The high price of BYD shares after $ 444, Hong Kong, where Tesla is struggling, will the march continue?

The price of the BYD arrow rose to the top again on Monday, when it jumped to $ 444 Hong Kong in trade between the day as the purchase of the momentum that was transferred from last week. The arrow is now closer to a record level, as it caught a new attention to traders looking to ride an electric vehicle outside China.

Many BYD optimism is now associated with increasing demand abroad and strong sales numbers in April. The company has increased its presence in Asia, Latin America and parts of Europe, and the market attention was caught, especially as Tesla continues to lose steam.

Tesla, on the other hand, has not only been able to seize a break recently. Between reducing prices to stay competitive and losing the mark on the last profits, it looks somewhat shaky. The margins have achieved great success, and merchants began to ask whether the EV giant is sliding. You can see it in the way the planning separated, go by by, and tugge.

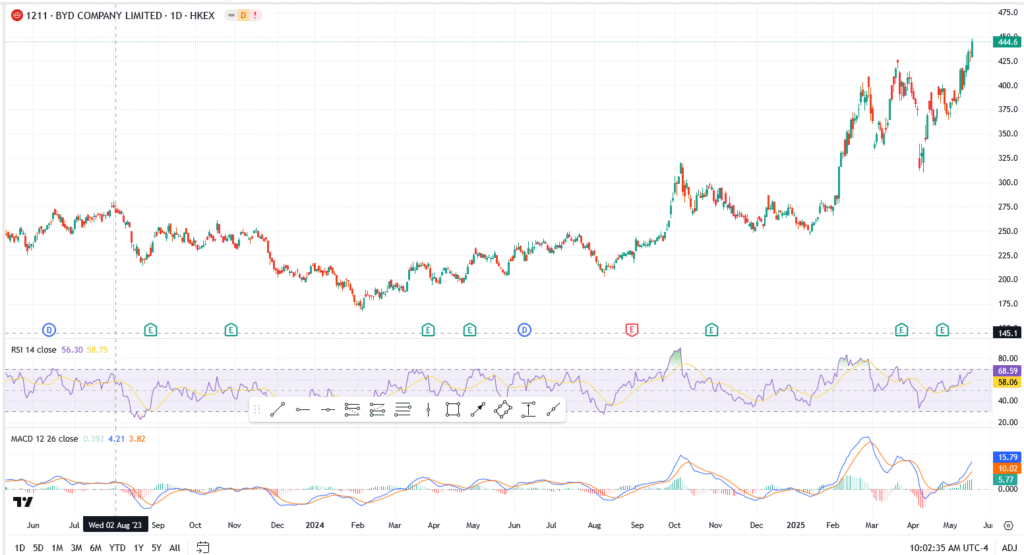

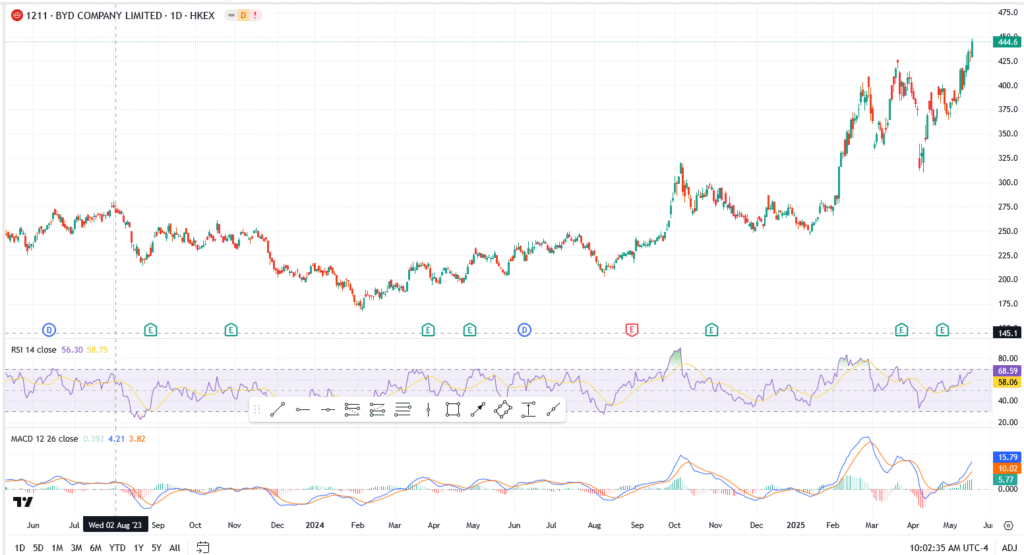

Technical analysis of the shares of BYD

- The price is broken over the main resistance near Hong Kong $ 430 – the bulls are now in control

- The current price is at $ 444

- RSI in 68.59 – approaching the peak area but still has a space

- The MacD Cross is still strong – the wide difference indicates a strong momentum

- The size is still supportive – the assembly is not speculative

- The next resistance is near Hong Kong $ 460 – the last main summit

- Support sits at $ 420 Hong Kong-which withdraw

See too

Expectations: Can you keep their progress?

With the superior price of the BYD share not only Tesla but the wider Chinese EV sector, the investor’s confidence is clearly transformed. The strong gathering contains technical legs, but momentum indicators indicate that some caution justifies these levels. If the stock is more than $ 430 Hong Kong and continues to ride global demand addresses, 460 dollars can be tested to Hong Kong and above.

While Tesla battles in the West, the BYD expansion story, backed by profits, politics and production scale, may just start.