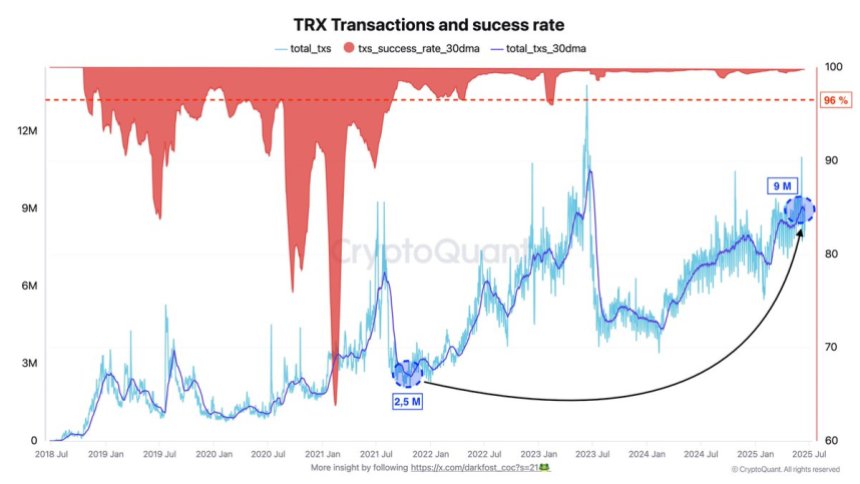

The volume of transactions increases, while the success rate remains above 96 %

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

TON acquired a renewed attention after a great development: his plan to enter public markets. Justin Sun, the founder of Tron, reached a deal with the SRM Entertainment listed on the Nasdaq Stock Exchange (SRM.O), according to which SRM will get Tron -related symbols as Ton Inc. , Sun as a consultant. This step is an important step in bridging the gap between Blockchain projects and traditional financing, which may make Tron one of the first Blockchain entities.

Related reading

Meanwhile, the high geopolitical tensions in the Middle East have sparked fluctuations across the broader encryption market, including TON. Despite this unconfirmed total environment, the basics of Tron on the chain are still strong. The best analysts in Darkfost participated in the data that shows that the size of the daily transactions in TON increased from 2.5 million in 2021 to more than 9 million today. This si growth emphasizes a sharp rise in the user’s activity and the participation of the developer over the network.

The continuous increase in the volume of transactions also reflects the increasing confidence in TON’s infrastructure as a developed alternative and reliable for other highly productive championships. With both the institutional exposure via SRM and the strong growth of the chain, TON finds itself in a pivotal moment in its development-which can reshape its path in the coming months.

TON declined after increasing the general inclusion: The basics of the network are still strong

TON is currently trading on the main demand levels after a sharp recovery from the Rally on Monday. The increase-which led to the announcement that TON will work in public through a deal with the SRM Entertainment listed in NASDAQ- has greatly sent more than 9 %, generating widespread attention. However, the escalating tensions between Israel and Iran have been affected by the market morale, which prompted the price to the levels of pre -implementation.

Despite the short -term fluctuations, the basics of you see painting a bullish image. According to DarkfostTron Blockchain showed a strong and consistent growth since 2021. Daily transactions have risen from 2.5 million to more than 9 million, reflecting the increase in adoption and constant demand for its infrastructure. Signs of increased activity indicated an increase in the investor’s interest and the developer’s confidence in the network.

However, the large size alone does not guarantee quality. What distinguishes TON is the success rate of impressive transactions, which remained above 96 % during this growth phase. Reliability is aimed at other highly productive chains such as Solana, where failed or unwanted transactions can lead to amplification of standards.

In addition, the production of the TON block has been stable and steadfast, as it displays its operational consistency. Even amid the high global transactions fees, TON continues to attract use, indicating that users are still seen as an effective and cost -effective solution. This combination of high performance, strong demand, network elasticity, Torron as one of the most technically mature cases in the current market cycle. If the total circumstances stabilize, the general TON list and strong standards on the chain can govern the bullish momentum.

Related reading

TRX price analysis: main support levels

TRO (TRX) is currently trading of about $ 0.273, as it is combined over the simple moving average for 50 days (SMA), which sits about $ 0.268. After a sharp rise on Monday, which paid the price about $ 0.30 after Tron’s announcement to the public, it regained the price to pre -execution levels amid the escalating geopolitical tensions in the Middle East. Despite this withdrawal, TRX is still in a bullish structure on the daily chart.

SMAS lasts for 100 days and 200 days, currently about $ 0.252 and $ 0.253, respectively, in the upward trend and works as strong dynamic support, confirming that the average to long -term trend is still intact. The volume has increased on the penetration, but it has been cooled since then, which is expected during the monotheism periods.

Technically, TRX creates a higher lower structure while staying within the broader upward trend that started in late March. As long as the price exceeds $ 0.268, Bulls may try another batch of about $ 0.285 and possibly re -testing the highest level near $ 0.30.

Related reading

A break less than $ 0.268 can nullify the bullish momentum and lead to a 0.252 – 0.255 dollar area. Currently, the price procedure is still a construction as TRX retains before all the main moving averages and the main structural support.

Distinctive image from Dall-E, the tradingView graph