DogwFhat prediction price 2025 – 2031: Can WiF reach $ 10?

Main meals

- Prediction of the 2025 DogwFhat price indicates the maximum price of $ 1.34.

- WIF can reach the maximum price of $ 3.98 by the end of 2028.

- By 2031, the price of WIF may rise to $ 6.46.

Remember Dogecoin and Shiba Inu? The famous mimokins bearing the title of the dog!

Dogwifhat (WIF) is a mimkequin inspired by dogs built on Solana Blockchain. Although it is relatively new in the market (which was launched in November 2023), the “Wi A Hat” project witnessed great success after its launch.

In the wake of the exchange list for the distinctive symbol on Binance and the famous “SPARE WIF HAT” campaign that led to collective financing for more than 690,000 USDC, the WIF value increased, and the Pepe Coin raped in late March 2024 to occupy the third largest mechanical behind Dogecoin (DOGE) and Shiba Inu (SHIB).

Lack of any benefit, successful DogwFhat (WIF) has reached another, CatwFhat, Simbawifhat, Wenwifeat, and Bonkwifhat, with dog notes that wear the hat that strikes the market after that. DogwFhat has so far scored important exploits in terms of evaluation and an exchange.

The symbol approached the mark of $ 5 on March 31, 2024 (the market ceiling of $ 4.58 billion), and witnessed huge movements in the prices after the US November elections, and were listed in Binance Us, Coinbase, Kucoin, Robinhood and more.

However, this was followed by the huge bear market, and the WiF has lost momentum. Let investors ask: To what extent can Dogwifhat Crypto go?

Let’s explore the current market’s feelings and access to WIF, reaching its highest levels (ATHS).

summary

| Coded | Dogwifhat |

| index | wif |

| The current price | 0.464 dollars |

| The maximum market | 463,862,590.8 dollars |

| Trading | 170.73 million dollars |

| Trading offer | 998,840,965.85 WIF |

| Ever | $ 4.85 on March 31, 2024 |

| Low | 0.000023 dollars in November 2023 |

| 24 hours a height | 0.5022 dollars |

| 24 hours low | 0.4638 dollars |

Prediction

| metric | value |

| Volatility (30 days) | 13.61 % |

| 50 days SMA | 0.791 dollars |

| 14 days RSI | 38.86 |

| Feelings | bearish |

| Fear and greed index | 30 (fear) |

| Green days | 12/30 (30 %) |

| 200 days SMA | $ 1.903 |

Dogwifhat (WIF) Price Analysis: WIF sees simple gains, an imminent bullish reflection?

TL; Doctor of collapse

- WiF displays the short -term recovery signs, but they are not yet important.

- Dogwifhat (WIF) resistance is located at about $ 0.528.

- The WiF’s immediate support level is at $ 0.429.

