The best encrypted currencies for investment now before increasing April 2025

April 2025 Credit or lower, and the Crypto market paves the way for the next dynamic month. With the main altcoins showing promising settings, opportunities continue to appear for merchants and investors.

Despite some corrections, the market is still full of potential plays-whether through long-term strategic property or picking up in the short term. In this discussion, we will dismantle some of the best watching followers, analyze the main market trends, and evaluate whether the time now is the time to accumulate.

Bitcoin (BTC)

Bitcoin is still a dominant force in the cryptocurrency market, with a market value of $ 1.67 trillion, which represents more than 50 % of the total assessment in Blockchain. Although it may not provide the capabilities of 10x or 100x made by some altcoins, Bitcoin is still a major advantage for institutional investors and long -term holders.

Numbers such as Michael Silor and major investment companies constantly accumulate to Bitcoin as a hedge against inflation, and they often refer to them as “liquid gold”. At a value of $ 84.2 thousand, the stability of Bitcoin and historical performance make the cornerstone of the encryption portfolio.

Instead of trying time for the market, often a long -term success of staying invested over time, as $ BTC has shown its ability again and again to face fluctuation and reach new high levels.

ETHEREUM (ETH)

Ethereum shows a strong performance, outperform bitcoin and most of the market in both price movement and trading volume. It has regained major levels between $ 1950 and 2000 dollars, with $ 2000 as an important psychological barrier.

The recent price increases, with the support of increasing volume, indicates the bullish momentum. Last week, technical movements witnessed $ ETH, filling a defect and testing critical support levels successfully, which enhances the buyer’s confidence.

source – Jacob Checks burial on YouTube

Despite the bullish structure, there is a justification for caution. Historically, Ethereum, which surpasses Bitcoin, often led to a decline in the market. In addition, an increase in the leverage indicates that the short qualifiers lead to an increase in the price rather than organic demand.

While $ ETH still can pay about 2100 dollars, keeping this penetration requires stronger basics or bitcoin to maintain its strength. Without these factors, the correction can be followed, as it is likely to be $ 1950 as a stable level of support.

Many Altcoins based on ETHEREUM also benefit from this momentum. While the current trend of Ethereum offers possible opportunities, long -term sustainability remains unconfirmed without confirming more wider weighting in the market.

Sui (Soy)

SUI is placed as a very capable symbol with great healing capabilities. It brings the benefits of Web3 with the ease of WEB2, making it an attractive choice for investors looking for innovative Blockchain solutions. Since its establishment in 2024, the market value of $ SUI has grown from $ 2.4 billion to $ 15 billion.

However, it has also seen 50 % correction in the maximum market, with a peak of $ 5.29 before declining to $ 2.25. Despite this decline, SUI is still a strong competitor in space, offering flexibility and future growth.

Solana (Sol)

Solana showed some bullish momentum after a declining end until last week, but fears are still regarding her sustainability. While the total encryption market has seen some positive movement, it seems that the $ Sol Rally is largely driven by lifting instead of strong organic demand.

Unlike Ethereum, which suffers from a natural trading flow, the Solana size remains relatively low, making its last prices less persuasive.

Basically, Solana’s standards are still weak. Locked (TVL) has been placed alongside the price, and although trading volumes of the decentralized stock exchange (DeX) still exceed one billion dollars, the total network performance has decreased.

Some reports indicate a significant trend in the Dex and TVL activity, highlighting concerns about Solana’s long -term stability. However, the possibility of the presence of ETF Solana and the flexibility showed by its ecological system provides some reasons for optimism.

To confirm the bullish penetration, $ Sol needs to break more than $ 136 with a strong size. If it succeeds, it can collect about $ 145 and $ 150. While the upscale penetration is still expected in the long run, the timing is still uncertain, and it requires the patience of investors.

