The height of the liquid (noise) may reach 20 dollars in a possible golden cross

The liquid (noise) is under pressure, a decrease of 16 % during the past seven days, as technical indicators are increasingly indicating the domain control. The momentum has weakened sharply, as the RSI has decreased to less than 40 and no signs of strong purchase were shown since late March.

At the same time, the DMI movement index shows sellers who acquire hegemony, with ADX’s height, indicating a potential promotion of the Habbudian effects. As the noise approaches the main support levels, the market is now waiting to see if the bulls can prove the recovery – or if the negative side is another.

DMI Hyperleliquid shows that sellers control

According to the directional movement index (DMI), hyperleiid shows early signs of growth direction, with average average trend index (ADX) from 21.5 to 23.6.

ADX measures the strength of the direction regardless of its direction. Readings that are less than 20 usually indicate a weak or related market, while values that exceed 25 indicate a strong direction.

As the current ADX approaches that threshold 25, it indicates that the trend force is adopting – but it has not yet been fully confirmed – that traders be on alert to continue the potential price movement.

Meanwhile, the +Di and -Di lines, which represent the ups and dramatic trend movement, have turned significantly.

+DI +decreased sharply from 25.68 to 12.79, while -Di rose from 11.29 to 23.4, indicating that the declining momentum has clearly exceeded the upward pressure. This shift indicates that the sellers control the market, unless the DI line can reflect and restore the land, the noise may be at risk of additives.

If the current dynamics persist, this, along with the increasing ADX, can indicate the start of a stronger declining direction.

Rsi Hyperleliquid shows that there is no momentum

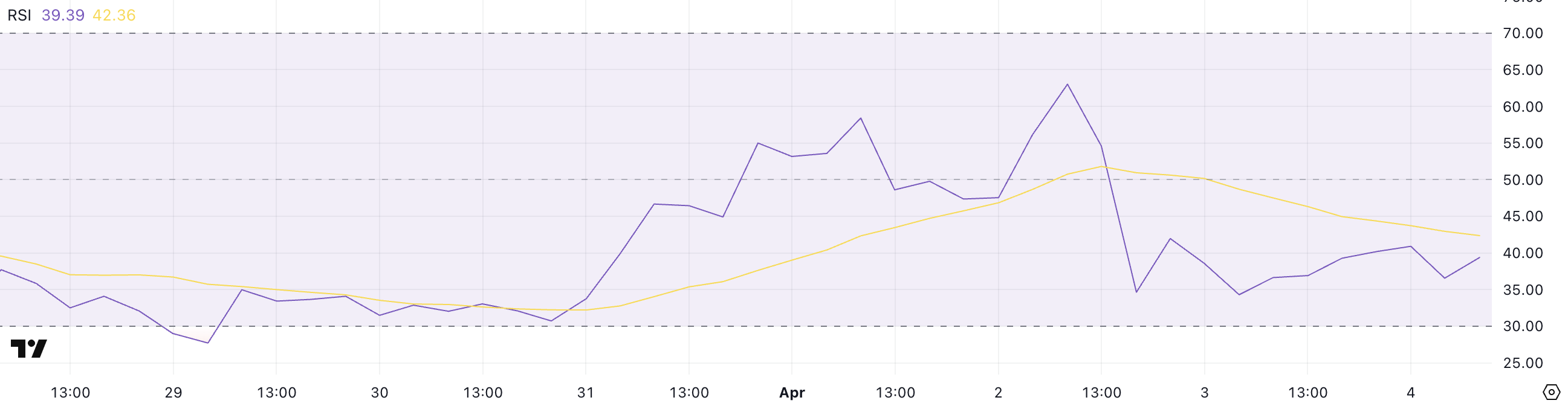

HyperLeliquid has witnessed a decrease in the RSI index (RSI) significantly over the past two days, decreasing from 63.03 to 39.39.

RSI is a momentum that measures the speed and size of modern price changes, ranging from 0 to 100.

Readings that exceed 70 indicate that the original may be excessive and may be due to a correction, while readings that are less than 30 are considered levels between 30 and 70 neutrals, but the directional transformations within this range often reflect the variable momentum.

With the presence of RSI in Hype now at 39.39, the index indicates the weakening of the upscale momentum and the increased declining pressure. The fact that RSI has not touched or exceeded a mark 70 since March 24 indicates that strong purchase is not condemned in recent weeks.

This declining trend in RSI may indicate that the market cools. Unless buyers intervene to reflect this path, the noise may continue to face the pressure pressure.

If the RSI persists in drifting about 30, this will increase the possibility of increasing the negative side or uniformity in the short term.

Will the liquid rise to less than $ 11 soon?

The excessive liquid price is currently an important threshold, as there is still a declining occurrence, but the possibility of recovery is still on the table.

If the current lower direction continues, the noise may soon decrease to less than a sign of $ 11.

This would be in line with the recent decline in momentum indicators such as RSI and the increasing decline in directional movement data.

However, if buyers are able to interfere in the momentum and transfer it, the noise may try to restore the higher levels. The rest of the immediate resistance at $ 12.19 will be the first sign of recovery, which may open the door to a move of about $ 14.77.

If the bullish momentum is accelerating, the gathering may extend up to up to $ 17.33, which represents a complete opposite of the current declining structure.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.