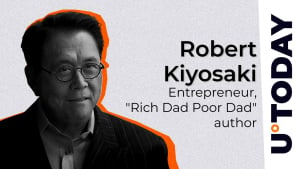

The new author of “Abi Abi Al -Fakr” expects ATH for the best best assets to Bitcoin

Robert Keusaki, a businessman and a defender of financial education, who is also famous for writing the book “Rich Dad Poor Dad” in the late 1990s, has revealed the origins of more than Bitcoin over the next few months.

It is expected that this original will reach the highest new level ever in the near future.

Bitcoin against “Fake Funds”

Robert Keusaki, who many believed to be a real financial teacher, has drew the community’s attention again to the issue of Fiat funds, which he refers to as “fake funds” by the government. His fans stated that for many years, he was defending investment in gold and physical silver and five years ago, Bitcoin added to these recommendations.

All this time, ordinary investors urged money not believed to be real assets – material gold, silver currencies, and bitcoin (even if it was saved in Satoshis, BTC particles). Unfortunately, most people work and provide “fake money”, “I have been tweet.

Keusaki insisted on the prices of these three assets constantly, and Keusaki and those who save these people become richer, while “the purchasing power of those who work to provide fake money becomes poorer … stealing the government known as” inflation “.

He said that since he wants to grow his fans richer, not poorer, it is important to “start working for and save gold, silver and bitcoin.”

The new ATH of this “Better of Bitcoin Assets” soon

Keusaki claimed that among the three “real origins” – gold, silver and bitcoin – “silver for the coming months is the best of the three”. Today, the audience reminds, silver is circulated by about $ 35 an ounce. In April 2011, it reached the highest level ever at $ 49.51.

Consequently, financial expert Keusaki believes that later this year can reach $ 75 an ounce and then rises to a historic peak of $ 200 or two. He says that almost anyone can fill “at least one silver currency a day … but not tomorrow.”

Other experts believe that silver can already reach a three -numbers price by 2024 due to the increasing industrial demand and decrease in supply. Moreover, silver can exceed $ 100 in a much closer if central banks persist in their aggressive cash decisions.