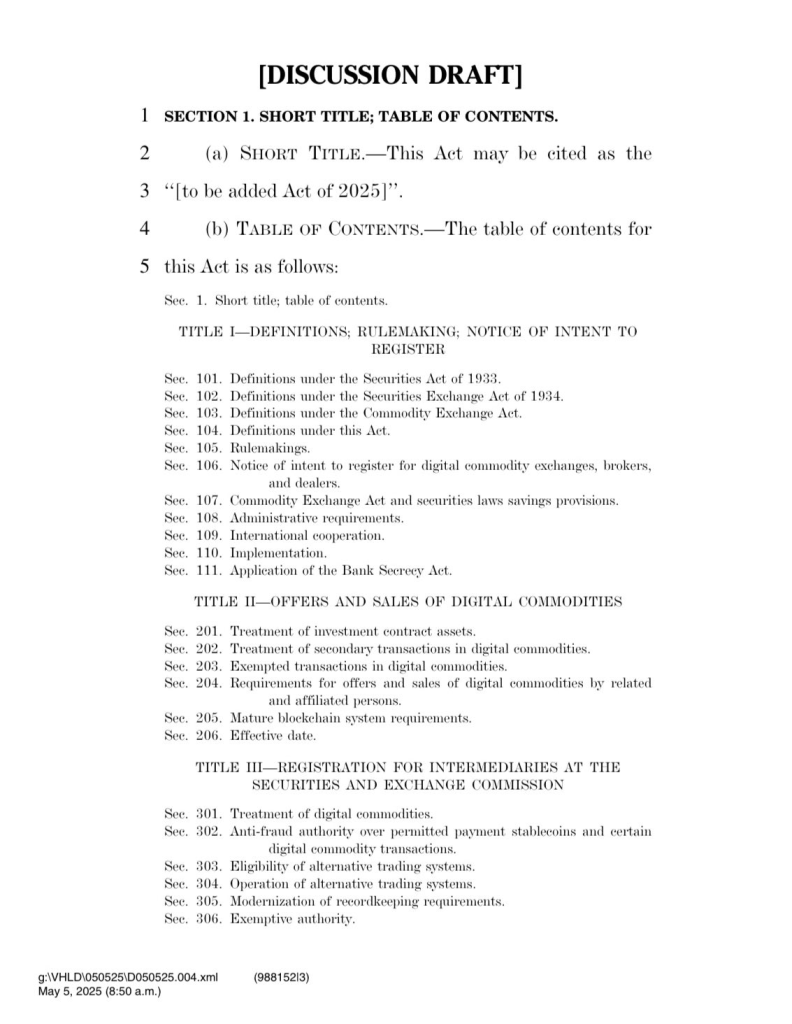

The new US encryption regulation bill has recently been issued

The United States has finally brought down the long -awaited numbers Crusion market structure billAnd it can be the game change. Before Financial services and agriculture committees in the House of RepresentativesThe new draft is trying to draw a clear line between those who organize what is in the encryption space.

Sec and

Unlike earlier Fit21 suggestionWhich sparked heat to weaken the role of the Supreme Education Council, the updated draft law draws a more balanced approach. the second You will continue to supervise encrypted symbols that are considered investment contracts, while CFTC It will take the initiative on encryption goods.

According to the Justin Siloter modelThe bill maintains CFTC in the driver’s seat, but it allows SEC to control some control until the projects prove that they are not truly central.

Interestingly, there is now official “Decentralization test.” The project should not be under the control of one party, and adult holders (who have more than 10 %) should be detected while remaining central. The bill also determines when Blockchain is considered “mature”.

It is worth noting that Blockchain should be open, functional, and not centrally owned – with no more than 20 % by any one party.

Retail investors also get a break. They no longer need to meet high income or wealth requirements to participate. This opens the door for ordinary people to invest in encryption, not only the wealthy elite.

Defi and Stablecoins get some clarity

Defi protocols It may be fully automated and do not maintain the user’s money, you may also avoid strict regulations under this draft law. It is also treated StablecoinsProvide them, but do not classify them as securities.

This comes as a detailed Bill Stablecoin, known as the Genius LawIt faces a political reaction to the Senate.