The price of Solana shows the recovery signs with facilitating the declining pressure

The total value of Solana (Sol) Locked (TVL) recently reached $ 9.90 billion, the lowest level since November 2024, before recovering slightly to $ 10.3 billion. Despite this apostasy, the Sol TVL still decreases by approximately 30 % from January 18, reflecting continuous concerns about its ecological system.

Sol price is also under pressure, as more than 8 % have decreased in the past seven days and more than 31 % in the past thirty days. Technical indicators show signs of recovery, but hoopy trends are still dominant, with Sol trading without main resistance levels.

Solana TVL has reached its lowest level since November 2024

The total value of Solana Locked (TVL) is currently $ 10.3 billion, and recovers from less than 9.90 billion dollars on February 17, which is the lowest level since November 14, 2024. Despite this recovery, TVL still decreases by 30 % from 14.2 billion Dollar on January 18. It reflects the low investor confidence.

This decline coincides with the differences surrounding the Solana ecosystem, including accusations that they are very extractive and very criticism about the launch of Meme Coin Libra, which contributed to the flow of capital.

TVL tracking is important because it shows the total closed capital in the Blockchain ecosystem, indicating liquidity and investor’s confidence. Although TVL of Solana has recovered a little, the sharp decline during the past month highlights continuous fears.

If these problems are not addressed, the continuous capital flows can press the Sol price and slow their recovery. On the contrary, if confidence is restored, the increasing TVL may indicate renewed interest and support.

