The PI network decreases approximately 6 % a week, and connect to support

The PI (PI) has decreased by approximately 6 % over the past seven days, indicating mixed signals through the main technical indicators. While the DMI suggests that the declining momentum fade and a potential transformation in the direction, CMF indicates a light purchase pressure but still positive.

Meanwhile, EMA lines indicate monotheism, with PI trading slightly higher than the critical support level at $ 0.601. Whether the price that collapses or rises from here will probably depend on whether he can get major support or pay nearby resistance levels.

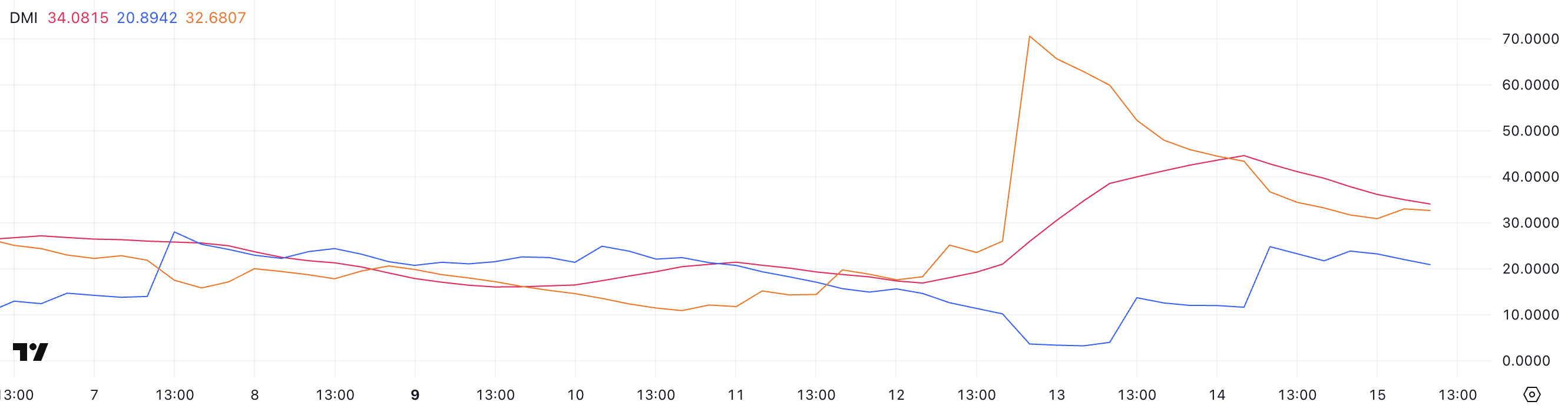

PI Network DMI

The PI (DMI) movement indicator indicates that the average trend index (ADX) decreased to 34, a decrease from 44.59 just one day ago.

This decline follows a sharp rise in 16.89 days ago, indicating a modern trend but weakens now. ADX measures the strength of the direction, regardless of the direction.

Readings that are less than 20 indicate a weak or non -existent direction, while values of more than 25 indicate a strong direction. As ADX continues higher than 30, it is possible that PI is in a heading stage, but the momentum appears to be cool.

When looking at the direction indicators, the +Di +rises to 20.89 of only 4 days ago, indicating an increase in upward pressure.

Meanwhile, -DI decreased dramatically to 32.68 after the peak in 70.57 three days ago, indicating that the declining momentum fades.

This intersection in the strength of the direction can hint into a possible shift in feelings. If +Di continues to rise during a decrease -DI, the PI price may start recovering or entering a more neutral stage after a period of intense sale.

PI CMF The light purchase pressure appears after a recent rise

CHAIKIN Money Flow (CMF) is currently flowing from Pi Network 0.07, decreasing from 0.19 two days ago but still higher than -0.05 three days ago.

The CMF index measures the flow of money inside or outside the original over time, using price data and size. The values above suggest that the pressure is purchased, while the values below indicate the sale of pressure.

Readings are usually seen above 0.10 or less than -0.10 as stronger signs of accumulation or distribution.

The current CMF level of PI at 0.07 indicates a light but positive purchase pressure.

Although it is not strong enough to confirm aggressive accumulation, it indicates that the capital is still flowing to the original, although it is less intense than two days.

If CMF continues to stick to zero, it may support stability or gradual recovery in the price. However, if it decreases below zero, it may indicate the weakening of demand and the risks of the potential downside.

The outbreak or collapse? PI trading near decisive levels

PI currents currently indicate a period of unification, after recovery from the sharp decline caused by the escalation of the Israeli conflict.

The procedures you hover with a little higher support at $ 0.601. If this level is broken, the PI price may decrease to $ 0.542, and if the landfill is built, it may decrease about $ 0.40.

This structure reflects uncertainty, with no clear or low -domination of control at the present time.

On the upper side, if the PI can penetrate the resistance levels at $ 0.647 and $ 0.658, this may lead to a new direction.

These successful areas may open over these areas to move about $ 0.796.

EMA’s setting supports a neutral position at the present time, waiting for a decisive step in either direction.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.