The analyst says that Bitcoin should scan the critical cost level to the continuation of the upward trend

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

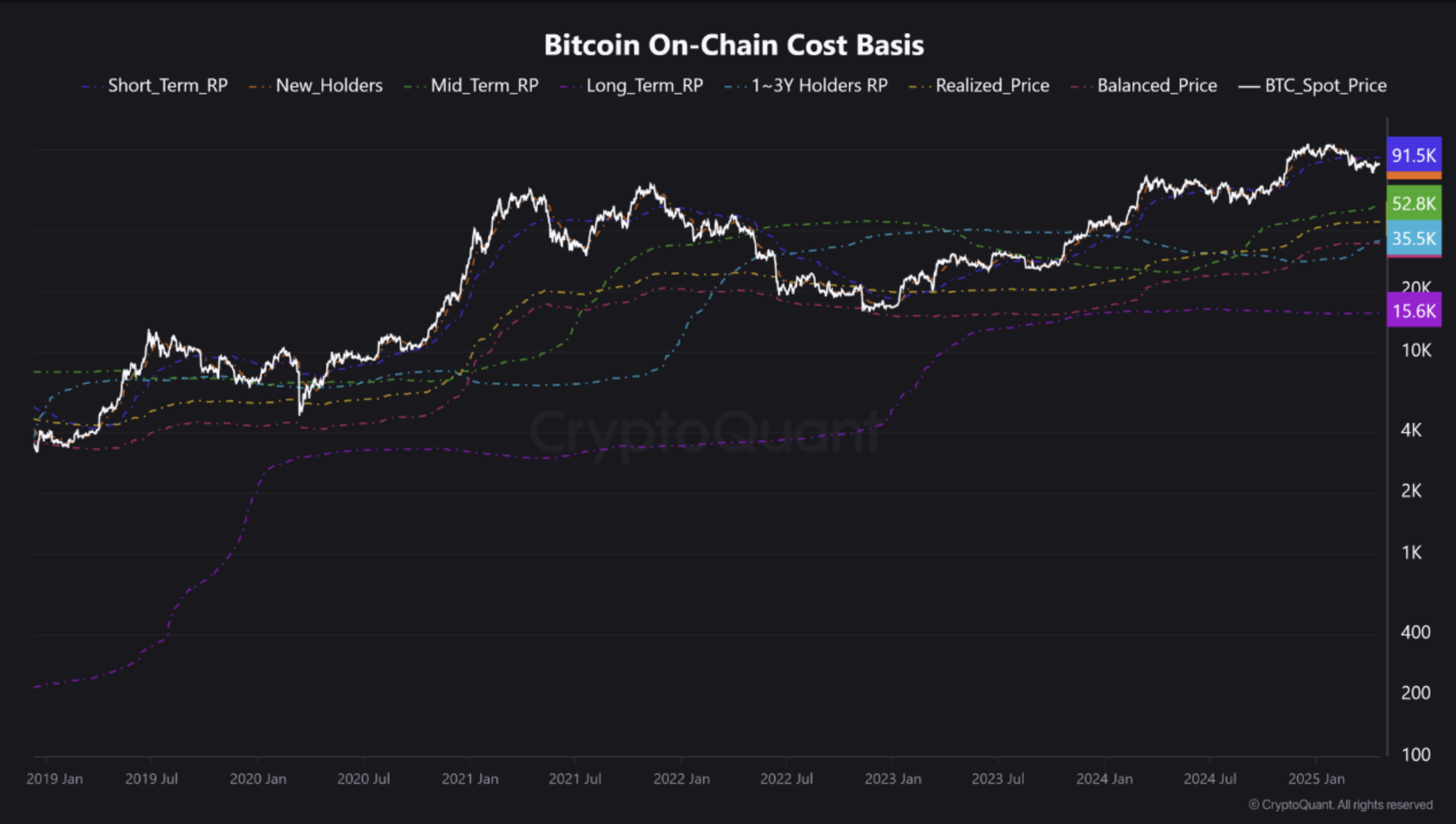

In the recently QuickTake CryptoQuant post, the most prominent shareholder Crazzyblockk is highlighted the main cost areas of Bitcoin (BTC) that should be the leading cryptocurrency – or avoid collapse – to maintain its upward momentum.

The analyst highlights the main bitcoin cost areas

Bitcoin started showing signs New powerWith the higher digital assets of approximately 3.5 % during the past week and trading in a range of $ 80,000 at the time of writing this report. BTC’s height amid the shrinkage of the global stock market discussed discussions on the potential of the cryptocurrency “jaw” from traditional markets.

Related reading

In the recently QuickTake Publicity, define Cryptoquant Crazzyblockk’s asset areas of different Bitcoin and price scores achieved to determine the main resistance and support levels.

The analyst pointed out that short-term holders-those who kept BTC less than 155 days-are currently the price of investigators, or average cost, who sit at the resistance level of $ 91500. Crazzyblockk added that this group tends to be the most sensitive to the price.

On the other hand, the basis for costs for new holders – those who kept digital assets for a month to three months – currently has the most powerful support level of about $ 83,700. The analyst pointed out that this level mainly represents the cost of participants in the modern market, who often lead changes in the short -term direction.

To clarify, the cost basis areas are price levels where a large amount of BTC has been transferred or earned. A possible collapse above the price of holders of the short -term holders will indicate a new rise, because these bearers will return a profit and less vulnerable to selling their holdings.

On the contrary, an interruption may indicate the level of support for the cost of new pregnant women to the movement of the potential negative side, as new buyers may start incurring losses and have to surrender.

It is worth noting that each cost basis line that was highlighted in the graph below is calculated based on the price achieved for non -transferred transactions (UTXOS) held within a specific age range. Likewise, the achieved price is determined by dividing the total value of all UTXOS on the number of coins.

Do investors expect more upward trend?

The latest analysis of the series indicates that BTC holders may be anticipation More bullish direction. It appears to be short -term holders a contract On BTC although they are in losing mode.

Related reading

In addition, net encoding net flow data Hints The BTC price may be imminent. Some analysts also draw similarities to the last historical work of gold and Prediction “Digital Gold” may soon face a similar momentum.

However, the feelings of the Bitcoin Futures Index Indicate Towards the high pessimism surrounding BTC, driven by total economic certainty. As of the time of the press, BTC is trading at $ 88,759, an increase of 1.7 % in the past 24 hours.

A distinctive image created with UNSPLASH, plans from Cryptoquant and TradingView.com