The Pepe coin is sliding after the bull lost 1.86 million dollars and the OI drop

Bibi, the Mimi -based currency, decreased by 2 % today at the time of the press, where the broader encryption market is experiencing a slowdown. The broader MIM sector has decreased by 20 % over the past thirty days to reach $ 60.29 billion.

Since Coin Pepe Meme, it exceeds the maximum market for $ 5 billion, the declining trend risk a possible withdrawal to a psychological mark of $ 0.000010.

Mimi Bibi currency analysis analysis

In the daily chart, the Pepe Meme Coin movement displays a low low composition, which is a new lower -lower formation near $ 0.00001350 with long candles. The reflection in PEPE is 50 % reversal in Pepe, at $ 0.00001222, which risk possible details as it currently trades at $ 0.00001226.

PEPE’s immediate support is an EMA height for 50 days at 0.00001159 dollars, followed by Emas Convergent 100 and 200 days at $ 0.000010 near $ 0.00,001100. With the growth of the sale pressure, the MACD lines and the signal lines hints to a potential cross.

However, short -term uncertainty leads to flat movement, which delays the positive intersection. PEPE’s decisive support is $ 0.00001037, and is highlighted at the lowest 30 days.

With an optimistic lens, if PEPE avoids a 50 % lower closure of the Fibonacci level, it may challenge the decisive resistance back of $ 0.000015 that created multiple peaks last month.

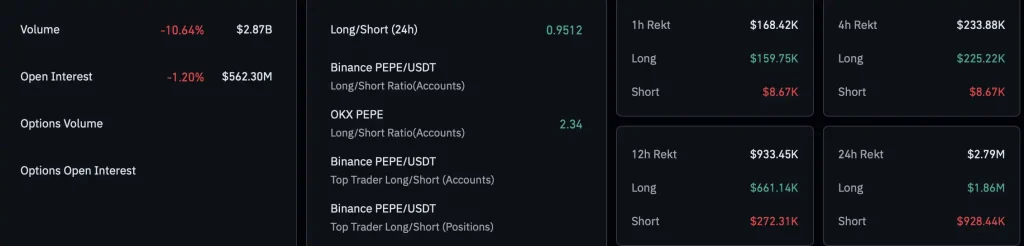

Baby derivatives indicate the risks of the negative side

In the derivative market, the short -term decline led to a sharp decrease in Pepe Open attention. It decreased by 1.20 % to $ 562.30 million. In addition, the long ranking with a length of 1.86 million people is approximately twice of the $ 928,000 short qualifiers.

This indicates a large survey of buyers in the derivative market. This has decreased long to a maximum to 0.9512, indicating a wider market anticipation for a more severe correction.

In conclusion, the last PEPE decline by 2 %, along with technical expectations, indicates an increase in negative risks. The closure without a 0.001222 dollar sign that is in line with the 50 % Fibonacci level can speed up the correction towards the switch support 0.000010. However, the reversal of the Fibonacci level may lead to the revival of the upward trend to $ 0.000015.

![Grasim Industries Elliott Wave Technical Analysis [Video] Grasim Industries Elliott Wave Technical Analysis [Video]](https://i0.wp.com/editorial.fxsstatic.com/images/i/Economic-Indicator_Industrial-Production-1_Large.png?w=390&resize=390,220&ssl=1)