Taker Buy Volume Lapkees sharply

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Bitcoin is trading over the level of $ 105,000 after a sharp recovery resulting from the announcement of the ceasefire between Israel and Iran. The geopolitical relief provided the strong background winds of risk assets, BTC responded with a strong increase, and a critical psychological level has previously turned into resistance. Now, with the bulls of momentum restoring, Bitcoin flirts with a potential outbreak of $ 110,000 – a major level crowned the gathering throughout June.

Related reading

This renewable power comes several days after volatility and fear, as BTC decreased to $ 9,200 amid the escalating conflict in the Middle East. However, rapid recovery may turn feelings in favor of bulls. According to the data on the series of Cryptoquant, there has been a heavy rise in the volume of purchases over the past 48 hours-a strong indication that the participants in the aggressive market interfere in condemnation.

This purchase side imbalances indicate that institutional and high condemnation traders put in a position of more upward trend. With the high temperature of the market and the risk grows, the collapse over the resistance of $ 110,000 can confirm the start of the new upper motivation. Currently, all eyes are on whether BTC can keep and stretch the current levels.

Bitcoin faces uncertainty with the bull’s defense structure

Bitcoin is currently facing a decisive test, as it is traded in a narrow range after it fails to separate from its highest level ever. Although the bulls have managed to defend the general structure and maintain BTC higher than the main moving averages, the price procedure did not provide a clear directional signal. The original decreased by approximately 6 % of its peak of $ 112,000, and although some traders expect an imminent outbreak towards high levels of highlands, others warn of the potential recovery of less than the psychological level of $ 100,000.

This gap between analysts stems from continuous geopolitical instability – especially in the Middle East – and tightening the conditions of macroeconomics. The Federal Reserve’s commitment to high interest rates and high US cabinet revenues to influence risk morale, makes it difficult for BTC to build a continuous momentum. Although uncertainty, buyers have shown signs of strength, as many are looking for the last bounce as a solid bond.

Senior analysts The most prominent Marton One of the main budgets: heavy nails in the size of Taker, which indicate the aggressive market orders that are filled on the purchase side. This indicates that high condemnation buyers interfere at the current levels, and may manage a greater step to the upward trend.

Although this is a positive sign of short -term feelings, Bitcoin still has to restore $ 109,000 to $ 112,000 to nullify the risk of wider correction. Until then, merchants remain cautious. If the BTC closes a daily candle less than the support of $ 103.6 thousand or loses the level of 100 thousand dollars again, this may lead to a wave of filters and sending prices less. On the other hand, keeping more than $ 105,000 and construction volume can pave the way for the next leg. The coming days will be decisive in determining the path of Bitcoin forward.

Related reading

BTC raises the highest main support with the intervention of buyers

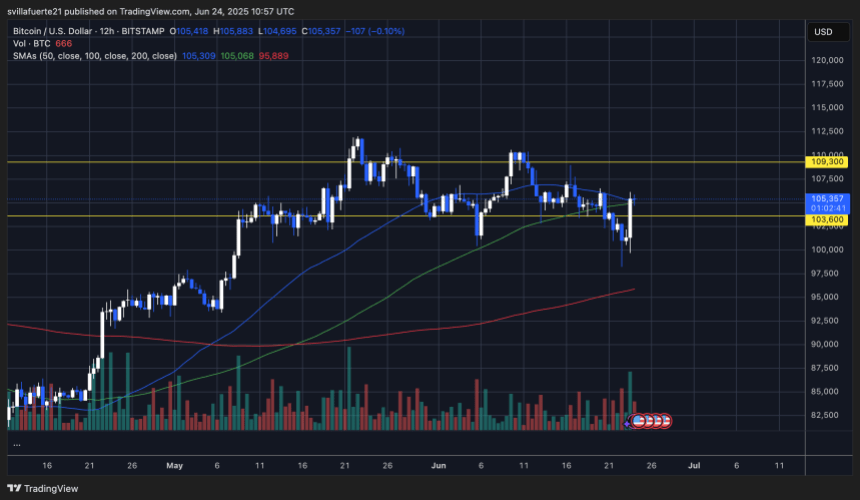

Bitcoin’s 12 -hour chart reveals a strong reaction after a lesser summary lower than $ 103,600 support. The price recovered sharply, and the restoration of both moving averages 100 and 50-fetro (green and blue lines, respectively), with BTC now trading around 105357 dollars. This step confirms the importance of the 103,600 dollar region as a high -order area, which has been a launch platform several times since early May.

The size rose over the last bounce, indicating the aggressive purchase activity. Spike suggests whales and institutional buyers probably absorb the panic caused by geopolitical events earlier in the week. The price is now approaching the resistance level of $ 109,300, a major roof that crowned multiple gatherings in May and June.

Related reading

The momentum remains in the short term, as long as the BTC carries over the moving averages. However, the rejection near 109 thousand dollars can confirm the scope of a wider unification ranging between 103 thousand dollars and 109 thousand dollars. If Bulls managed to turn $ 109,300 to support, the path to re -test its highest levels open 112 thousand dollars.

Distinctive image from Dall-E, the tradingView graph