Sonic (S) jumps 50 % in 7 days, and the market price reaches $ 2.5 billion

Sonic (S) is currently witnessing a strong upward momentum, as its price has increased by approximately 15 % over the past 24 hours and 53 % over the past seven days. Its market hat is now $ 2.6 billion, which reflects the increasing interest of the investor and the increasing trading activity.

Technical indicators show that Sonic’s AdX is 51.6, which confirms the strength of the continuous upward trend. The 78.4 RSI indicates that the purchase pressure is still intense, although the excessive conditions of the peak may lead to a short -term decrease. Sonic can test resistance levels at $ 0.849 and possibly $ 1.06.

Sonic AdX shows that the current upward trend is strong

Sonic, formerly Fantom (FMT), ADX currently operates at 51.6, indicating a significant increase from 34 only three days ago and a dramatic height over 19.8 eight days ago.

ADX rising refers to a strengthening direction, which reflects the growing market momentum. This rapid upscale movement indicates that Sonic suffers from increased volatility and directional strength, which can be an indication of increased interest in purchase or intense market activity.

Given the current upward trend, this increase in ADX can be explained as a confirmation of the constant rise, indicating that the price movement is gaining strength and may continue in the same direction.

ADX is an index of momentum used to measure trend strength, regardless of its direction. It does not indicate whether the trend is optimistic or declining, just its intensity.

Usually, ADX indicates less than 20 to a weak or not present direction. Between 20 and 40 indicates an increasing direction, while values that exceed 40 indicate a strong direction. With Sonic ADX at 51.6, the market appears a strong trend, and supports the current upward trend.

This strong strong momentum may lead to more prices because it indicates continuous purchase pressure. However, merchants must monitor excessive signals or potential reflection with the maturity of the direction.

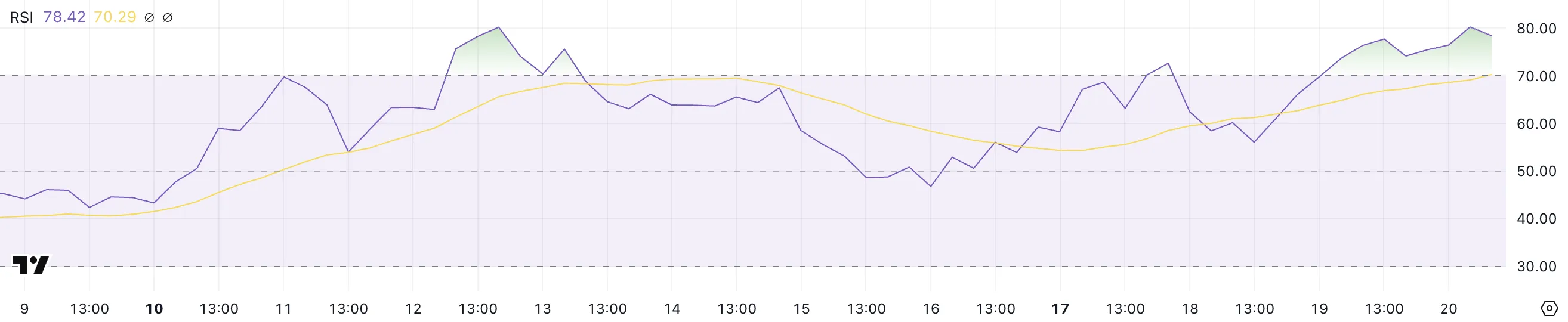

S RSI has been purchased for more than a day

RSI’s Sonic is 78.4, a significant increase of 56 days ago. It remains above 70 for more than a day, indicating a strong upward momentum.

The rapid rise in RSI reflects the increasing purchase activity, indicating that the upscale feelings are intensified. The relative power indicator usually indicates an excessive conditions, which implicitly means that the original may be exaggerated in the short term.

Given the current upward trend, these high service indicators can indicate the continued purchase attention; However, it also increases the possibility of declining or standardizing prices as traders may start achieving profits.

RSI is a momentum that measures the speed and change of price movements. It ranges from 0 to 100 and helps determine excessive conditions in peak or sale.

In general, RSI above 70 indicates that the original may be excessive and may be due to a correction, while the relative strength index indicates less than 30 to the sale conditions, which may indicate the opportunity to buy. With RSI’s Sonic at 78.4, it is clear that the original in the peak purchase area, which may lead to a short -term decline or unification as traders benefit from recent gains.

However, in powerful uptrends, RSI can still stop it for a long time. This indicates that the momentum of the audio ascension may continue before any significant correction occurs.

Is Sonic Sonic over one dollar in February?

Sonic’s EMA has recently formed two golden crosses, indicating a strong upward momentum. The golden cross occurs when EMA crosses the shortest time above EMA in the long run, which usually indicates the beginning of the upward trend. If this upscale momentum continues, Sonic can test the resistance at $ 0.849.

If this level penetrates, the next target price for Sonic will be $ 1.06. This would represent its highest price since the end of December 2024. This would confirm the continuous upward trend and can attract more purchasing benefits, which prompted vocal prices up with the promotion of upward morale.

However, if the trend is reflected, Sonic may face major negative risks. The first support levels are located at $ 0.65 and $ 0.58, which, if breached, can open the door for more declines.

In this landline scenario, Sonic may decrease to $ 0.47. In the worst cases, it can reach $ 0.37, which represents a correction of more than 50 %.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.