The Hang Seng Index faces resistance in the middle of Tencen and alibaba profits and uncertainty in the trade war

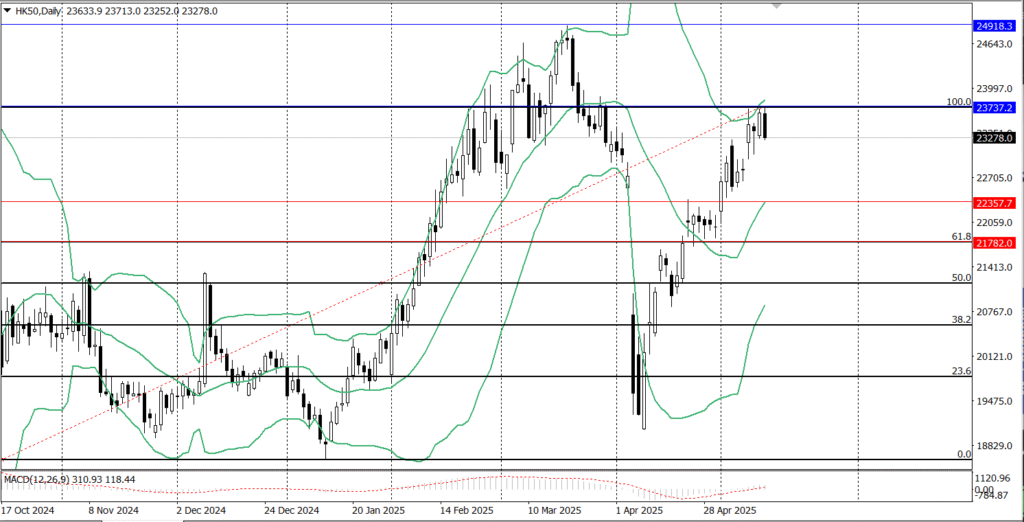

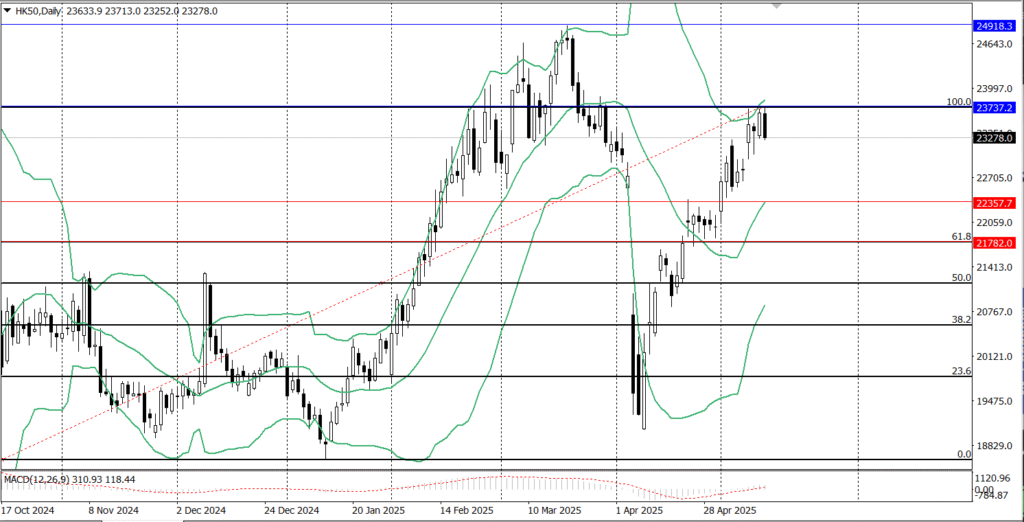

- Technically, the index faces strong resistance at 23,737.2, with the possibility of relapse or landfill.

- Markets remain sensitive to commercial updates, which affects investor morale and appetite.

The Hang Seng (Indexhangsing: HSI) is a marketing indicator that tracks the performance of the largest companies listed on the Hong Kong Stock Exchange.

This indicator is the index of the Standard Standard Market of Hong Kong, the Hong Kong economy and the Asian market scale in general.

Today, the Asian market was mixed with investors awaiting updates of the US -Chinese trade war. So the Hang Seng index decreased by 0.24 %, while the technology index decreased by 0.60 % in response to the Hang Seng Perteries Index fell 0.49 %

On the other hand, the profits of Tencent were not as good as expected, so their shares decreased by 0.48 %, as Alibaba shares decreased by 0.38 % slightly because people are waiting for their profit report today, May 15.

Meanwhile, car shares had a mixed morning. Some stocks rose and others fell. Li Auto and BYD companies advanced 0.71 % and 3.33 %, while NIO decreased by 1.55 %.

Hang Seng Technical levels:

Technically, the Hang Seng (HK50) index is traded at the time of writing at a strong resistance level of 23737.2, so if the index can make W at this level, we can reach higher levels to the highest level ever at 24918.3.

On the other side, if the indicator remains under the pressure of the aforementioned resistance level, it may be exposed to a declining direction that reaches less than 22357.7 and then 21782.0.

See too

All eyes on American -Chinese commercial updates:

The markets are now very sensitive to any updates related to the United States of China trade. Therefore, any positive progress in this deal may increase the appetite of risk to investors, support stock trading and offering flows of safe guard origins.

In the event that any negative advertisement related to the commercial deal between the United States and China appears, this will affect the opposite of stock markets. Because this will lead to less risky appetite, buy less arrows, and reduce flows to safe guaranteed assets.

Investors must be awake and respond to any updates in the market and the central bank signals.