The encryption market climbs 605 million dollars in 24 hours, with whales response to volatility

Correction of the huge market surrendered more than 605.5 million dollars from encryption sites within 24 hours, affecting more than 210,000 investors.

Most of the liquidation was in long locations, According to CoinglassWith $ 582 million of Longs Longs was wiped amid a rapid shrinkage.

Bitcoin fell to 103,553.47 dollarswhile Ethereum slide 0.80 % to 2,531.82 dollars and Solana refused 1 % to 174.56 dollars.

The scale and speed of the correction indicates a broader shift in feelings, especially among the great investors who are now re -balances with caution.

The decrease follows a feverish rally last week.

I touched the Crypto Fear & Greed 70, indicating the strong investor’s uniqueness.

But with the restoration of the main assets now, the whales began to change the strategies-starting to make profit in the previous long bets to opening short pants and adapting to more negative aspect.

Long -whaling, Falib Al -Hibati

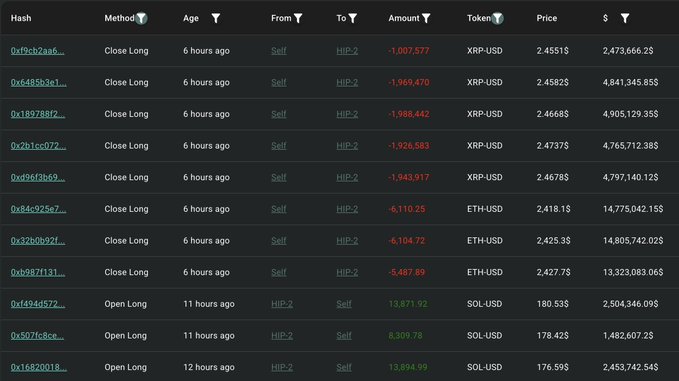

Lookonchain revealed that many high -value portfolios have closed long sites and put them back to a declining scenario.

One closed whale of $ 7.5 million as gains by closing 17,702 ETH ($ 14.8 million) and 9.83 million XRP (at a value of 24.2 million dollars).

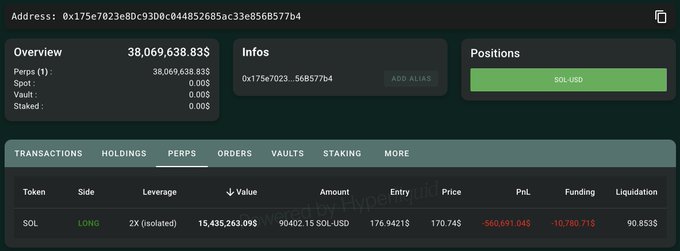

Because of the decline in the market, this whale closed $ ETH and $ Xrp Long situations, lock in a profit of about $ 7.5 million. He still maintains $ 15.4 million $ SolCurrently, below 560 thousand dollars.

Hypurrscan.io/address/0x175e

x.com/lookonchain/st …

Then the wallet itself prepared the capital to 13,871 Sol code ($ 2.5 million), although this trade is now facing an unrealized loss of $ 560,000.

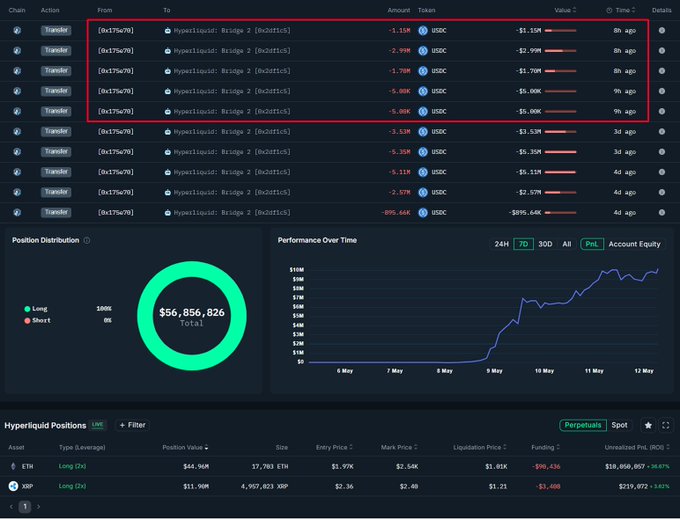

On May 12, OnchainLens tracked a separate transaction as the same whale deposited $ 5.84 million in liquid rising to open a long 2X position in XRP.

