The price of the PI network decreases by 15 % a week – what is behind the fall?

Pi Network (PI) exposes the escalating technical weakness, as it has decreased by 15 % over the past seven days and 4.4 % in the past 24 hours, with the market ceiling now at $ 5.12 billion. The trading volume increased by 25 % in the past day, reaching 104.6 million dollars, indicating an increase in activity amid the direction of deepening drop.

The main indicators such as the ADX, CMF and EMA structure indicate the increased landfill, with increased pressure pressure and price procedures that are struggling to obtain support. Unless the momentum turns, the PI appears vulnerable to increasing the negative side in the near term.

PI’s landmark reinforcement

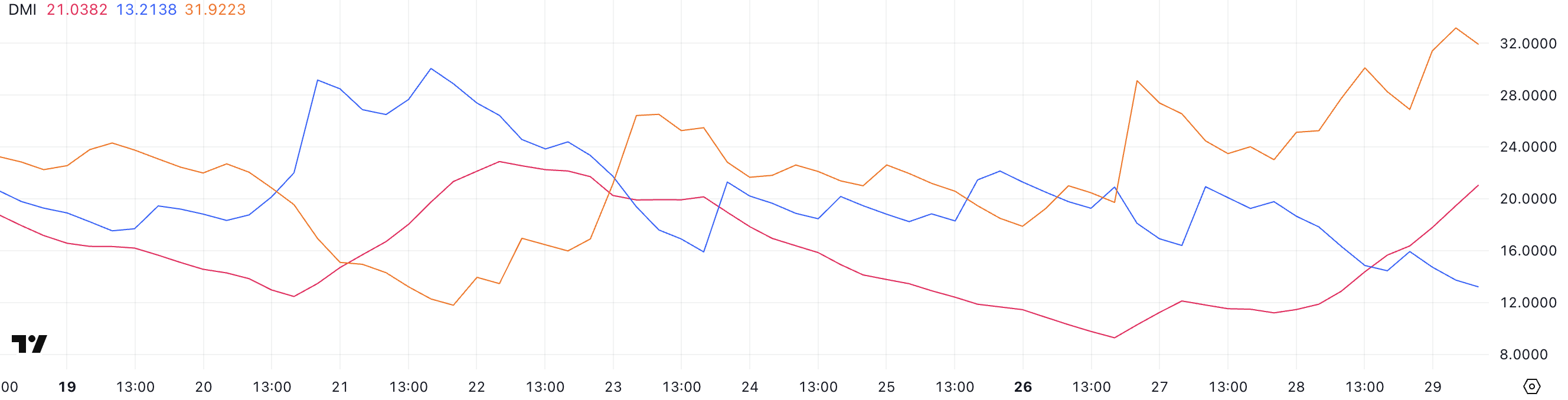

The PI (PI (PI) plan shows a remarkable rise in the average direction index (ADX), which rose to 21 from 11.46 just one day ago.

ADX measures the strength of the direction, regardless of the direction. In general, ADX is less than 20 to a weak or incompatible market, while the above readings indicate that the trend has begun to gain strength.

With ADX from PI now over this threshold, the data indicates that a more decisive step – either difficult or downward – may develop.

If we look deeper, the DI +(the positive trend index) decreased to 13.21 out of 20.93 two days ago, while the -di (the negative trend index) rose to 31.92 from 23.48.

This wide gap, with a clear -dominant -di, increases the declining pressure on the PI. When -Di rises above +Di besides ADX reinforcement, it usually confirms a declining trend that acquires momentum.

In short, the indicators correspond to the suggestion that PI may enter in a stronger declining direction, and merchants must closely monitor the follow -up through prices.

Indicators show strong sale pressure

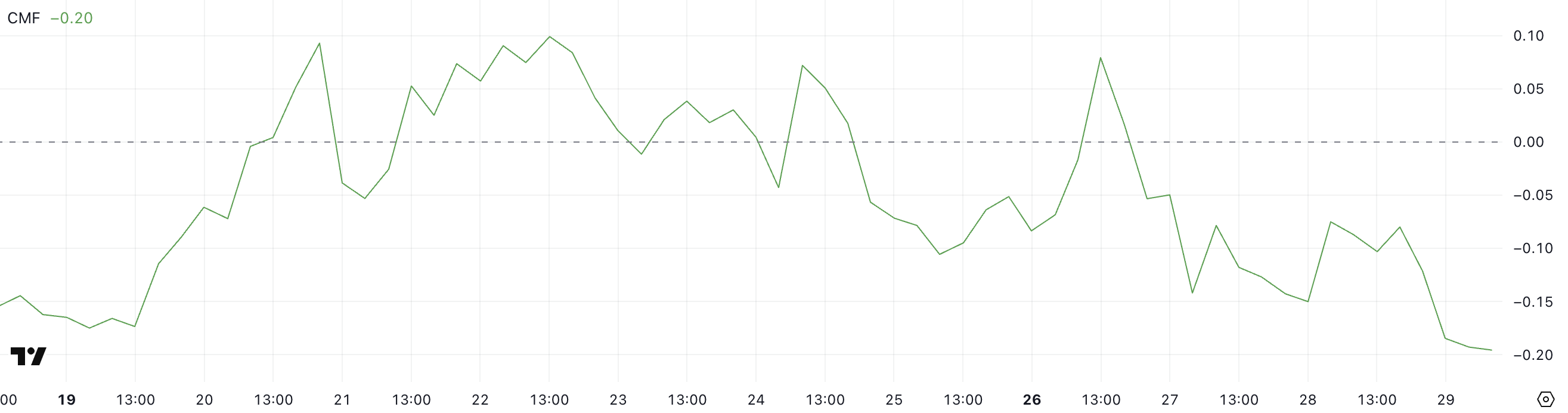

The flow of Chaikin (CMF) of the PI (PI) decreased sharply to -0.20, down from 0.08 three days ago and -08 just one day ago.

