The expert says that Bitcoin exceeds gold by more than 13,000 % – “Let the numbers speak.”

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

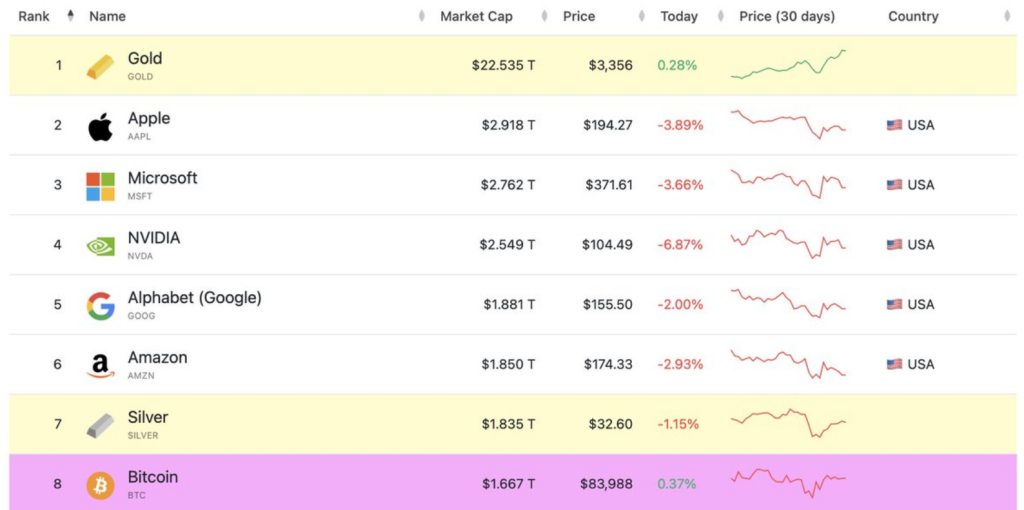

Bitcoin has increased dramatically over the past ten years against gold, with an incredible increase of 13693 %, according to financial statistics shared by Raed Chipir Ted.

The numbers show the disturbing difference between April 2015 and the April 2025. In particular, this amazing rise from Bitcoin The spread of investors all over the world.

Related reading

Bitcoin opposite. Gold: from equal to the huge gap

Ten years ago, gold and bitcoin were at similar prices. In April 2015, Bitcoin moved between $ 200 and $ 250, while gold It ranged about $ 1,200 to $ 1,300 an ounce.

The wealth of these investments has become different since then. Bitcoin rose to about $ 84,000 per currency, an increase of about 33,500 % in the ten -year period. The cryptocurrency for a short period of $ 109,000 during the time frame.

If someone tries to tell you that gold is better than Bitcoin …

Just show them this:

In 2015, 1 btc = 1 ounce of gold.

today? The same bitcoin increased by 13693 % in 10 years.

Let the numbers speak. pic.twitter.com/8jiph5isnr

– TED (ettedpillows) April 17, 2025

On the other hand, gold maintained its reliability image on volatility, instead of offering amazing gains. The precious metal increased only 156 % during the same period. From the spectators on the market, the Gold’s Worth suggestion is still decree with its steadfast and inflationary behavior that extends on a very long time.

The historical context shows different patterns of growth

Return further appear bigger Variousness in growth rates. According to the market analyst on the social media platform X, the price of gold was only $ 20.67 for ounce in 1933. For 2025, the price increased to some extent to about $ 3330 an ounce, which is already a sharp increase but a gradual increase over almost a period.

Ted's analysis on X.

Bitcoin had a completely different history. From a price of $ 1 in 2011, it reached $ 84,000 by 2025. With these rapid estimation rates, both excitement and suspicion were made by financial analysts who discuss the merit of such growth.

Variation in size

According to analyst Bell, the blatant contrast in behavior is due to the huge difference in the size of their market. Gold has approximately the market value of more than 22 trillion dollars. Due to this large size, gold provides an element of stability, making the market less sensitive to individual transactions or short -term investment flows.

Gold added $ 1 trillion to the maximum market in one day.

This is the full value of #Bitcoin now.This indicates the huge traditional markets and the early range we are still with Bitcoin.

Until a small turning into $ BTC It can send it flying. pic.twitter.com/YsjsgokjxBelle (pitt_bele) April 17, 2025

Bitcoin Market value About $ 1.667 trillion – still a small part of gold. This reduced size makes bitcoin more sensitive to capital flows. Gold recently witnessed an impressive increase in market value of $ 1 trillion over a day, but this was a much smaller percentage of the same dollar flow that would lead to bitcoin value.

Related reading

The same dollar flow, the effect of a different price

Meanwhile, mathematics in terms of market value generates price movement scenarios. Based on the reported accounts, if Bitcoin will get a 1 trillion dollars in the market value-the assembly of the increase that lasted for one day in gold-the unit price may rise from $ 84,000 to $ 135,000.

Distinctive image from the LEDN Blog, the tradingvief chart