FXS FXs is low to the lowest level since March before Powell Certificate

Federal Chairman (Fed) Jerome Powell will witness the Financial Services Committee in the US House of Representatives on Tuesday. Investors will search for new hints about the timing of the following political procedure after the recent comments from federal policies showed a difference of opinion.

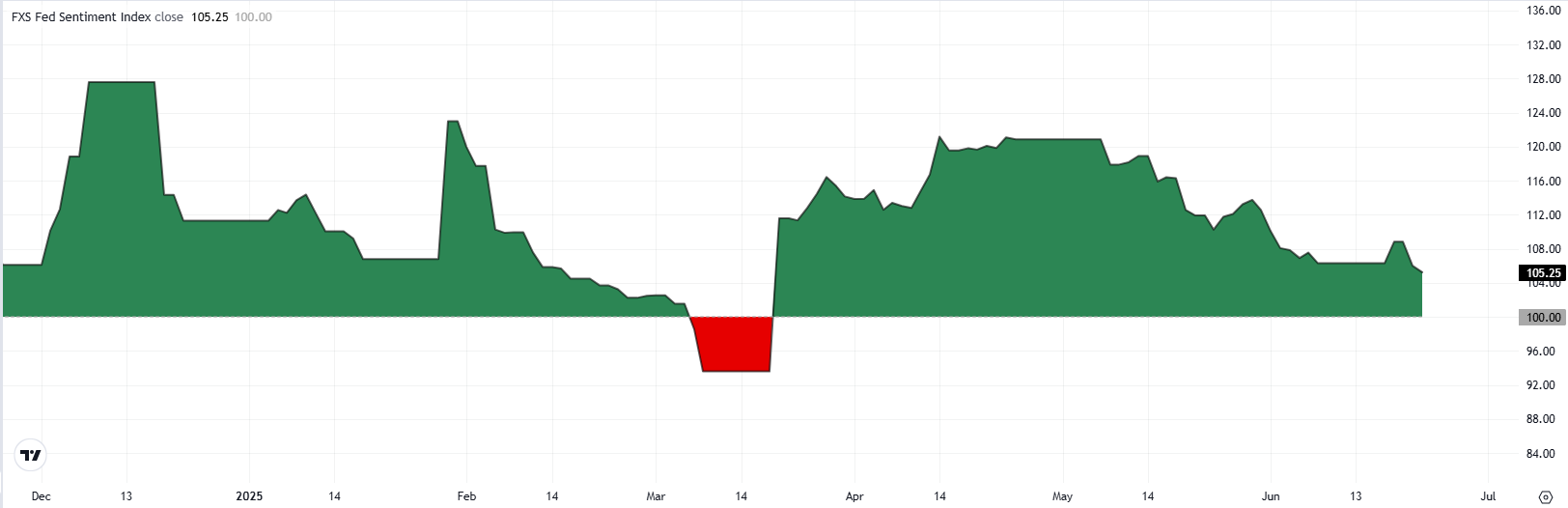

FXSTREET (FXS) Reserve Personality Index It rose to 108.84 after the June Policy meeting, in which the US Central Bank decided to leave the policy price unchanged within 4.25 % -4.5 %. At the press conference after the expression, Powell reported that they had to maintain high rates to get inflation along the way and noticed that they need to see more data before taking the policy steps.

However, in Duofish’s observation, the governor of the Federal Reserve, CNBC, was told last Friday that the Federal Reserve in a position allowing it to reduce the policy rate early July, on the pretext that they should not wait for the labor market to start policy reduction. Likewise, Governor Michelle Bowman noticed on Monday that she would support the reduction of the policy price at the next meeting if inflation remains.

After these comments, the FXSTREET FED SENTIMENT index fell to its lowest level since March in 105.2. Although the index remains higher than the neutral line at 100, it highlights the general feeding tone.

According to the CME Fedwatch tool, the markets are currently pricing about 20 % of the possibility of a July price and an opportunity by 80 % in a decrease in the policy rate by at least 25 basis points by September.

Fed questions and answers

The monetary policy in the United States is formed by the Federal Reserve (Fed). The Federal Reserve has two states: to achieve price stability and enhance full employment. Its primary performance to achieve these goals is to adjust interest rates. When prices rise very quickly and inflation is 2 % higher than the Federal Reserve goal, it raises interest rates, which increases borrowing costs throughout the economy. This leads to the most powerful USD (USD) because it makes the United States a more attractive place for international investors to stop their money. When inflation decreases to less than 2 % or the unemployment rate is very high, the Federal Reserve may reduce interest rates to encourage borrowing, which weighs on the green back.

The Federal Reserve (Fed) holds eight political meetings annually, as the FOOC Open Market Committee (FOMC) evaluates economic conditions and takes monetary policy decisions. FOMC attends twelve officials of the Federal Reserve-the seven members of the Governor, the President of the Federal Reserve in New York, and four regional regional presidents, the remaining regional regional, who serve for one year on a roundabout.

In extreme situations, the Federal Reserve may resort to a policy called quantitative mitigation (QE). QE is the process that the Federal Reserve increases significantly from the flow of credit in a suspended financial system. It is a non -standard policy scale used during crises or when inflation is very low. The Federal Reserve’s favorite federal weapon was during the great financial crisis in 2008. It includes the printing of the Federal Reserve more than dollars and their use to buy high -quality bonds from financial institutions. QE usually weakens the US dollar.

The quantitative tightening (QT) is the reverse process of QE, as the Federal Reserve stops buying bonds from financial institutions and the manager does not re -invest from mature bonds, to buy new bonds. It is usually positive for the value of the US dollar.