Markets

The most accurate analysts on Wall Street give 3 utilities that offer high dividend yields – Northwest Natural HLDG (NYSE: NWN), AES (NYSE: AES)

During times of turmoil and uncertainty in the markets, many investors turn to dividend factor stocks. These are often companies that have free cash flow and reward shareholders while paying a dividend yield.

Benzinga readers can check out the latest analysts on their favorite stocks by visiting our Stock Analyst Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including Ratings by Analysts.

Here are the most accurate analyst ratings for three high-yield stocks in the utilities sector.

AES Company AES

- Dividend yield: 5.95%

- Barclays Analyst Nicholas Campanella maintained an Overweight rating and lowered the price target from $23 to $17 on December 13, 2024. This analyst has an accuracy rating of 63%.

- Mizuho Analyst Anthony Cauldell maintained an Outperform rating and lowered the price target from $24 to $16 on November 21, 2024. This analyst has an accuracy rating of 61%.

- Recent news: On December 6, 2024, AES announced a 2% increase in quarterly earnings.

- Benzinga Pro real-time news alerted you to Latest AES News.

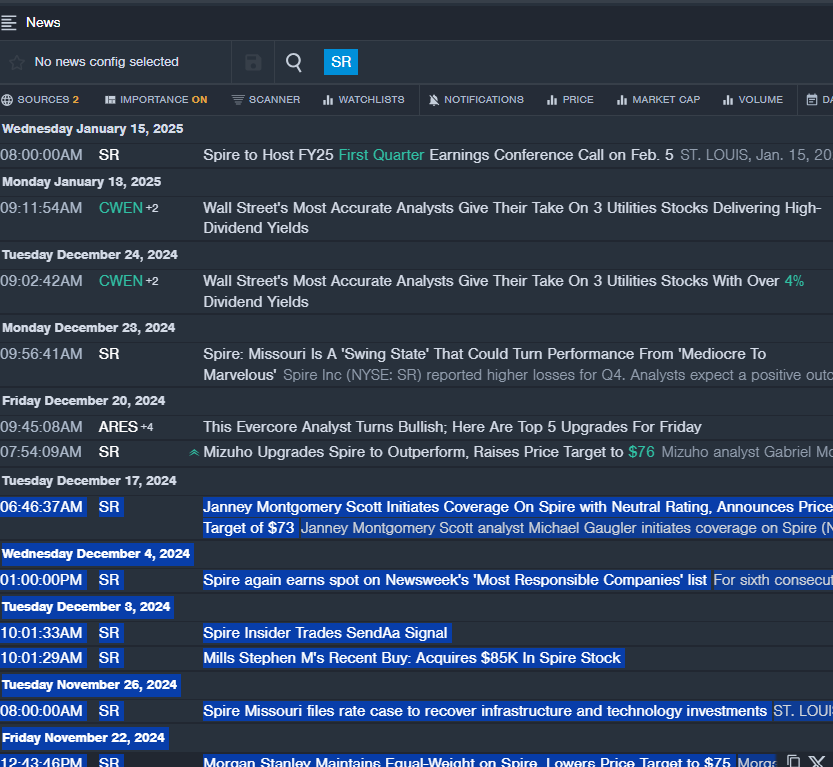

Spire Inc. SAR

- Dividend yield: 4.51%

- Mizuho Analyst Gabriel Morn upgraded the stock from Neutral to Perform and increased the price target from $65 to $76 on December 20, 2024. This analyst has an accuracy rate of 78%.

- Janie Montgomery Analyst Michael Gagler initiated coverage on the stock with a Neutral rating and a price target of $73 on December 17, 2024. This analyst has an accuracy rate of 73%.

- Recent news: Spire will host a conference call on Wednesday, February 5 to discuss first quarter 2025 financial results.

- Benzinga Pro real-time news alerted you to Latest SR News.

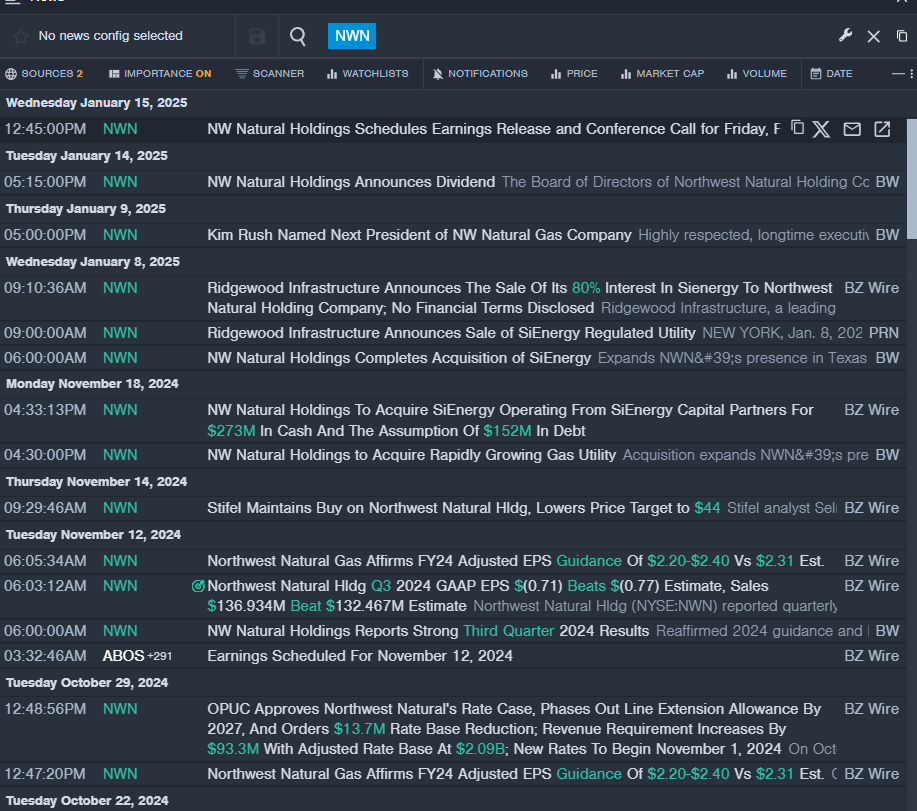

Northwest Natural Holding Company NWN

- Dividend yield: 4.91%

- Stifel Analyst Selman Akyol maintained a Buy rating and lowered the price target from $45 to $44 on November 14, 2024. This analyst has an accuracy rate of 75%.

- Janie Montgomery Analyst Michael Gagler upgraded the stock from Neutral to Buy and raised the price target from $36 to $43 on August 5, 2024. This analyst has an accuracy rate of 73%.

- Recent news: Northwest Natural Holding will release its fourth quarter and full year 2024 earnings release on Friday, February 28, 2025.

- Benzinga Pro’s real-time news feed up to the latest NWN News.

Read more:

Market news and data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.