Monero jumps 11.5 % amid decisive support

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

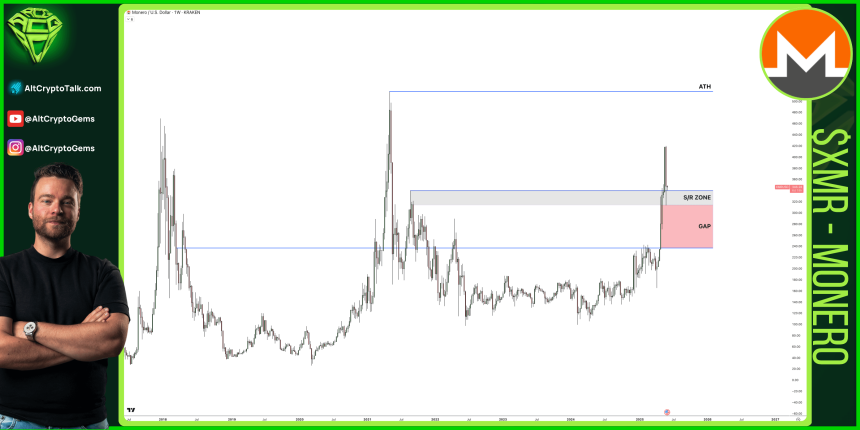

The distinctive code that focuses on safety (XMR) witnessed an 11.5 % increase in the daily time frame, and the support of $ 360 for the first time a week. Some analysts suggest that its current domain contract can send the cryptocurrency to another $ 420 to resist its historical resistance.

Related reading

Monero bounces from its lowest levels

Amid the decline in the encryption market, Monero has led the best 100 symbols through the market value list with a jump from two numbers over the past 24 hours. The cryptocurrency increased by 11.5 % on Monday morning, as it erupted from the lower direction for seven days.

It is worth noting that XMR witnessed a 66 % increase in prices during the month and a half, jumped from the 220 dollar support zone to its current levels. The daily increase code recorded 55 % at the end of April, connecting the $ 340 brand before restoring.

According to this increase, this increase was fueled by a “suspicious transfer” of 3520 BTC, at a value of $ 330.7 million, from a possible victim of social engineering. According to Crypto Sleuth Zachxbt, the stolen money of XMR has been replaced, leading to the driving of the encoded currency to re -test the main horizontal level.

Nevertheless, the privacy code continued to collect it during the month of May, which pushed XMR to the highest level in four years ago, with the approaching resistance of $ 420 for the first time since 2021.

Now, the last performance of the Monero market is sent alongside the rest of the leading cryptocurrencies to re -test the main levels. The symbol regained 21 % last week, and was briefly lost for three weeks on Saturday.

However, XMR wore this level over the past two days after restoring a brand of $ 325 and near to resist $ 370.

XMR Rally suspended at this level

“Monero has an impressive scheme and is likely to be a few metal currencies” Dino “is not far from breaking it at all.”

He highlighted that XMR re -testing the recently turned the support and resistance area, which is the key to the continuation of the gathering. Loss of 310 to $ 345 to send the cryptocurrency to the gap between this level and the next main support on the 220 dollar sign.

Likewise, the former analyst Rekt Capital noticed Monero Repeat the play book in early 2021 after it came out of its multi -year accumulation in the fourth quarter of 2024, as it rose over the resistance of $ 286 and hit the high levels of the last session.

he newly He pointed out that XMR has historically ended its emerging market around $ 422 resistance, with “this type of price procedure for XMR occurs once every four years”, and price pools in the main resistance “are often volatile beyond there.”

Related reading

Amid his last rejection of the height of a 419 -dollar cycle, the analyst considers that Monero must keep its current group, “if PRICE wants to contradict the history of history and break the resistance of $ 422 over time.”

If you fail to stick to $ 300, Rekt Capital has confirmed that supporting $ 286 is the next level, but he added that historically, the XMR test usually fails.

As of the writing of these lines, Monero is trading at $ 366, an increase of 32.2 % in the monthly time frame.

Distinctive photo of Unsplash.com, Chart from Tradingview.com