The collapse of the encryption market today: the liquidation rises after $ 1 billion

The encryption market witnessed a significant decrease today, as the total market value decreased by 2.93 % to $ 3.21 trillion. On the other hand, trading volumes increased by 39.75 %, reaching 144.4 billion dollars, indicating a wave of sales of panic or forced exits. In the midst of this volatility, Crypto ETF flows recorded a significant withdrawal of $ 267.1 million. Surprisingly, the fear and greed index is still relatively stable at 46, indicating a neutral feeling despite the reactions in the sharp market.

Why is the encryption market today?

The following stimuli sparked domino effect for sale through the main symbols.

- Political and social feelings: A general dispute between Donald Trump and Elon Musk over political laws, rocked the trust of the market, which sparked discussion and confusion on social media.

- Block liquidation events: The positions with high procedures have faced forced assets, which exacerbates the declining momentum.

- The opposite winds of the macroeconomic economyInvestors progress before issuing data notes that are not planted at the American Statistics Office and the unemployment rate later today. These numbers can strongly affect the Federal Reserve Policy, which prompts cautious feelings.

Encryption The references reached $ 1 billion

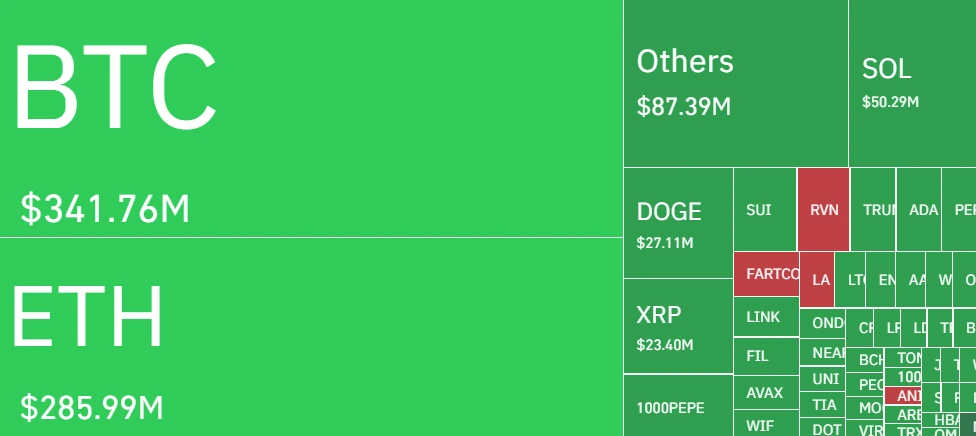

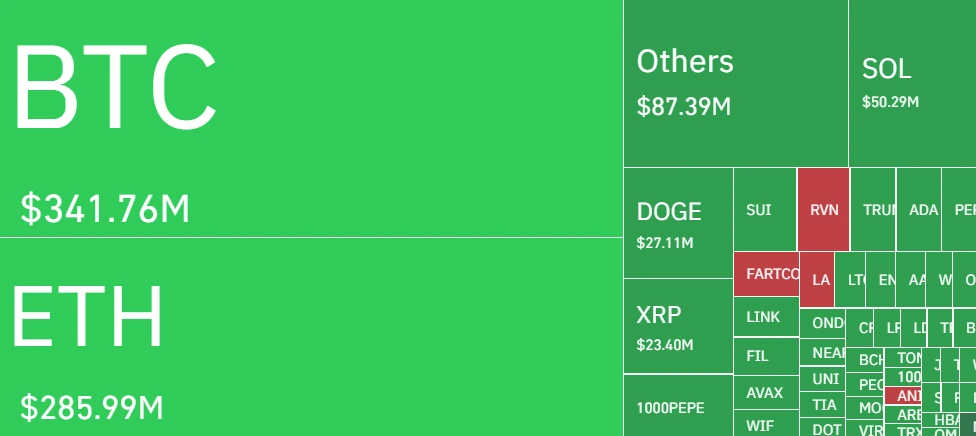

Within the past 24 hours, the encryption market carries more than one billion dollars in the rank, the majority of which were 900 million dollars of long jobs. Short liquidation operations have formed about $ 100 million, which clearly reflects the bull trap that caught the excessive guard buyers. Bitcoin alone witnessed $ 341.76 million in the liquidation, followed by Ethereum closely at $ 285.99 million.

The most prominent stock exchanges like bybitit with $ 352 million, and Binance with $ 248 million led the number in filtered positions, with more than 89 % of these long deals. This acute judiciary not only intensifies the sale, but also saves the increasing tension between merchants, especially those who depend on the subsidized gains.

What do you expect after that?

Despite the fall of today, the neutral result in the Fear & Greed index indicates that the market is not in a state of complete panic yet. Looking at the graph, the total ceiling of the encryption market decreased from $ 3.3 trillion to $ 3.17 trillion, indicating a discontinuation of the main support. SMA works for 9 days at $ 3.23 now as resistance. If the market fails to restore this level soon, it is possible that the downside is about $ 3T.

If you are keen on the future of Bitcoin, the prediction price of Bitcoin (BTC) 2025, 2026-2030 is a must!

Common questions

The sudden decrease in the market has caught up with the guardians, forcing long -standing positions to liquidate the masses.

Not necessarily. Neutral feelings and upcoming macro data indicate that it is better to wait for a more clear direction before the rash movements.