The loss that launched Bitcoin means early signs of the seller’s exhaustion

The Glassnode company, which it shows, has revealed how the trend in the loss from Bitcoin may mean that sellers may start reaching exhaustion.

Bitcoin loss shows signs of saturation

In new mail In X, Glassnode talks about how Bitcoin surrender appears during the latest price clouds. The sign of importance on the series here is the “achieved loss”, which measures, as its name suggests, the total amount of loss achieved by investors on the Bitcoin network as a whole.

The scale works by passing through the date of treatment for each currency that is transferred or sold on Blockchain to find out the price that was dealt with before. If the previous sale price is more than the current immediate price of any currency, it will be said that its sale contributes to the loss.

The amount of loss achieved in the sale, of course, is equal to the difference between prices. The achieved loss calculates this value for all transactions that occur on the network and summarize it to find the total position.

Like the achieved loss, there is also an indicator known as the verified profit. This scale naturally follows the sales of the opposite type (i.e., where the last transfer value is less than the latest spot price).

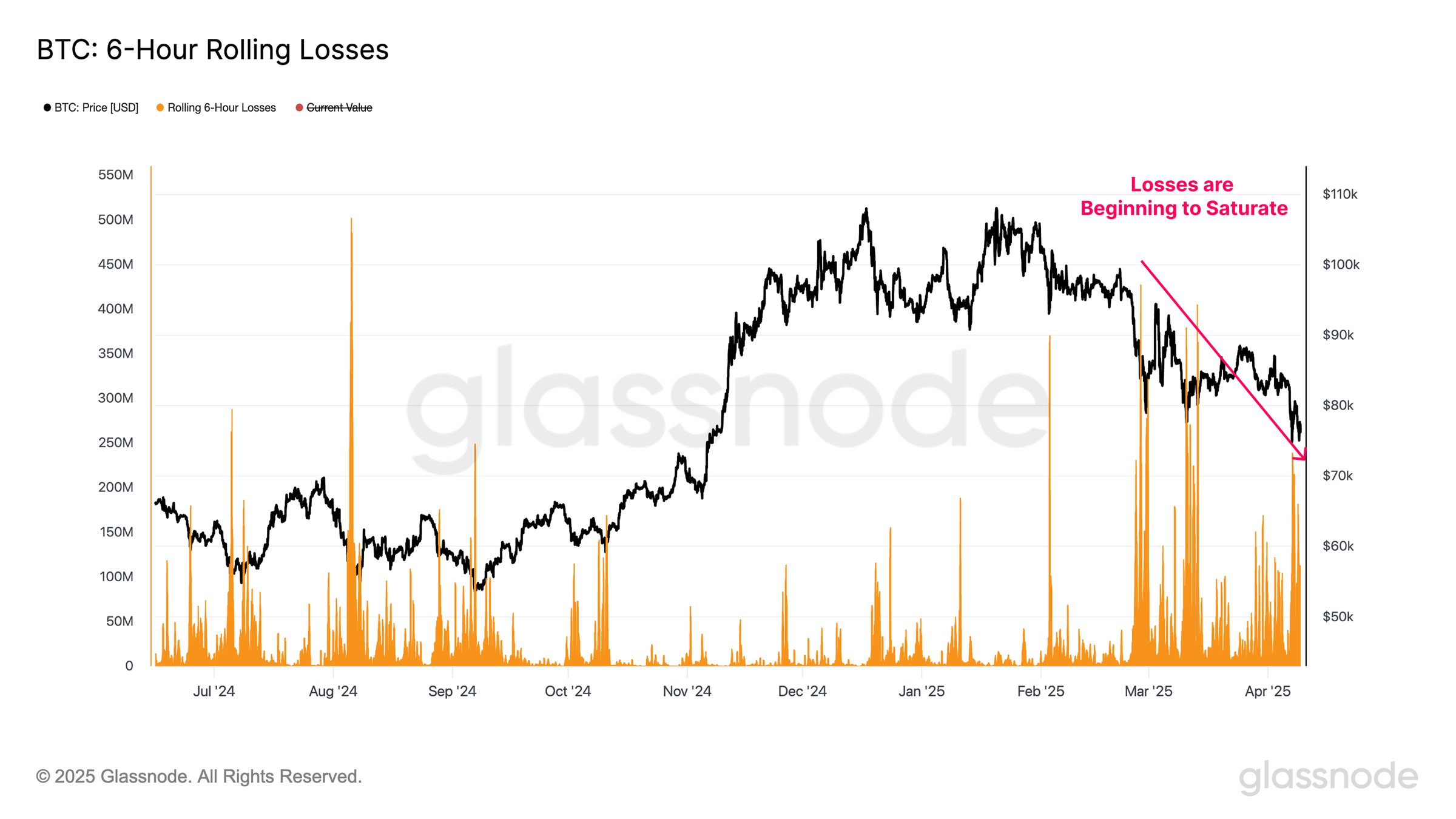

Now, here is the Bitcoin loss graph that has been shared by the Analysis Company that shows the trend in its 6 -hour trading value during the past year:

Looks like the value of the metric has observed large spikes in recent days | Source: Glassnode on X

As visible in the graph above, Bitcoin realized the loss that many large nails lost during the declining prices in February and March, indicating that the panic of investors sold their underwater coins.

