The analyst says that the Bitcoin Market Course indicates that

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

According to Cryptoquant Quicktake Post recently by Burkkemeci shareholder, Bitcoin (BTC) began to show signs of direction reflection after weeks of the descending movement. It is worth noting that BTC rose to $ 100,000 yesterday since February 3.

Bitcoin on the edge of the reflection of the direction?

At the time of this report, Bitcoin is trading a little bitcoin, or approximately 5.2 % of its highest level (ATH) of $ 108,786, which was determined earlier this year on January 20. The leading cryptocurrency has organized an impressive recovery of more than 20 % of its lowest level of $ 74.508 registered on April 6.

Related reading

In their analysis, the Bull-Bear Cryptoquant Market Course indicated, saying it tends to Early signs In contrast to the potential upward trend. Note the analyst:

With Bitcoin rising again over $ 100,000, the index began to flash bullish signals again – for the first time in weeks. Although the signal is still weak (laboratories: 0.029), the mere appearance of a positive transformation is a fan.

To explain, the Cryptoquant Bull-Bear market is a tool on the chain that tracks long-term and short-term market morale by comparing investor behavior trends. Two major components-average movement for 30 days and 365 days (MA)-is used to determine the transformations between bulls and bear.

More importantly, the analyst indicated that MA Bull-Bear for 30 days has started to climb. If this scale crosses above the MA 365 days, historical trends indicate that Bitcoin can enter a stage of equivalent price growth.

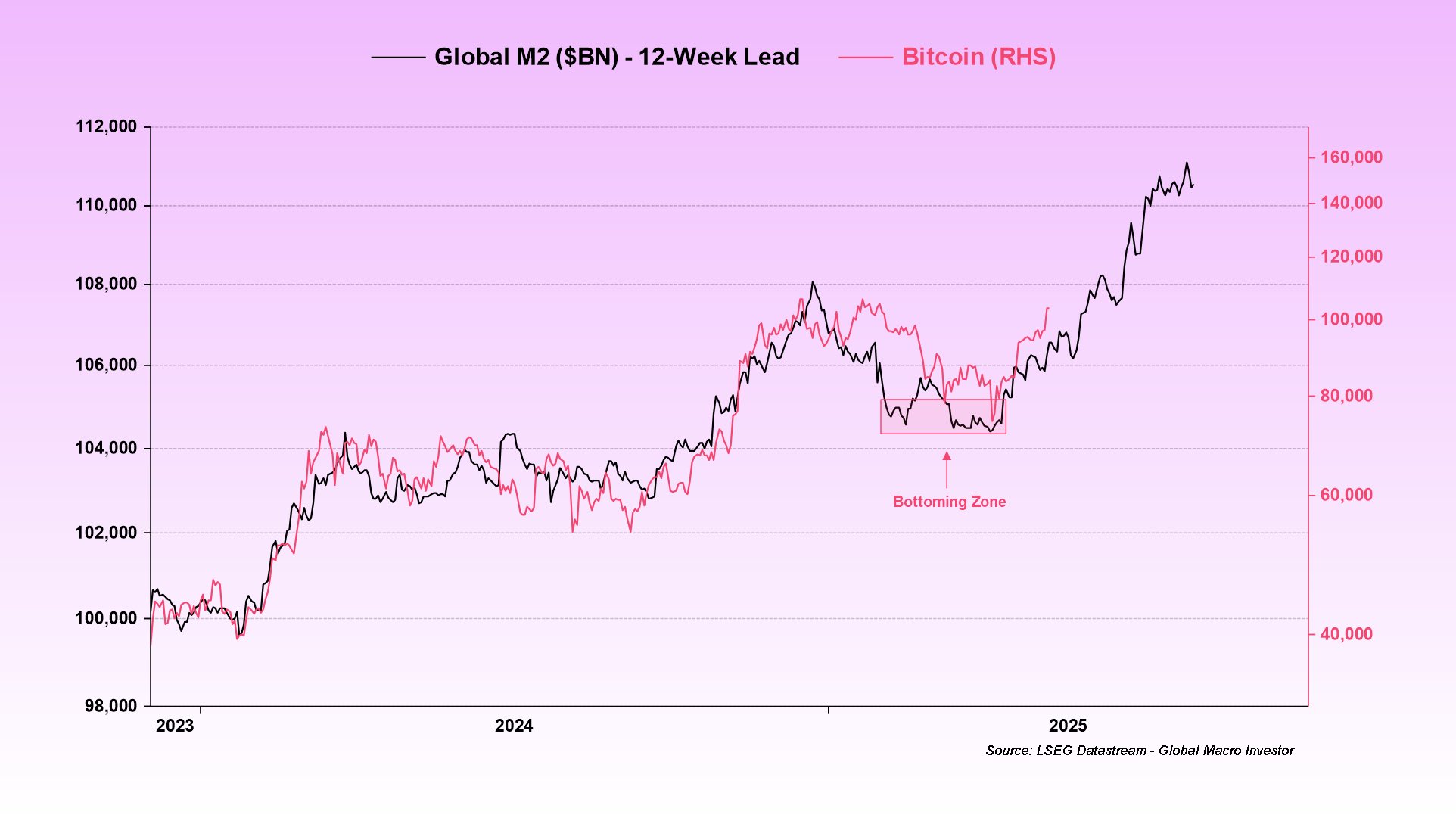

Modern economic developments may support the budget of Bitcoin. Julian Beetle, head of Macro Macro Investor, has recently shed light on the relationship between the global M2 Supply and BTC price.

Bittel shared a scheme that interferes with the price of BTC with M2 Money Supply, modified with a duration of 12 weeks. Data reveals a severe increase in global liquidity since early 2025, which means that BTC can follow this trend and continue to rise in the coming months.

Warning signs are still based on BTC

Despite modern power, not all signals are upward. Analysts warn that the current assembly was Accompanied By achieving aggressive profit and increasing the chances of forming a local summit.

Related reading

Moreover, modern analysis He appears This momentum request BTC has not yet left the negative lands. The analyst pointed out that this behavior in the market is mostly spread during the stages of the late cycle distribution or periods of unification of the total level.

However, the RAM index began in Bitcoin (RSI) Reflect Renew the bullish momentum. At the time of the press, BTC is trading at 103,444 dollars, an increase of 4 % in the past 24 hours.

A distinctive image created with non -bloggers, plans from Cryptoquant, X, and TradingView.com