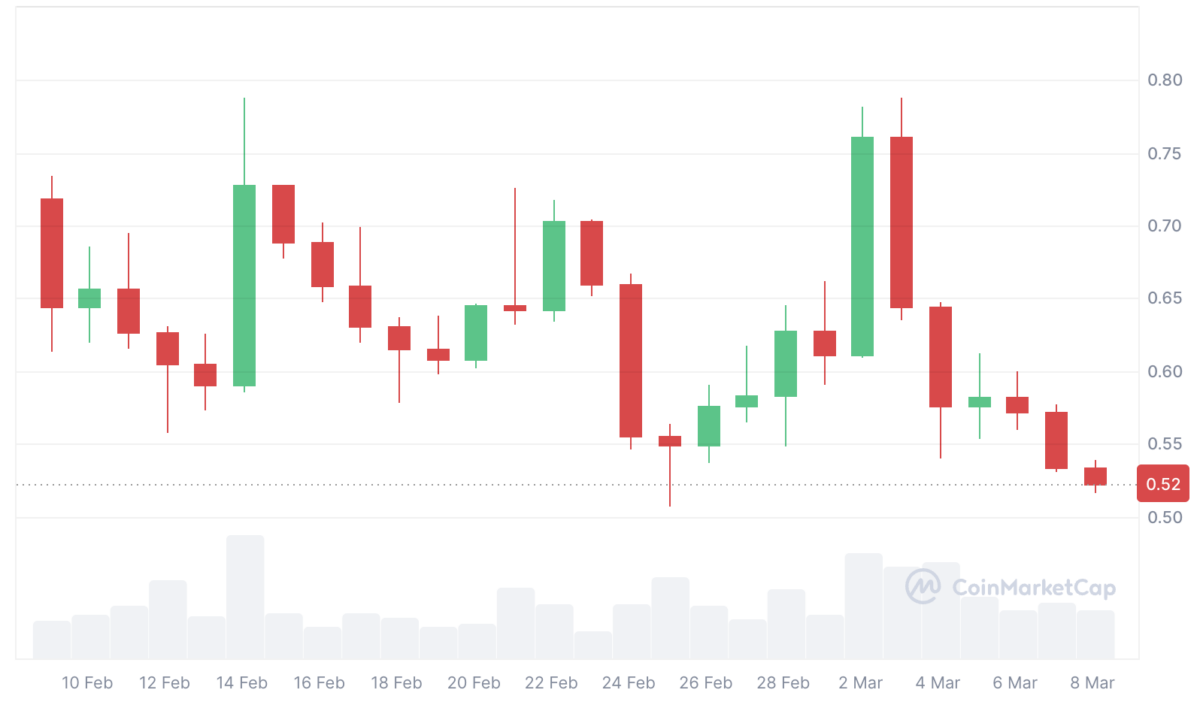

DogwFhat 1 day analysis: WiF faces rejection at $ 0.528

WiF/USDT in the declining direction on March 16 after facing the rejection at $ 0.528 on the two previous candlesticks. MACD is a little optimistic, indicating the possibility of recovery, and the relative strength index (37.87) shows neutral to a state of sale. If $ 0.429 is held, it is possible to recover about $ 0.528, $ 0.601 or $ 0.649. The collapse may lead to less than $ 0.429 to further decreases.

DogwFhat 4 hours: WIF to re -test $ 0.492 soon?

WiF/USDT for 4 hours shows a clear decrease in the price, although some recovery fermentation. DogwFhat is currently trading over Bollinger Band Lower (short -term support level). The reversion from this level may lead to another attempt at the resistance level of $ 0.492.

MFI reflects a market controlled by the seller, while BOP suggests a budget, although it is often the pressure of the sale. To confirm the BOP indicator, WIF needs to restore the price level of $ 0.492 and break the previous resistance at $ 0.525.

Technical indicators DogwFhat: levels and work

Simple daily moving (SMA)

| a period | value | an act |

|---|---|---|

| SMA 3 | 0.8692 dollars | He sells |

| SMA 5 | 0.7200 dollars | He sells |

| SMA 10 | 0.7153 dollars | He sells |

| SMA 21 | 0.6470 dollars | He sells |

| SMA 50 | 0.7912 dollars | He sells |

| SMA 100 | $ 1.4255 | He sells |

| SMA 200 | $ 1.9036 | He sells |

Daily Si Mobile Mediterranean (EMA)

| a period | value | an act |

|---|---|---|

| EMA 3 | 0.6153 dollars | He sells |

| EMA 5 | 0.7531 dollars | He sells |

| EMA 10 | $ 1.0408 | He sells |

| EMA 21 | $ 1.4250 | He sells |

| EMA 50 | $ 1.9466 | He sells |

| EMA 100 | $ 2.21 | He sells |

| EMA 200 | $ 2.25 | He sells |

What do you expect to analyze the price of WIF?

WiF’s broader expectations are landing. Meanwhile, the level of restoration and separation is needed from $ 0.492 to $ 0.528 to confirm a potential upward reflection, while a long -term batch exceeding $ 0.649 can indicate a sustainable upward trend. The failed bullish attempt can lead to a decrease in more prices about $ 0.395.

Is Dogwifhat Crypto a good investment?

Dogwifhat (WIF) is the Mimi currency on Solana Blukchen. Its value is driven by the interest of society and speculation. Expectations indicate that by 2025, the price can be returned to about 1 to $ 1.5. While it may have the possibility to achieve short -term gains, it is equally fraught with risks. Investing only after comprehensive research.

Where do you buy WiF?

Currently, traders and investors can buy Dogwifhat (WiF) on these CEXS: Binance, Binance.us, Raydium, Coinbase Exchang, Gate.io, Kucoin, Crypto.com Exchang, Mexc, HTX, Bybit, Bitge, LBANK And Another severalS.

Why is it below wif $?

WiF has decreased after the recent refusal facing $ 0.529. The currency decreased due to the shrinking interest of the market and the folding liquidity resulting from huge sales and the transition to other assets that investors consider more profitable.

Will WIF reach $ 10?

After reaching the peak price of $ 4.85 in 2024, the goal may not be $ 10.

Can DogwFhat reach $ 100?

DogwFhat (WIF) that reaches $ 100 is very ambitious and can be unlikely. It must be at least $ 99.9 billion in its market – a value that exceeds the highest market price ever for Meme (Dogoin) for $ 88.79 billion.