FUD about the recent definitions sparked a continuation of the bending of the original, as expected, holders of great surrender now showed.

But it is interesting, that the size of the achieved loss for 6 hours was significantly less than the nails before. This may mean that surrender is to reach a saturation point, which, according to Glassnode, may be an early sign that sellers have exhausted. If so, it is possible that BTC is close to some kind.

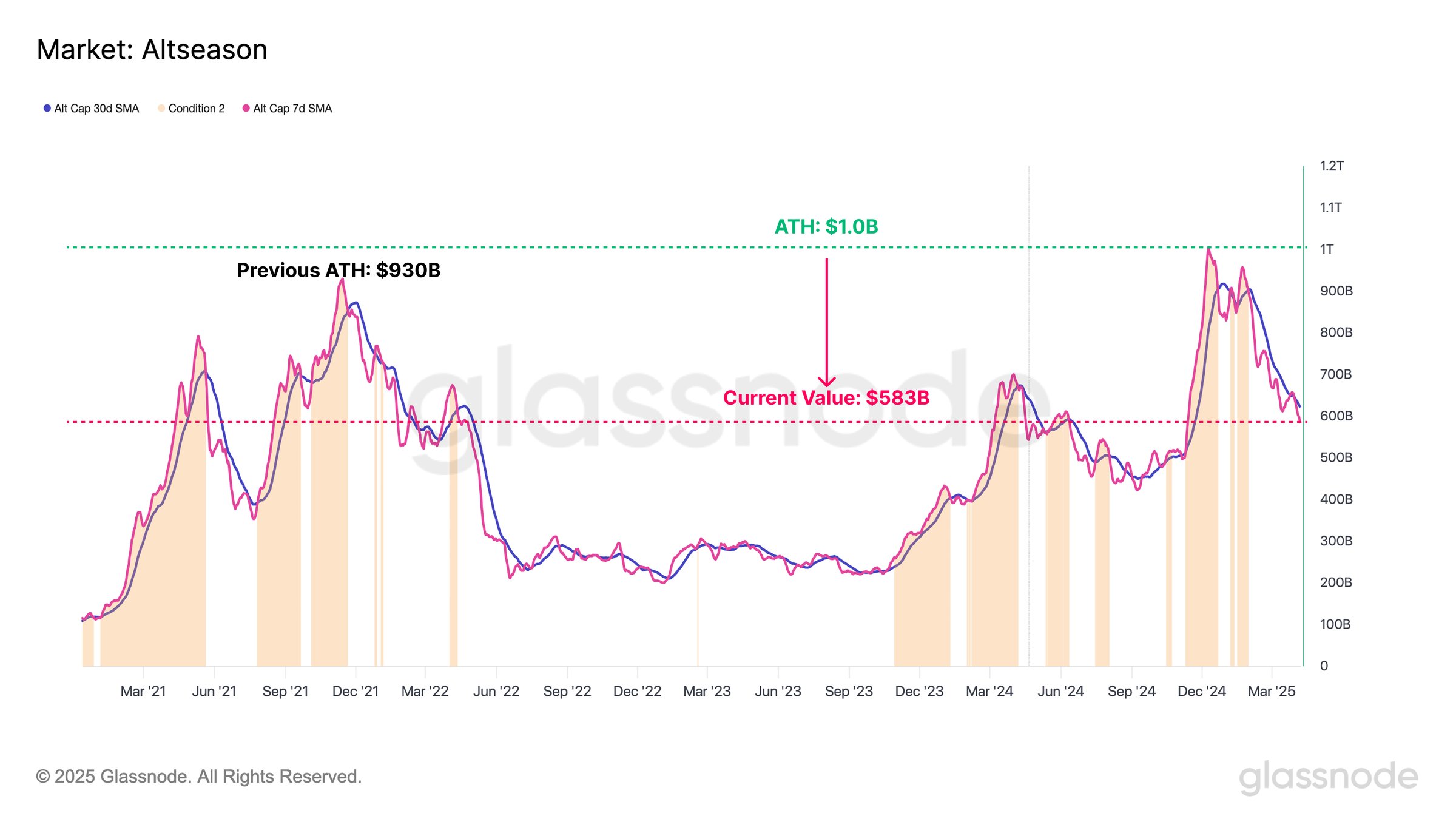

In the same thread, the Analysis Company also discussed the last track in the maximum Altcoins market (i.e. cryptocurrencies except Bitcoin, Ethereum, and Stablecoins).

The trend in the combined market cap of the altcoins over the last few years | Source: Glassnode on X

From the graph, it is clear that the Altcoin market cover was sitting at a higher level than one trillion dollars ever in December 2024, but today the scale shrinks to $ 583 billion. “The assets have shown more risk curve increasingly sensitive to liquidity shocks, which reduces the value of severe values at the sector level,” Glassnode notes.

BTC price

Bitcoin has tried to recover during the past two days, as its price has returned to 81,900 dollars.

The price of the coin seems to have been rising recently | Source: BTCUSDT on TradingView

Distinctive image from Dall-I, Glassnode.com, Chart from TradingView.com

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.