The price of Ethereum decreased again as it builds the landfill

ETHEREUM (ETH) has decreased by almost 9 % over the past seven days and continues to trade without a sign of $ 3000 – a level that has not been restored since February 1. Modern technical indicators indicate that the declining momentum is built, with poor directional strength and pressure pressure.

The momentum oscillator, such as RSI, has decreased sharply, while the main resistance levels continue to retain ascending attempts. Since the ethics to restore the land, traders closely monitor to see if the support levels will keep them or the additional negative side was imminent.

Ethereum bears gain momentum with fading trend

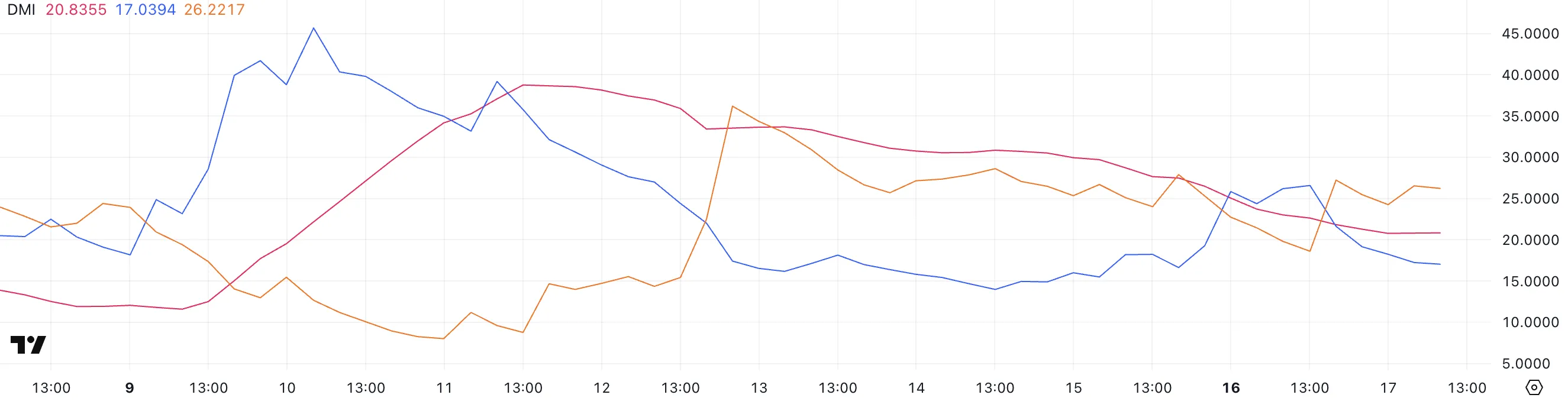

The ETHEREUM movement index (DMI) appears ADX to 20.83 from 27.64 two days ago, indicating twice the strength of the direction.

ADX, or medium trend index, measures the strength of the direction, regardless of whether it is higher or down. Values of more than 25 usually indicate a strong direction, while values that are less than 20 indicate a weak or uninterrupted market.

With ADX from ETH now near the lower border, it indicates that the last directional momentum fades, and the market may enter a period of movement or side frequency.

Looking at the direction indicators, Ethereum’s +Di decreased to 17 from 26.57 yesterday, after a short jump from 16.62 two days ago. This indicates that the upward pressure has been cooled quickly.

Meanwhile, -Di rose to 26.22 out of 18.60, indicating the growing downside. This difference between the decline +Di and RISING -DI indicates that sellers acquire the upper hand, which may push the eth to a short -term downtown direction.

Besides ADX’s weakness, the current preparation indicates an increase in the risk of the negative side unless the bulls regain control soon.

ETH faces pressure after a sharp RSI reflection

The ETHEREUM (RSI) has decreased to 46.2, a sharp decrease from 61.82 yesterday, after it rose from 38.14 two days ago.

RSI is a momentum that measures the speed and size of the recent prices to assess the conditions that are made or increase the sale.

Values of more than 70 usually indicate the excessive origin that may be due to withdrawal, while readings of less than 30 excessive conditions may precede a recovery.

The neutral area is between 30 and 70, where the price procedure is generally balanced or cooperative.

RSI from Ethereum is now 46.2, where she returned to a neutral area after a brief approach to the peak area.

This decline indicates that the momentum of ascension fades and may indicate that the recent purchase interests have weakened. Although reading about 46 does not indicate an immediate reflection, it reflects uncertainty and can open the door to more negative aspect in the event of an increase in the sale pressure.

If the RSI continues to slip about 30, it may confirm that the ETH enters a more clear and declining phase.

Ethereum is struggling at the bottom of the resistance as the EMA direction bears landing

Ethereum’s EMA (Si -moving average) currently indicates a declining direction, as the price is struggled to restore upward momentum.

Recently, ETH tried to penetrate the resistance level at $ 2,679 but failed, enhancing that sellers remain in control. If the market is tested and the support is lost at 2479 dollars, the additional downside may lead to ETH to $ 2,386, and perhaps low up to $ 2,326 in the event of condensation of the declining pressure.

These levels put the key areas where buyers may interfere-but until then, the short-term structure remains tilted to the downside.

However, a transformation can occur in the momentum in case of re -test ETHEREUM and successfully successfully resistant to $ 2,679.

The collapse above this level will be a strong signal of the bullish intention, which may lead to a move about $ 2,790 and up to $ 2,878 if the direction is reversed. The EMA intention will then start the settlement or curl up to the top, indicating a renewed force.

Until this happens, though, ETH remains vulnerable to more losses, as traders closely monitor how it interacts about the main support and resistance levels.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.