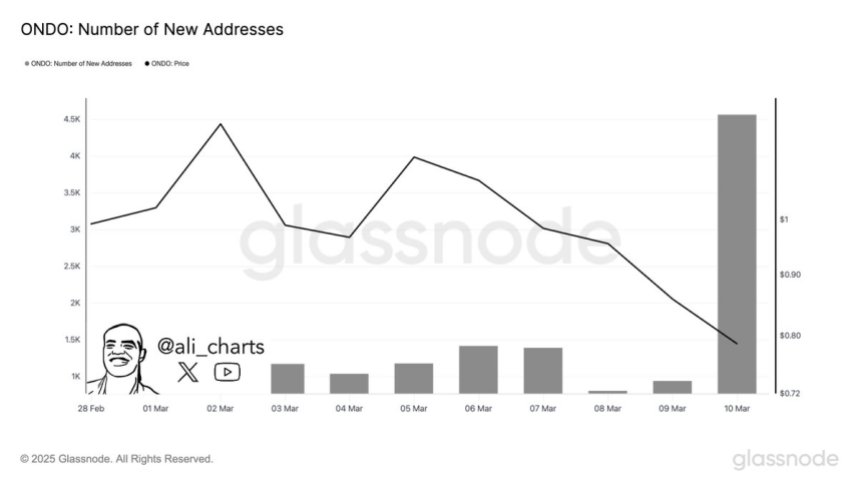

The new Oondo treats a 390 % increase in 24 hours – a sign of increased interest in the financing of Oondo

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Oondo Finance (ONDO) suffers from severe pressure for sale and increased fluctuations, as the broader encryption market continues in its landmark. Since the beginning of March, Oondo has lost more than 40 % of its value, reflecting the total morale of the risk risk of the market. With a fear of price procedures, analysts warn of more declines as investors remain reluctant to re -enter long positions.

Related reading

Despite the continuous declining direction, the data on the series of Glassnode reveals a noticeable shift in the network activity. Within the past 24 hours, the new UNDo addresses have increased by 390 %. This rise in new addresses indicates that interest in the financing of ONDO is increasing, even with no price movement. Historically, the growing network activity can be a provider of stronger accreditation, which may lead to an increase in the long -term recovery price.

As the market is continuing in the market, the coming days will be very important for the short -term price track. Investors closely monitor whether the emerging network activity translates into a renewed demand or whether the sale pressure will continue to affect the prices of prices.

Oondo leads the RWA market despite volatility

Over the past year, Ondo Finance has created itself as one of the leading encryption projects, as she got his position as a market leader in the real world (RWA). The project gained a large traction by providing symbolic financial products and filling traditional financing with Blockchain technology.

Recently, they took a big step forward by unveiling the Oondo series, which is Blockchain layer 1 layer designed for institutional finance. This innovation aims to bring in organized institutions to the area of digital assets, and enhance efficiency and safety while ensuring compliance with financial regulations.

Senior analysts Ali Martinez shared visions on xAnd revealed that the new Oondo addresses increased by 390 % in only 24 hours, an increase from 935 to 4559. This rise in the network activity can indicate a shift in investor morale, indicating that Oondo may be ready for strong performance once the market stabilizer. Historically, the increased network adoption was a bullish signal, and price recovery is often preceded.

Although the current market shrinks, the basics are still strong. The project continues to expand, attract institutional interests and enhance its role as a major player in the growing RWA sector.

Related reading

As Blockchain solutions and network activity are adopted, Ondo is still a strong competitor to growth in the future. If the conditions of the market become favorable, the project may appear as one of the best artists in the next bull session, driven by its continuous innovation and expanding the ecosystem.

The bulls monitor the main support

Oondo is currently trading at $ 0.83, after all the gains are wiped from the post -election gathering that started in November 2024. After months of steady growth, Oondo was arrested in the shrinkage of the broader market, facing pressure on sale and uncertainty as investors are equivalent to risks.

In order for the bulls to regain control, Ondo must exceed the support level of $ 0.75 to create a strong basis for recovery. Tawheed at these levels can help fixing price procedures, but as the market continues to the bottom, this process may take longer than expected. If buyers fail to get $ 0.75, Ondo may face more negative risks, which extends its correction.

Related reading

However, if Oondo exceeds $ 0.80, the bulls should aim to pay about $ 0.95, a major resistance level that can indicate the beginning of the recovery phase. With the increase in the growth of the new address, indicating an increase in the network activity, Oondo can be in a good position for the apostasy as soon as the market morale improves. Currently, traders are monitoring whether Ondo can defend their support levels or if the continuous weakness will send it to less in the short term.

Distinctive image from Dall-E, the tradingView graph