Does WIF have a good long -term future?

WiF has a good -term future if it continues to obtain popularity and adoption. Analysts at the market price are about $ 1.2 by the end of 2025 and about $ 5 to $ 7 by 2031. However, as with all coins, the future WIF is not certain and depends heavily on market trends and community support.

News/modern opinion on wif

- Coinbase WIF, Pepe, Aero, APT and Compt add to the Coin50.

Dogwifhat prediction price March 2025

If the Bulls team returns to WiF, the distinctive symbol may reach $ 0.89 in March. Traders can expect the average trading price of $ 0.67 and a percentage of at least $ 0.45.

| Dogwifhat prediction price | Possible low ($) | Average price ($) | Possible high ($) |

| WiF March 2025 predict | 0.45 | 0.67 | 0.89 |

DogwFhat prediction price 2025

Effective updates and community support in 2025 can witness a $ 1.34 value of WiF. On average, the WIF code can be traded for about $ 1.02. The minimum price is expected to be about $ 0.70.

| Dogwifhat prediction price | Possible low ($) | Average price ($) | Possible high ($) |

| DogwFhat prediction price 2025 | 0.50 | 0.90 | 1.34 |

Doughaws predict 2026-2031

| year | The minimum price ($) | Average price ($) | The maximum price ($) |

| 2026 | $ 1.82 | $ 2.07 | $ 2.32 |

| 2027 | $ 2.65 | $ 2.90 | $ 3.15 |

| 2028 | $ 3.48 | $ 3.73 | $ 3.98 |

| 2029 | $ 4.31 | $ 4.55 | $ 4.80 |

| 2030 | $ 5.13 | $ 5.38 | $ 5.63 |

| 2031 | $ 5.96 | 6.21 dollars | 6.46 dollars |

DogwFhat 2026 price expectations

According to WiF PRICE expectations for 2026, DogwFhat is expected to trade at a price of at least $ 1.82, a maximum price of $ 2.32, and an average price of $ 2.07.

Dogwifhat prediction price 2027

The WiF -2027 prediction indicates a continuous rise, with a minimum and the maximum price of $ 2.65 and $ 3.15, respectively, and the average price of $ 2.90.

DogwFhat prediction price 2028

DogwFhat is expected to reach at least $ 3.48 in 2028. The expected maximum price of WiF is $ 3.90, at an average price of $ 3.73.

Dogwifhat prediction price 2029

The price of WIF for 2029 is expected to estimate the minimum of $ 4.31, a maximum price of $ 4.80, and an average price of $ 4.55.

Predicting Price DogwFhat 2030

The prediction price of 2030 is proposed for at least $ 5.13 and an average price of $ 5.38. The maximum price of Dogwifhat is determined at $ 5.63.

Dogwifhat (WIF) prediction price 2031

The WiF is expected to predict the price of 2031 price, which led to the maximum price of $ 6.46. Based on expert analysis, investors can expect an average price of $ 6.21 and a price of at least $ 5.96.

Predicting the market price of Dogwifhat: WiF price expectations for analysts

| firm | 2025 | 2026 |

| DigitalCoinprice | $ 1.02 | $ 1.20 |

| Cryptoprecitions | 0.636 dollars | $ 1.389 |

| Coincodex | $ 1.99 | $ 1.368 |

Predicting prices from Cryptopolitan Dogwifhat (WIF)

WiF’s prediction at Cryptopolitan is suggested with a thunderbolt look at the future Dogwifhat price if the market recovery soon. According to our analysis, if the bulls return to the distinctive symbol in 2025, WIF can recover to about $ 1.2. By 2028, we expect a continuous growth of the total encryption market and a tool -based approach for one, which can see the distinctive symbol trade at an average price of $ 5.

DogwFhat historical morale

- DogwFhat (WIF) was launched in November 2023 and traded in the range of $ 0.1 – $ 0.3 for the rest from 2023.

- WIF started in 2024 at $ 0.15, rose to $ 0.5 in January, and ATH was $ 4.85 by the end of March after a strong upward momentum.

- The distinctive symbol decreased to $ 1.95 in April, uniting between $ 2 and 4 dollars to May, but fell to $ 1.48 in June amid declining pressure.

- WIF witnessed a mixed performance in the second half, as it peaked at $ 4.67 in November before the year was closed at $ 1.86 under renewable declining pressure.

- WiF opened the market at $ 1.862 in January 2025 and closed the month at $ 1.1138. This was followed by a decrease in February and March, where WiFs are currently trading between $ 0.4654 and $ 0.5045.

(Coinbaseinsto)

(Coinbaseinsto)