Trump attacks are nourished, Wall Street tremble, Bitcoin draws power

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

The US financial markets fell on Monday, while the prices of the cryptocurrency remained firm, as US President Donald Trump increased General conflict With Federal Reserve Chairman Jerome Powell, the Guardian newspaper and other news means reported on Tuesday.

The clash between the highest political and monetary leaders in the country Traditional markets shook To their essence, but leave the encryption amazingly safe.

Related reading

The stock markets declined after presidential notes

American stock indicators closed less strongly on April 21, with Large losses In the main standards. The S& P 500 index decreased by 2.3 %, the technology -dominated NASDAQ lost 2.4 %, and the Dow Jones industrial average decreased by about 1000 points, a decrease of 2.4 %, based on Google financing data.

Now only: President Trump is called Jerome Powell “the main loser” and demands interest rates “Now” pic.twitter.com/ram7cvMPW2

– MorningBrew) – Morningbrew April 21, 2025

Trump calls for the price cuts and championships covered by the chair

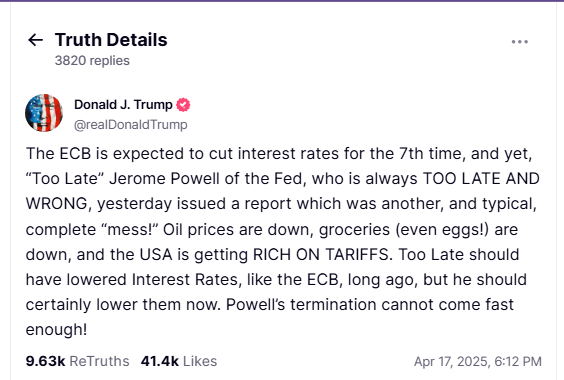

Market fluctuations are a rapidly condensed clash between President Trump and the Chairman of the Federal Reserve Board of Directors. Trump used April 21 Social truth The forum to publish this “preventive discounts in interest rates are called by many.”

The president claims that price cuts are justified because “energy costs [are] Below, food prices [are] Many lower, most “things” [are] It goes down, “stressing,” There is almost no enlargement. “

Trump has repeatedly criticized Powell, describing him as “too late and wrong” because of the lack of interest rates, which are still 4.5 %.

Tensions rose after Powell warned that Trump’s tariff had caused the recession, which prompted the president to demand his removal, saying that “his end could not come quickly enough.”

The dollar weakens while the encryption shows strength

As the political conflict continued, the US dollar index (DXY), which tracks the green back for other important currencies, decreased less than 98 on April 21, and recorded the lowest level in three years.

This follows the trend of decrease the dollar has decreased more than 10 % of its value since the beginning of 2025, and the latest data has appeared.

Bitcoin is not obsessed with political turmoil

In a blatant contradiction with traditional markets, cryptocurrencies maintained the weekend gains. The total value of the cryptocurrency market, based on TradingView data, remained fixed at $ 2.74 trillion.

The price of bitcoin, according to data from Coingecko, has reached the highest level in four weeks 88,428 dollars.

Why bitcoin price is flat? Should Trump Jerome Powell release? Will the United States lose the state of backup?

Answer your questions

pic.twitter.com/s7q6han3h

Anthony Boxbrano

(Appliano) April 18, 2025

Industry numbers are a warning. Political intervention

Person of encrypted Anthony Pombaniano caution Against presidential intervention in the Federal Reserve Command.

In a video clip he uploaded to X on April 18, PoxPyiano announced that he does not believe that Trump should come and call the Federal Reserve chair unilaterally.

Related reading

He also stated that the release of policy disagreement will lead the nation into risky water: “Where you have a dispute and then fire, I think this is not the field that we want to enter.”

Market experts believe that the central bank will settle in its next meeting on May 7. According to data, interest rate markets now expect a rate of a decrease of only 13 % in that session.

A distinctive image from Chip Somodevilla/Getty Images. TradingView graph