8 hours ago, I made it clear whale $ 5.84 million $ USDC inside #Herliquid To put a long position on $ Xrp With 2x financial lever. The whales previously opened a long site $ ETH With a 2X crane, which led to a floating profit of $ 10 million+. Address: 0x175e7023e8dc93d0c044852685AC33E856B57B4

Another portfolio recorded $ 5.73 million on ETH in February 2025 recently $ 4.71 million in profits, highlighting the feature and deep liquidity of big players.

Some whales completely turned into short sites. Seasoning title “Address 50x HyperleliQuid“She reflected a short period on the same day and seized $ 1.18 million of profits before closing it immediately.

Another whale after that He deposited 10 million US dollars To enhance short exposure to BTC, ETH and Sol, with a total of $ 14.8 million (BTC), $ 13.3 million (ETH), and $ 2.5 million (SOL). These attitudes reflect wide -ranging expectations of a constant decline in the short term.

Rally fades, caution returns

The sudden correction follows a week of vibrant purchase as the encryption assets have broken multiple levels.

The feelings of the market were perverted with the rapid appreciation of Bitcoin and Ethereum, prompting retail traders to stress in long jobs.

However, the liquidation wave has confirmed the extent of the rapid shift in the encryption space.

Although the sales process appears technically, driven by excessive positions in greed and high greed levels, it has reinforced the short -term uncertainty.

Whale moves indicate a more conservative position as fluctuation returns to the market.

Analysts see long -term support

Despite the short -term sale, some analysts still believe that encryption remains on a broader upward path.

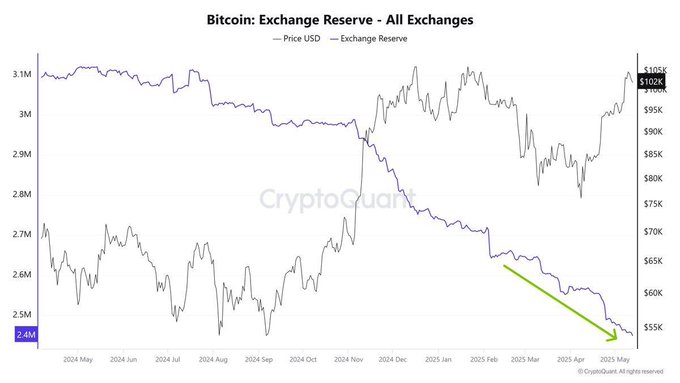

Da Vinci Jeremy pointed out that Bitcoin supplies on the stock exchanges are decreasing, noting a possible trauma in the future.

Bitcoin did not remain on exchanges! Miners do not sell. The shock of the show is a fermentation

Merlijn has published a technical analysis indicating that Bitcoin has come out of the “accumulation cylinder” – a pattern historically preceding sharp escalating moves.

Cheating paper in Livermore never misses

$ BTC He just left the “accumulation cylinder”. Historically, this is when things go out. If this is turned on, then $ 500,000+ is not a structure.

The Merlijn chart notes that if the date is repeated, Bitcoin can eventually be a move to $ 500,000.

Meanwhile, analyst Michaël Van De Poppe believes that Bitcoin’s hegemony has reached its climax, a sign that has distinguished the end of the Bear Altcoin market.

He pointed to a declining difference in the weekly time frame that supports this theory.

While the total economic factors and organizational doubts continue in the cloud in expectations, the behavior of the chain of whales and long -term accumulations indicates optimistic expectations of caution for investors who can afford the volatility of the term.

The post -encryption market climbs $ 605 million in 24 hours, as whales interact with fluctuations first on Invezz