CMF is a weighted indicator of size that measures the flow of money inside and outside the original for a specified period, usually 20 or 21 days.

The above values indicate in general to purchase pressure and accumulation, while the values below indicate 0 to sell pressure and distribution. CMF reading is usually exceeding ± 0.10 mission, indicating deeper negative values to sustainable external flows.

With CMF from PI now at -0.20 -the lowest reading since May 17 -there is a strong indication of controlling the sellers.

This sharp decrease reflects the increase in the capital that leaves the original, and when it is associated with twice the last prices, it enhances a downward look.

If CMF continues to decrease or withstand negative levels deeply, this may indicate that any attempts to bounce may face severe resistance due to the lack of support for the upscale size.

PI price lener lember super

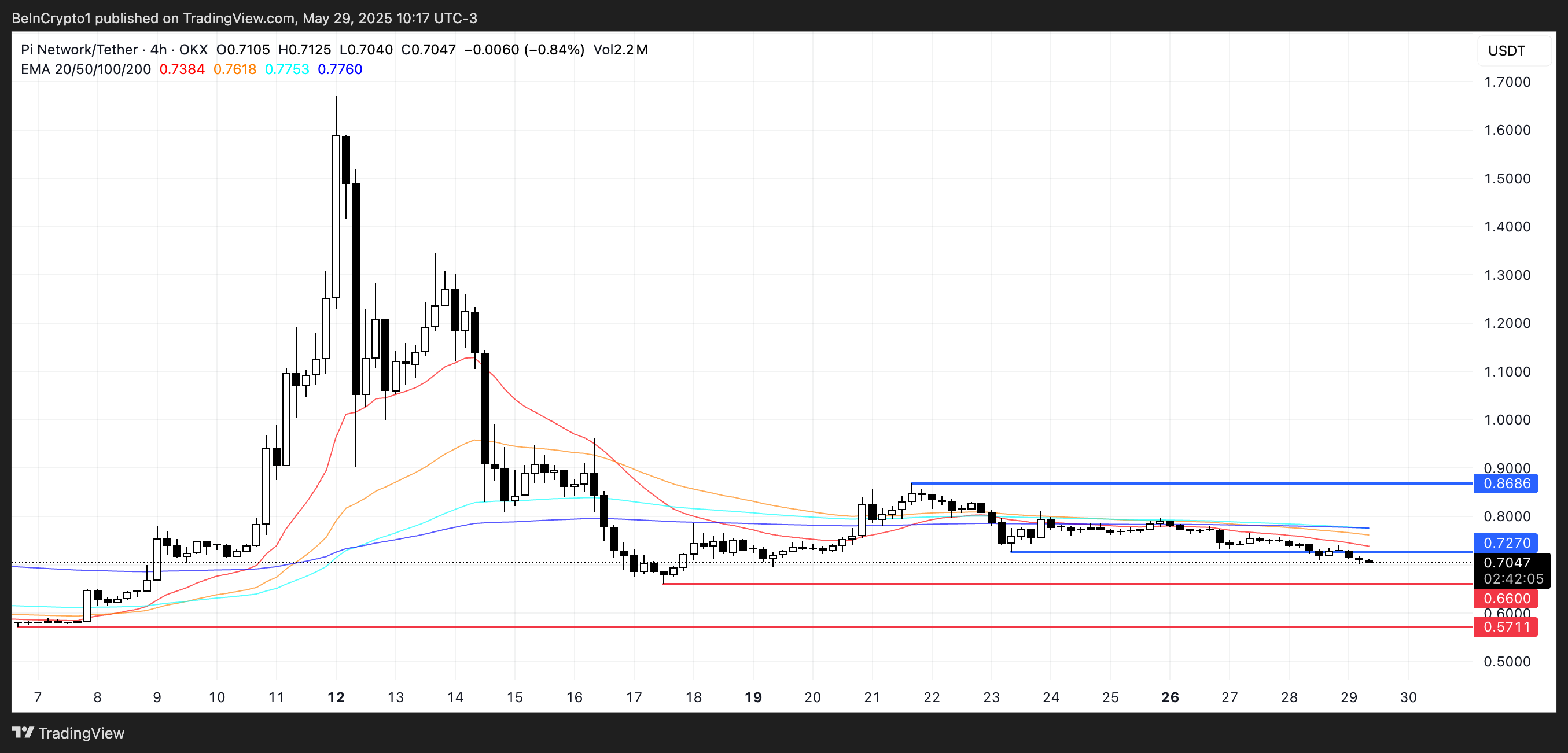

EMA indicators of the PI remain down, with EMAS mode in the short term below those long-term-a clear sign that the declining momentum is still in control.

The increasing distance between these EMA lines enhances the strength of the current declining direction. If PI continues to slip, the next support level falls at $ 0.66, and the loss of this can open the door for an additional decrease of about $ 0.57.

On the other hand, if the PI managed to reverse its current course, then the first main resistance to watch is $ 0.727. The collapse above this level can indicate a short -term recovery and the price may be sent up to the 0.86 dollar sign.

However, until the short -term Emas begins to settle or cross the long -term, any upward attempts may remain vulnerable to the pressure pressure.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.