Bitcoin after the golden footsteps? The analyst sets an average goal in the range of $ 155,000

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

With gold continues to put new levels at all (ATH)- commerce At $ 3333 an ounce at the time of writing this report-Bitcoin (BTC) witnessed quieter price procedures, combined in the mid-$ 80,000. However, analysts note that the highest digital assets may soon reflect the last momentum of gold.

Bitcoin set to follow the gold momentum?

In a conversation mail In X, the Crypto Trading Cleptollica account that BTC may be ready to repeat the historical price of gold in the past few months. Share the next scheme, with the amazing similarities between gold prices and BTC.

The graph shows both gold and BTC formed a micro -bottom in early 2023, followed by a rejection in the range in early 2024. Gold ultimately erupted in the following months, while BTC was slightly left, around November 2024.

Related reading

According to Cryptollica, BTC now seems to explode from a unified wedge style, with a possible goal in the middle of the period of up to $ 155,000. Currently, the price of Bitcoin’s ATH is 108786 dollars, and it recorded earlier this year in January.

BTC is also likely to benefit from many favorable macroeconomic trends. For example, the global money show is expected to be M2 He increases In 2025, a development usually supports assets of risk such as bitcoin.

BTC ripens as a safe haven

Beyond the patterns of artistic charts, showed BTC great Steadfastness Amid the escalation of uncertainty caused by customs tariffs. According to the last week’s report, Gold and BTC were well performed during the ongoing tariff war. The report notes:

In the midst of these disorders, the performance of solid assets is still noticeably impressive. Gold continues to rise higher, after reaching a new ATH of $ 3,300, as investors turn to the assets of traditional safe haven. Bitcoin was sold to 75 thousand dollars in the beginning, along with the origins of the risk, but it has regained the gains made by the week, as up to 85 thousand dollars was circulated, and it is now flat since the fluctuation explosion.

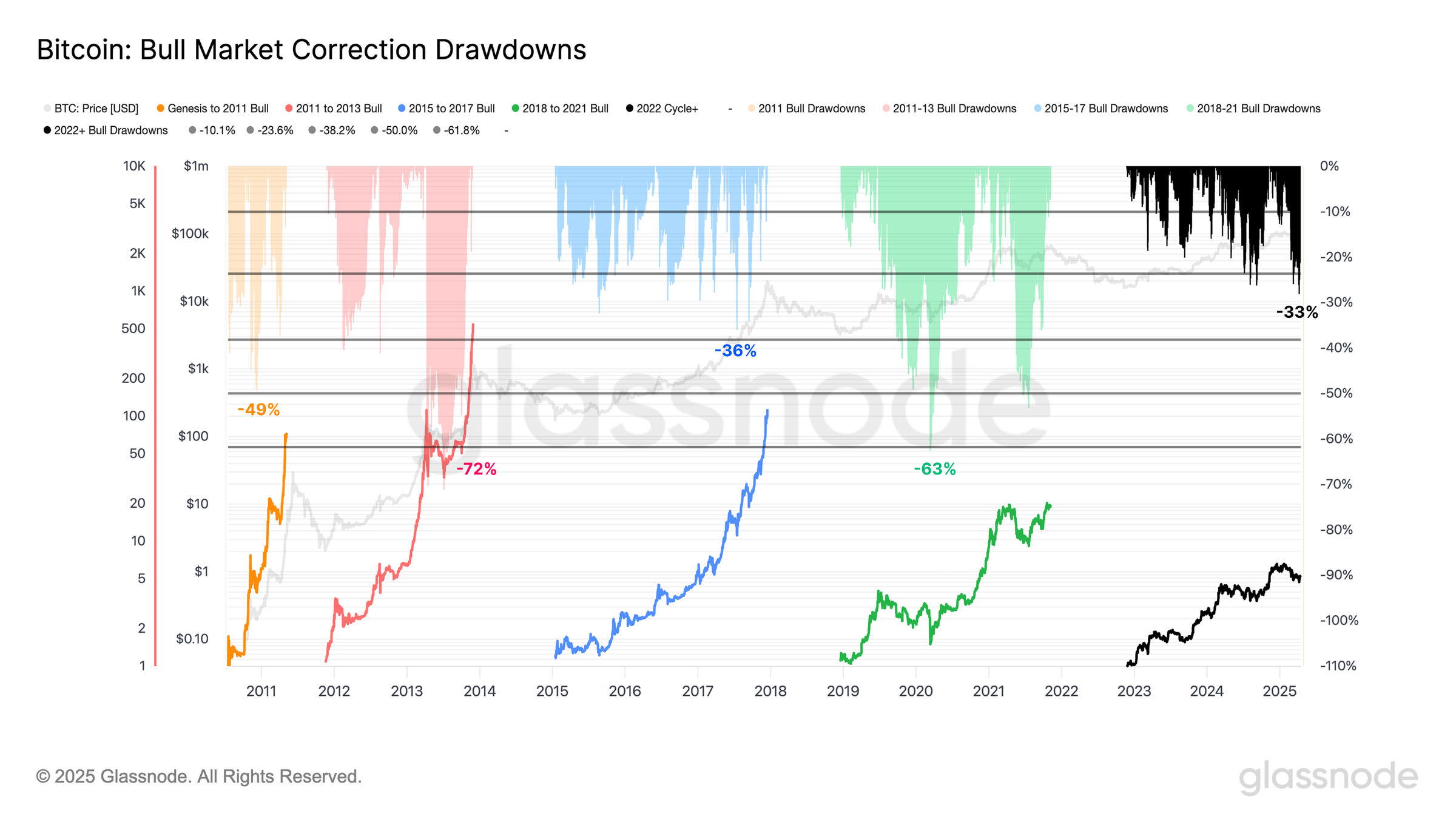

The report also states that BTC recently witnessed the largest price correction in the 2023-25 cycle, by -33 % of ATH earlier this year. However, this correction remains relatively modest compared to those seen in previous market courses.

Related reading

The following chart shows the declines of the BTC Bull market since 2011. As shown, the last -33 % correction is the most shallow of the previous sessions, with the deepest being -72 % during the Taurus 2012-14.

While BTC continues to show signs of maturity as a reliable origin during times of geopolitical uncertainty, institutional investors He appears To take profits. This is evident through the recent outflows of boxes circulating in Bitcoin exchange (ETFS). At the time of the press, BTC is trading at $ 84,694, an increase of 0.7 % over the past 24 hours.

Distinctive image from Unsplash, X, Glassnode, and TradingView.com