The price of Sainlink shows the recovery signs – why $ 15 is the level to watch

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

The price of Chainlink achieved its fair share of early 2015 conflicts, as it decreased to the lowest new level exceeding $ 12 earlier this week. Altcoin had to face the downside pressure on a large scale and exacerbate investor morale in the public encryption market.

Chainlink price overview

On Tuesday, March 11, the price of ChainLink surrendered to the market pressure at the market level, which witnessed the largest number of cryptocurrency currencies of 77,000 dollars for the first time in more than four months. Other large assets in this recession have also suffered in the last market, as the price of ETHEREUM also decreased under $ 2000.

Related reading

The price of ChainLink seems to be well recovered in the past few days, as it represents a play for $ 15 on Friday, March 14. In a strong appearance show, Altcoin was classified as one of the best daily winners with a positive performance of approximately 10 % a day.

After crossing $ 14.5 early in the day earlier, the price of Sainlink returned to less than the psychological level of $ 14. As of the writing of these lines, the correlation price is about $ 13.83, which reflects an increase of approximately 6 % over the past 24 hours.

This performance for one day, however, was not enough to wipe the altcoin loss on the weekly time frame. According to data from Coingecko, the bonding price has decreased by more than 13 % in the past seven days.

Could the bonding price rise to $ 16?

Although the price of the Sainlink price appears to be changing, the price level may be necessary for its long -term path. In a post on X, the famous encryption analyst Ali Martinez gave an insight into decisive levels of the binding price.

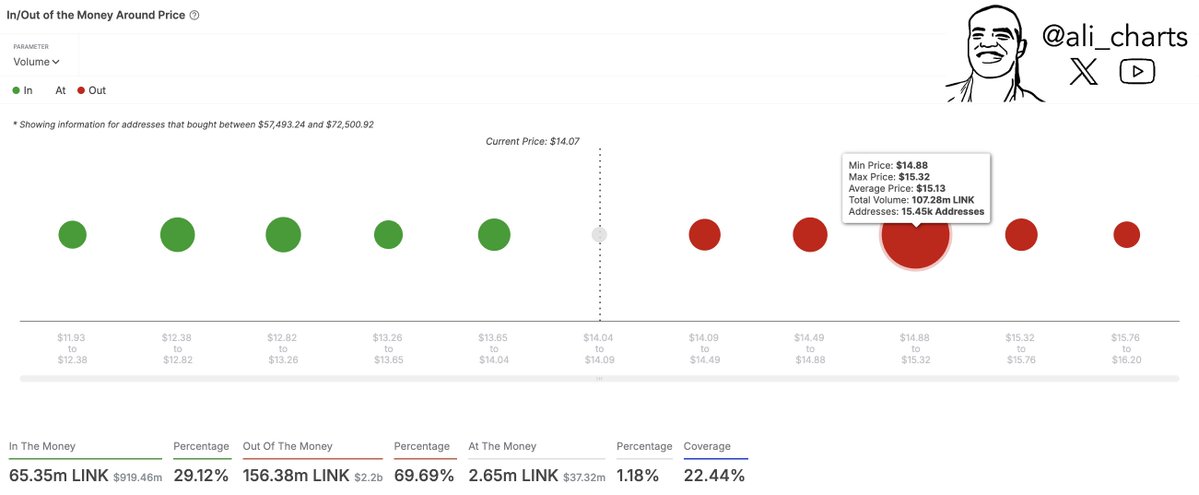

this analysis It revolves around the average cost of several link investors. In cost analysis, the ability of the work level as support or resistance depends on the total amount of metal currencies purchased by investors in the region.

As shown in the graph above, the point is the size of the point and corresponds directly to the number of cookies acquired within the price chip – with the opposite of the strength of each level. Based on this analysis, Martinez pointed out that the price of Sainlink faces a large resistance about $ 14.88 – $ 15, where he bought 15,450 investors 107.28 million link link ($ 1.62 billion at $ 15.13).

The higher investor activity led to the formation of the show barrier around the $ 15.13 region. The price of Sainlink is likely to witness great pressure for sale due to the desire to sell distinctive symbols after returning to the basis of cost, which hinders more price increases and leads to low prices.

However, it should be noted that there are no large resistance levels that exceed this area of $ 15.13. Consequently, investors can see the link price of up to $ 16 if the resistance level of $ 15 is successfully violated.

Related reading

Distinctive image from Unsplash, tradingvief chart