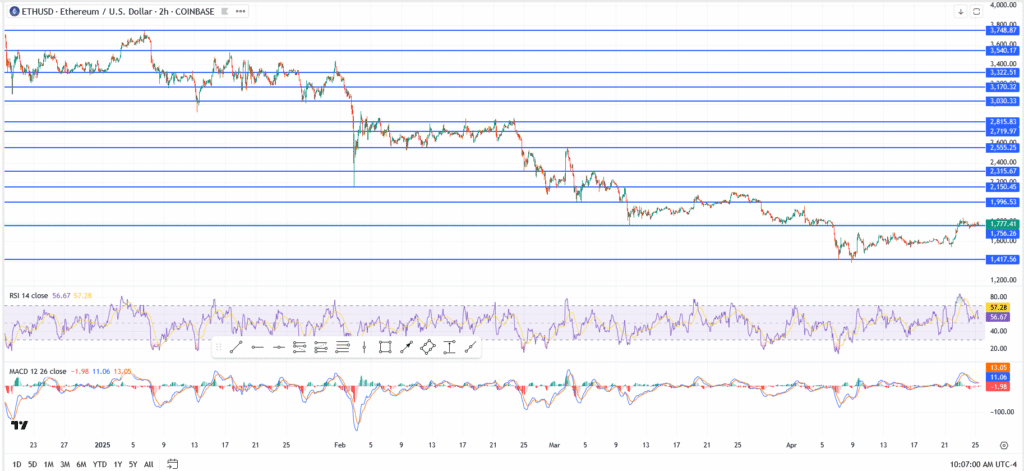

The price of ETHEREUM is struggling near $ 1,800 like Bulls and Bears Tug War

ETHEREUM was opened on Friday under pressure, as it was circulated slightly less than the level of $ 1,800 despite the spread of a modest daily gain. The momentum stops at a critical axis, as RSI hovers near 56 and MACD flattening it, indicating that there is no decision instead of driving. In order for the bulls to regain control, the ETH needs a clean recovery of $ 1,800 – not only a fabric above it, but it is closed.

Institutional flows are picked up, as Spot ETH ETFS 63.5 million dollars in net flows on Thursday, the highest level in three weeks. The open interest increased to $ 9.8 billion, indicating that locations on the long side.

This is not a complete reflection, but it is far from collapse. Ethereum sits in a sensitive spot, and it is likely to dictate the next 48 hours whether the bulls pay the resistance or fold under pressure.

Ethereum chart analysis

- resistance: $ 1800 → 1,836 → $ 1,876

- Support: 1,745 dollars → 1700 dollars

Institutions purchase declines, but the weakness of the chain reduces the bullish direction.

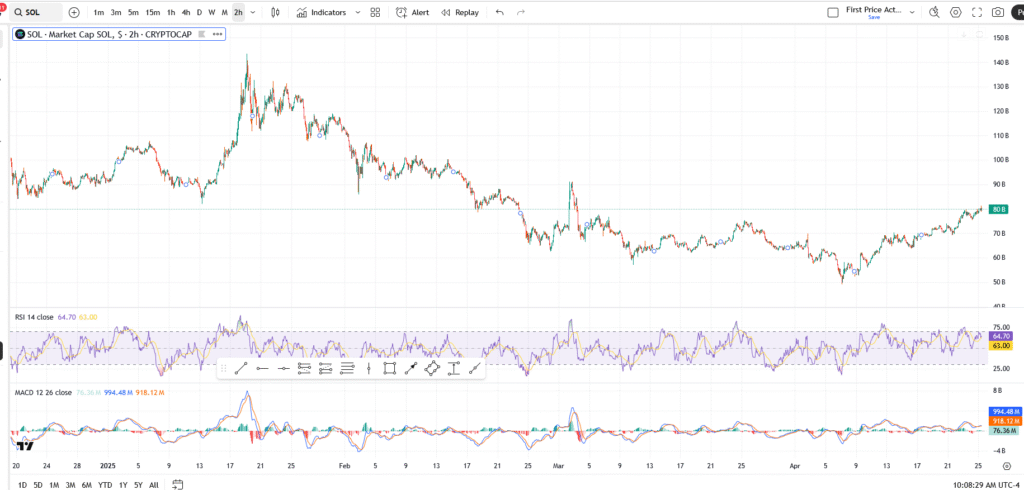

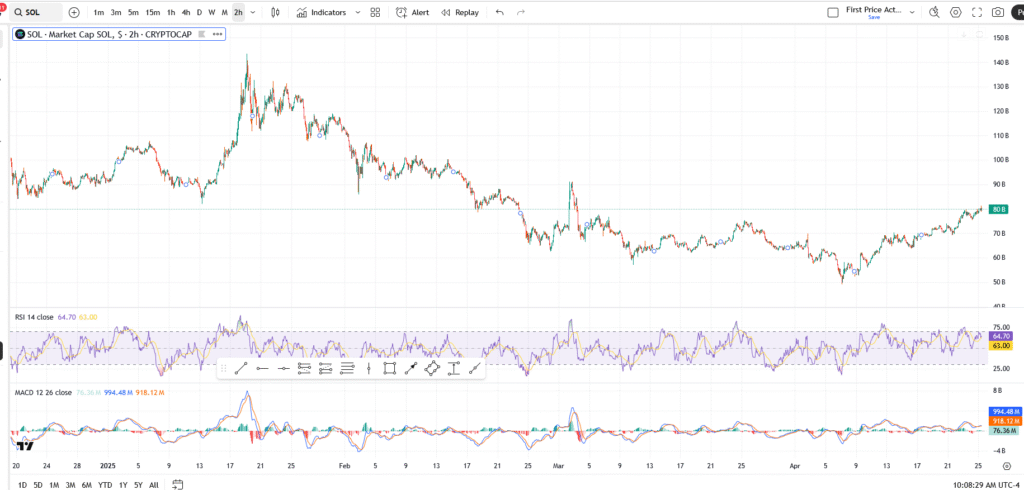

Solana regains the maximum market 80 billion dollars – Meme Mania or Smart Money Contings?

The total market ceiling in Solana hovers about $ 80 billion, and the price procedures have turned up sharply over the past week. Merchants revolve in Sol amid the launch of the Mimi currency and the growing developer activity on the chain.

Solana’s strength, especially as Ethereum is struggling to maintain benefit standards. Meme currencies such as WIF and Bonk attract huge sizes on Solana, which contributes to the high number of transactions and fees in the chain.

Solana scheme analysis

- Resistance levels: 85 billion dollars → 91 billion dollars

- Support levels: 74 billion dollars → 70 billion dollars

If Solana collapses over $ 85 billion with size, the following Altcoin course can be managed.

Take the final: rotation, patience and the waiting game

The half of Bitcoin has finished, but the effect has just started. While BTC merges, ETH and Sol are fighting to dominate the market under the surface. Ethereum has the institutional width but weak on the chain, while Solana flourishes with retail energy and the noise of the alternative season.

This is not a noticeable melting-it is a calculated rotation. And when one of these three collapses decisively, the rest is likely to follow.