Solana’s indicators are still declining, but they recover

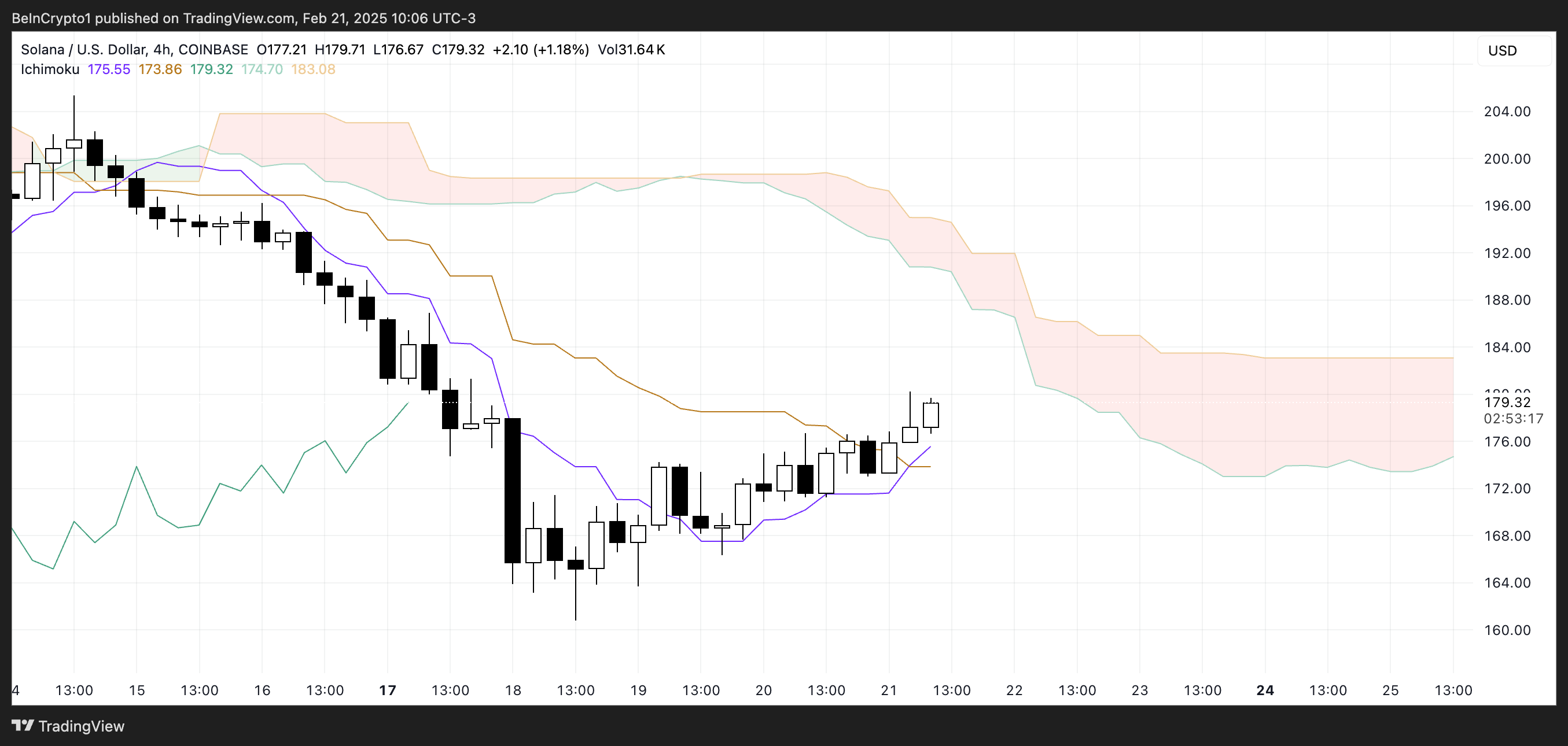

The Solana Ichimoku cloud chart explains that the price is currently less than the red cloud, indicating that the declining trend is still dominant. However, the price is now traded above the blue Tenkan-Sen (the conversion line) and the Kijun-Sen (the foundation line), indicating that the declining momentum weakens.

This can indicate a possible recovery in the short term as buyers began to get some control. However, the thick red cloud acts as a strong resistance, which Solana will need to penetrate to confirm a bullish reflection.

In this case, the fact that Solana under the red cloud indicates that the general declining trend has not yet revived.

However, if the price can be broken over the cloud, this will be a strong upward signal. On the contrary, failure to break the resistance may lead to the renewal of the sale pressure and the continuation of the declining direction.

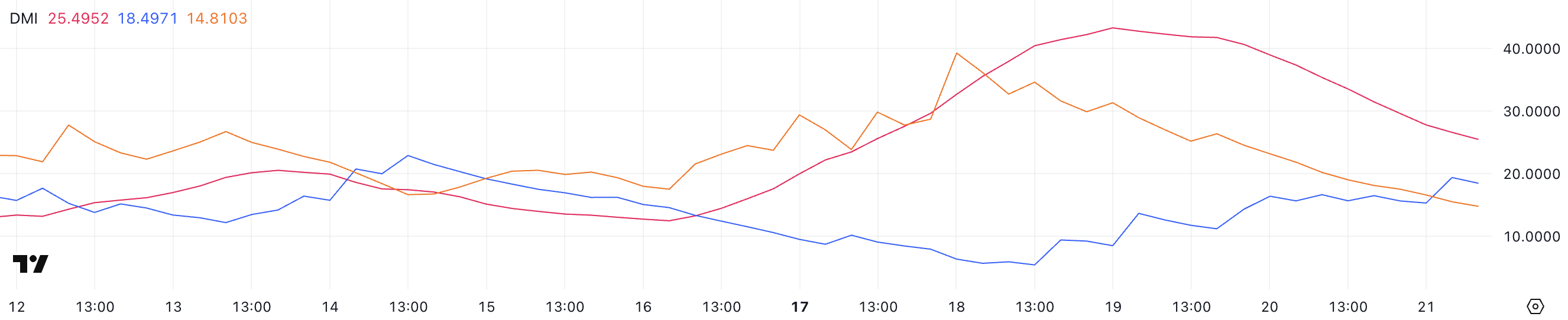

Solana (DMI) (DMI) (DMI)) explains that the average trend index (ADX) is currently 25.4, a decrease from 43 days ago only when the Sol price decreased to about $ 165.

This decrease in ADX indicates that the strength of the declining direction is weakening, although the direction itself still exists. ADX above 25 usually refers to a strong direction, but the decreasing value indicates that the declining momentum loses strength. This can lead to a standardization stage.

Meanwhile, the Di +is 18.4, as it rose from 5.4 three days ago, while -Di is 14.8, as it decreased from 39.2 during the same period. This shift shows that the purchase pressure increases gradually with the low sale pressure. If +Di continues to rise above -DI, it may indicate a possible reflection of the direction.

However, since Sol is still in the declining direction, it will need a continuous purchase momentum to break the declining style. If +Di fails to maintain its upward movement, the declining direction can resume.

Solana can recover 200 dollars if the declining trend is restored

Si -moving average lines (EMA) still indicate a declining direction, as short -term EMAS is less than long -term lines. However, the trend of these lines began to shift slightly since yesterday, with Solana’s price increased by 4 %.

This indicates that the pressure pressure weakens and that interest in purchase is gradually returning. If this momentum continues, this may lead to a reflection of the direction. However, this requires the short -term Emas crossing over it in the long run.

If Sol can completely reversed the current declining direction, it can first test the resistance at $ 183. A successful break above this level would indicate a stronger rise, which may push the price to the following resistance at $ 197.

If the purchase continues, the Sol PRICE may target $ 220, which represents a large recovery.

On the contrary, if the declining direction continues and the intensification of the sale pressure, Sol can re -test the support at $ 159.

A break below this level indicates the continuation of the declining direction. This may lead to a decrease in about $ 147, which is its lowest level since October 2024.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.