The encryption flows amounted to $ 1.3 billion despite the fluctuation of prices

Despite the decrease in recent prices, encryption flows rose to $ 1.3 billion last week. It represents the fifth consecutive week of positive flows, indicating the investor’s constant confidence in the cryptocurrency market.

Interestingly, Ethereum flows have almost doubled positive flows to Bitcoin, which represents a prominent transformation in the model.

The encryption flows reached $ 1.3 billion last week

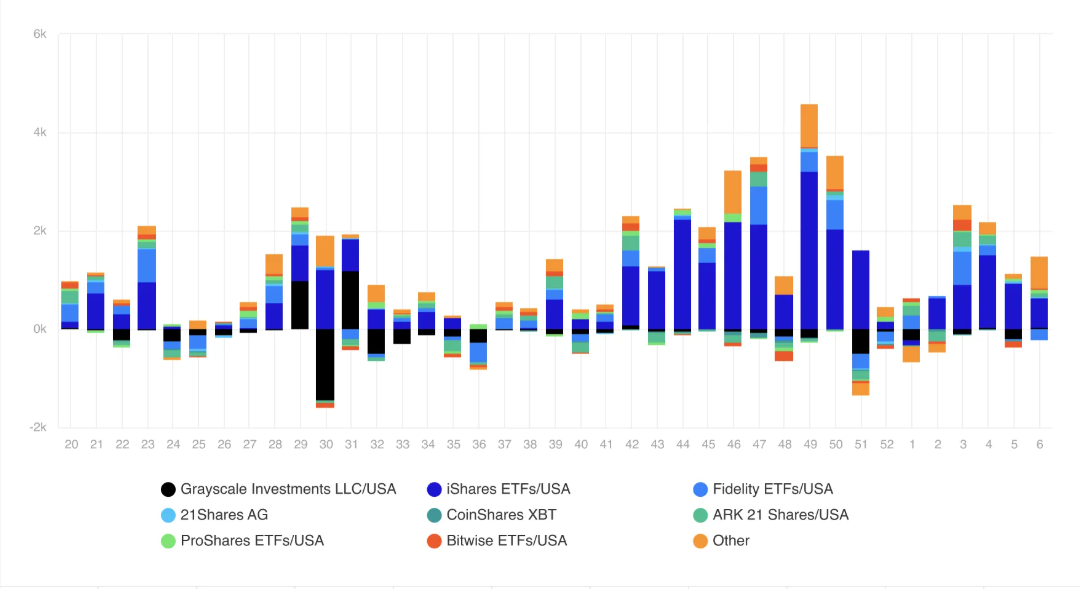

The latest Coinshares a report It indicates that encryption flows amounted to $ 1.3 billion last week. Specifically, Bitcoin witnessed flows of $ 407 million, while Ethereum witnessed the important “purchase” task of “purchasing” the important “decline” after a decrease in the price to $ 2,500, which led to flows of $ 793 million.

Analysts attribute Ethereum flows to the noise about the upcoming Pectra upgrade.

“ETHEREUM still has retained his emerging support since May 2023. Last week, ETHEREM ETFS had more than $ 400 million in flows. Large ETH promotions will come next month. Trump still buys and holds eth. On the occasion of my words. Once ETHEREM exceed $ 4000 , It will be pumped like madness. ”, One of the analysts Note.

This increase in encryption flows follows a week, as encryption investments witnessed $ 527 million in flows amid Deepseek Ai and Donald Trump tariffs on several countries. The constant benefit highlights how institutional investors and retail investors benefit from market declines for digital asset accumulation.

However, market corrections on the five trading sessions witnessed that the AUM (under management assets) of ETPS decreases to 163 billion dollars. This represents a decrease of about 10 % of its highest level ever at $ 181 billion in late January.

Nevertheless, the global ETPS remains the largest bitcoin holder compared to any other entity.

“With ETPS worldwide now it represents 7.1 % of the current market value, making it the largest pregnant for any other entity,” the report excerpt I mentioned.

Trading volumes remained fixed at $ 20 billion for the week, indicating the active re -blogging between merchants and investors amid recent price fluctuations. US President Donald Trump’s tariff was a major operator for corrections, which led to a historic liquidation event in the encryption market.

More altcoin boxes on the horizon

In a relevant development, NASDAQ officially presented 19B-4 models with the US Securities and Stock Exchange Committee) to include and trade ETPS from Coinshares. Firstly , Coinshares XRP ETF The second, and Litecoin etfWith the proposed money that is expected to provide investors exposure to XRP and LTC, respectively.

Coinshares is not alone – other companies such as Grayscale, Wisdomtree, BitWise and Canary Capital have provided XRP ETF files, as mentioned in modern deposits with SEC.

Brad Garlinghouse, CEO of Ripple, recently stated that ETF XRP is inevitable, with a focus on the increasing demand for structured investment vehicles that provide organized exposure to asset.

Likewise, ETFS Litecoin acquires a traction, as Canary Capital and Grayscale apply for their money. NASDAQ has also applied to include ETF Litecoin, which reflects more expanding market for encryption products.

This increase in ETF files is in line with the wider industry trends, where the founding players search for the organized investment vehicles of alternative digital assets.

Since speculation about EtF Litecoin building, data on the series reveals that whales increase LTC holdings, and expect possible organizational approval.

Historically, accumulation trends were early indicators of strong institutional demand and retail.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.