The encryption qualifiers near a billion dollars, where Bitcoin & altcoins bounce again

Este artículo también está disponible en estñol.

Data shows that the cryptocurrency market has witnessed huge qualifiers during the past day after Bitcoin Recovery and has made altcoins.

Bitcoin & altcoins jumped after Trump’s announcement

Bitcoin and the rest of the cryptocurrency sector ended in February with a very declining observation, as the market passed with a deep slope of BTC to $ 78,000. However, in the flash, digital assets witnessed that their destinies fluctuated during the past day.

Related reading

The motivation behind the recovery step was Donald Trump’s announcement of a encryption strategy reserve that includes Bitcoin, ETHEREUM (ETH), XRP (XRP), Solana (Sol), and Cardano (Ada).

This announcement came through the president’s official social handle. In the first publication, Trump only mentioned Altcoins XRP, Sol and Ada, but in a follow -up post, BTC and ETH also confirmed, saying they would be “the heart of the reserve.”

Since the American elections, the encryption reserve has been something that has been capable in cryptocurrency circles, so it is not surprising that the news has a fundamental impact on the mood of trading.

From the graph, it is clear that Bitcoin approached the level of $ 95,000 during the increase, but its price witnessed a small withdrawal to 92,800 dollars. Ethereum offered a similar pattern, although its recovery from $ 2550 to $ 2,360 was larger than BTC.

In general, the first cryptocurrencies increased by 8 % and 6 % over the past 24 hours, respectively. Interestingly, XRP, Sol and Ada, and the three currencies announced at first, showed much stronger gatherings by 17 %, 13 % and 48 %, respectively.

Distinguished momentum was not only limited to these five listed in the reserve, as coins all over the space noticed a degree of height. The result of all this volatility was that the structures have accumulated on the derivative platforms.

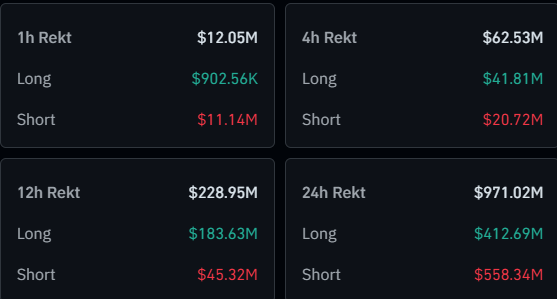

The Mashtaqat Al -Tafir Market has just witnessed $ 971 million in liquidation

According to data from CoinglassI found a total of $ 971 million in decades of derivatives of the coded currency last day. The “liquidation” here refers to the strong closure to which any open contract is subject to a certain degree.

Below is a schedule that collapses the relevant numbers related to the latest mass filtering event.

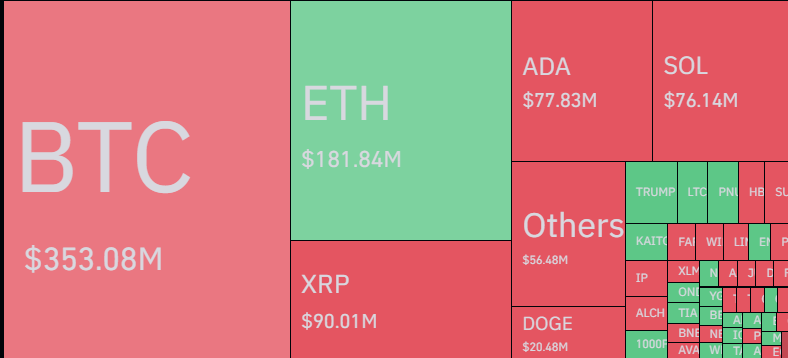

As visible above, about $ 558 million of this liquidation included short investors, representing more than 57 % of the total. These merchants who compensate for the majority of this event are naturally expected, as the market has risen within this window. Nevertheless, despite the upscale procedure, there are still about $ 412 million in long holders, as a result of withdrawal.

Related reading

Regarding individual symbols, Bitcoin and Ethereum occupied more than $ 353 million and $ 182 million in liquidation, respectively.

Distinctive image from Dall-I, Coinglass.com, Chart from Tradingview.com