The next big step for Bitcoin? Open attention says “Preparation”

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Bitcoin price recovered to 80,000 dollars after a sharp decrease in concern for US President Donald Trump tariff policies. The cryptocurrency market has witnessed the sale of panic within the past 12 hours, with economic concerns spread in various sectors.

Related reading

The maximum market is worth $ 1.5 trillion with bitcoin dominance growth

According to market data, Bitcoin Market value It is currently $ 1.5 trillion despite the recent fluctuations. While the leading cryptocurrency has worn slightly, Altcoins is still struggling with deeper losses.

Bitcoin’s dominance in the total encryption market jumped to 60 %, indicating that investors may demand a shelter in the largest digital assets during the unconfirmed times.

Market analysts said that the market responds directly to the broader economic concerns instead of coding issues.

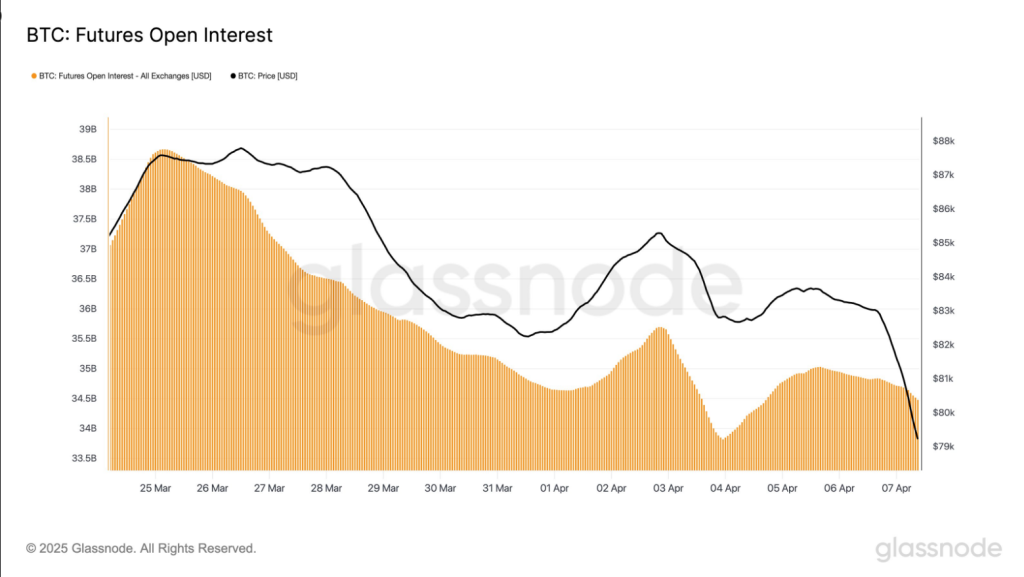

$ BTC Open futures are located at $ 34.5 billion. While there was a brief recovery of a decrease in 33.8 billion dollars on April 3, the broader downward trend remains intact. Future exposure continues to relax, as traders reduce risks in response to the decline in price momentum. pic.twitter.com/zx06yoctsa

– Glassnode (Glassnode) April 7, 2025

The futures market shows sudden flexibility

Based on reports from Glassnode, the open interest of Bitcoin Future decreased to $ 34.5 billion, indicating a brief recovery of a decrease in $ 33.8 billion, but maintaining a total declining trend. Traders reduced their future exposure with a slowdown in bitcoin.

Since March 25, open exchange interest has decreased from 30 billion dollars to $ 27 billion. The encrypted open interest decreased at the same time from $ 7.5 billion to $ 6.9 billion. The most modern figures indicate that the open attention encoded in the height again, indicating that some traders belong to more dangerous sites.

The share contract contracts collected reached 21 % of the open attention from 19 % on April 5. This change may make the market more responsive to the shift in the price, and therefore, leads to increased fluctuations in the next few days.

Limited references refer to the controlled sale

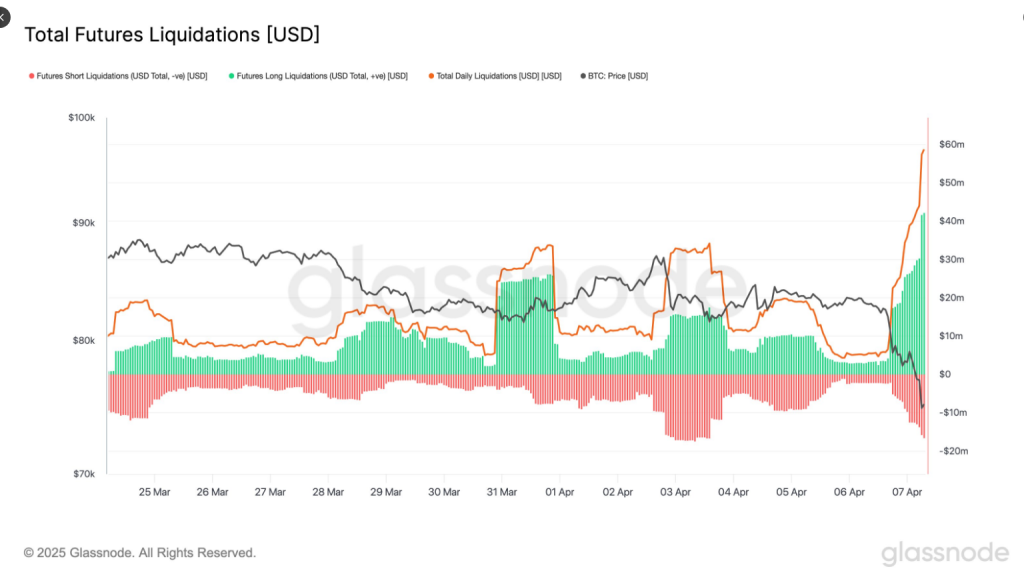

The past 24 hours have witnessed a 58 million dollar qualifiers at a value of $ 58 million, as Al -Taweel received 42 million dollars for the short pants it received 16.6 million dollars. Market monitors indicate that this liquidation number is significantly low given the 10 % decrease in Bitcoin.

the total $ BTC The futures reviewers have reached $ 58.8 million over the past 24 hours. Longs got a heavier blow of $ 42.1 million, for $ 16.6 million in short pants. Although prices have decreased by 10 %, this filtering volume is relatively modest, indicating an increase in the level of leverage in the direction of the upper direction. pic.twitter.com/104km2xqof

– Glassnode (Glassnode) April 7, 2025

The relatively small filter numbers indicate that the market has not been used significantly before the sale. Long references constituted about 73 % of the total future contract, indicating the presence of moderate upward feelings before the correction.

Related reading

These numbers are faded compared to the events of the previous market in February and March, when the daily references reached $ 140 million. The current trend indicates a decrease in prices organized primarily by immediate sale and not a wave of forced cells due to excessive situations.

Founding investors continue to enter the market

There are reports of increased institutional demand despite the recent fluctuations of the market. Statistics reveal that 76 new institutions with more than 1000 BTC entered the network in the past two months, which is 4.5 % in large bitcoin holders.

Distinctive image from Gemini Imagen, the tradingvief chart