The most important reasons that make Bitcoin to refresh and explode to the new ATH before the end of June

The price of Bitcoin (BTC) continued to slip into the weekly and monthly timetables despite the unification and the volatile markets in the hourly chart. The leading currency is a bullish -continuing pattern after its rejection at its highest level at about $ 111,900, which was identified on about 22 May 2025.

Since June 9, 2025, the BTC price has seen a large resistance level of about $ 110,500, which has led to a decrease of 2-3 percent so far. The decrease of less than $ 108,000 during the past 24 hours has created a clear fear of more short -term correction.

Here are the main factors for the start of Fomo and the budget feelings of Bitcoin soon

Technical

BTC PRICE has been trading over the decisive weekly support level of about $ 104,354 in the past five weeks. In the past three weeks, the BTC price has been re -testing the upscale collapse, indicating an equivalent gathering soon.

In the time frame for one hour, the BTC price was re -tested from the completion of the falling direction. Although a solid base is not created to correct the continuous market, the main recovery is on the horizon.

Weakening Usdollar amid clarity of organizational encryption

Despite the historical attempts by the Donald Trump administration to strengthen the US dollar, the DXY, which measures the value of the US dollar against other major currencies. The Chinese yuan and other currencies were strengthened against the US dollar.

With Bitcoin mostly against the US dollar, the basic value will increase in the near future. Meanwhile, American organizations have made strategic moves to help the US dollar to remain dominant worldwide.

For example, the country intends to use stablecoins by enacting clear regulations. Consequently, the encryption liquidity will significantly increase with synonym with the global money show (M2).

High demand from institutional investors

According to the total data of BitcointreasuriesBitcoin’s entities in Treasury bonds have increased by 21 companies in the past thirty days, which increased BTC’s possessions by 3.28 percent to 3.41 million. More institutional investors, led by Gamestop, followed the strategy to benefit from global stock markets to enhance Bitcoin.

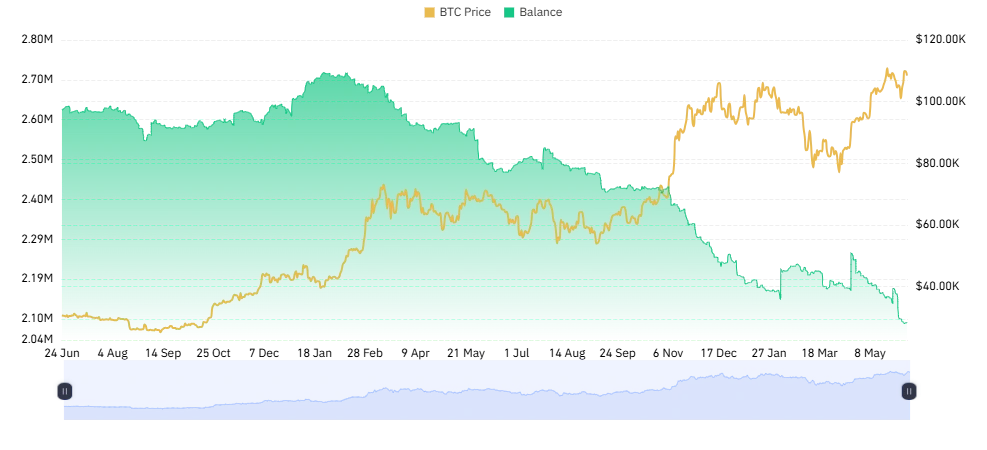

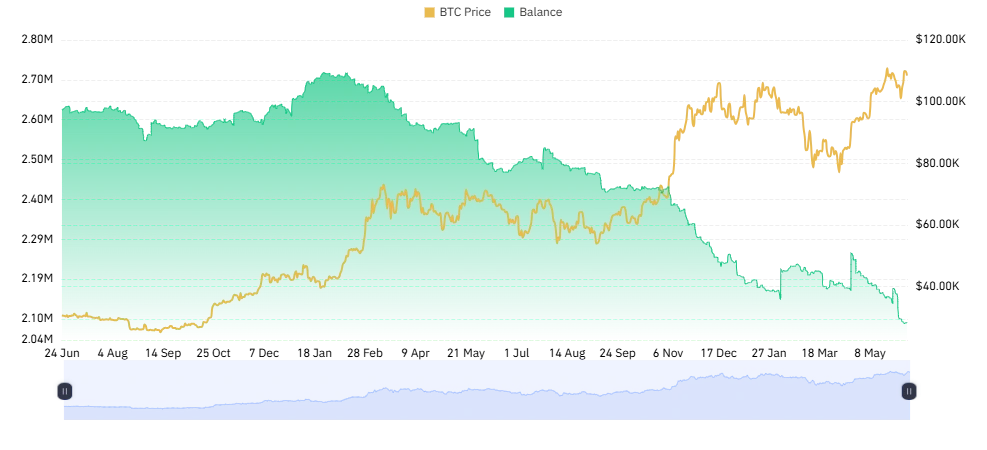

The investment funds circulated in the United States in the United States, led by IBIT from Blackrock, continued to accumulate more BTCS last year. As a result, bitcoin balance on the central stock exchanges has dramatically decreased to the lowest multi -year level of about 2.09 million coins, confirming a great shock against the demand.