Avalanche (Avax)

Avalanche showed impressive growth in previous market courses, reaching a market value of $ 22 billion in 2021. Despite its strong basics, Avalanche has not yet achieved the highest new level ever in the current session, making it a potential candidate for further growth.

The AVAX price is currently $ 19.55, with a $ 8 billion market formation and 24 -hour trading volume of $ 157 million. During the past week, AVAX increased by $ 6 %. Blockchain is famous for its speed, expansion and interim operation, providing a safe and effective environment for decentralized applications (DAPS).

With the entire Doxxed team behind the project, Avalanche remains a promising option for investors looking for a high -performance Blockchain network with a space for expansion.

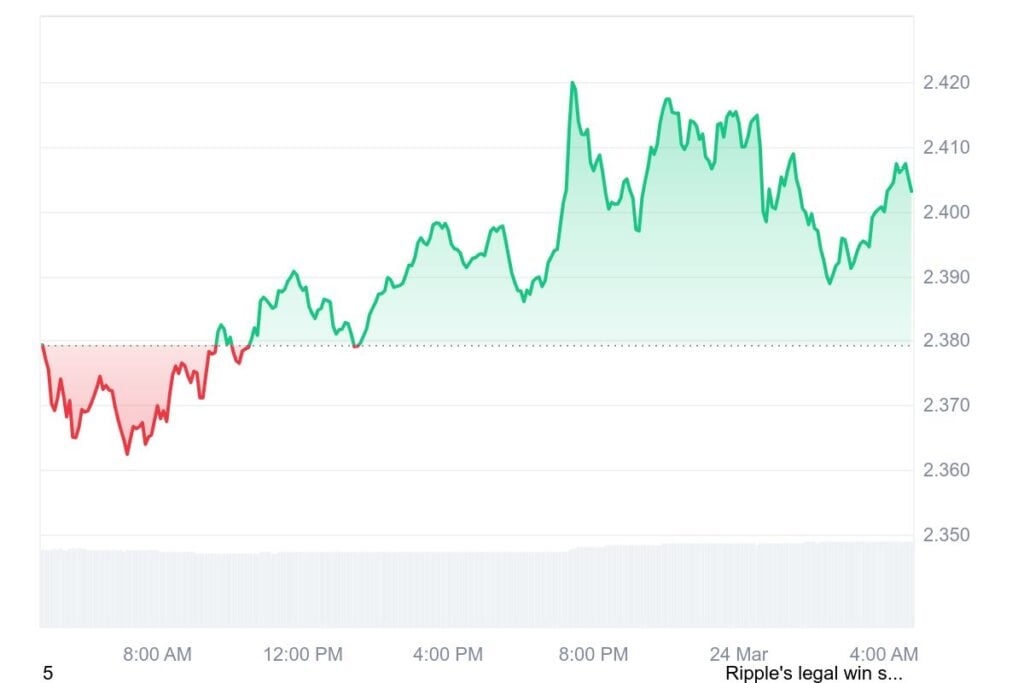

Xrp (xrp)

XRP remains an important player in the encryption market, although not generating a lot of excitement like some other symbols. From a basic perspective, XRP has $ strong potential, especially after resolving its legal battle with the Supreme Education Council.

Although the results of the case did not classify XRP as safety, its cleansing of organizational uncertainty provides a more stable path forward.

Historically, XRP has not yet reached a sign of $ 4, but there is speculation that it can reconsider its highest level of $ 3 and may exceed this level. With a large market share and strong hegemony, $ XRP is still one of the relevant assets in the broader scene of encryption.

Cardano (Ada)

Cardano currently holds the market value of $ 24.7 billion, but it has not yet made any important moves in this session. However, there is increasing speculation that Coinbase has become increasingly favorable towards Cardano, which may lead to a large launch on the stock exchange.

Such development has the ability to increase the increase in large prices for the original. While $ Ada has been relatively calm in terms of major developments, it can be a strategic list or increasing support from major platforms like Coinbase is the catalyst for a strong escalating movement in its evaluation.