Bitcoin LTH pressure pressure pressure on low annual – bull market is ready to take off?

After a widespread price of the price in the past three months, the bitcoin bull market continues to suspend the balance. Despite the recovery of modest prices in April, the first cryptocurrency has not yet been offered a strong intention to resume the bull’s gathering amid positive market factors. However, the Axel Adler JR. A promising development that can indicate the possibility of the main height of Bitcoin.

Bitcoin holders in the long run looking to stop the pressure

in Modern job In x, Share Adler JR. An important update in the activity of Bitcoin in the long run (LTH), which may be greatly positive for the broader BTC market.

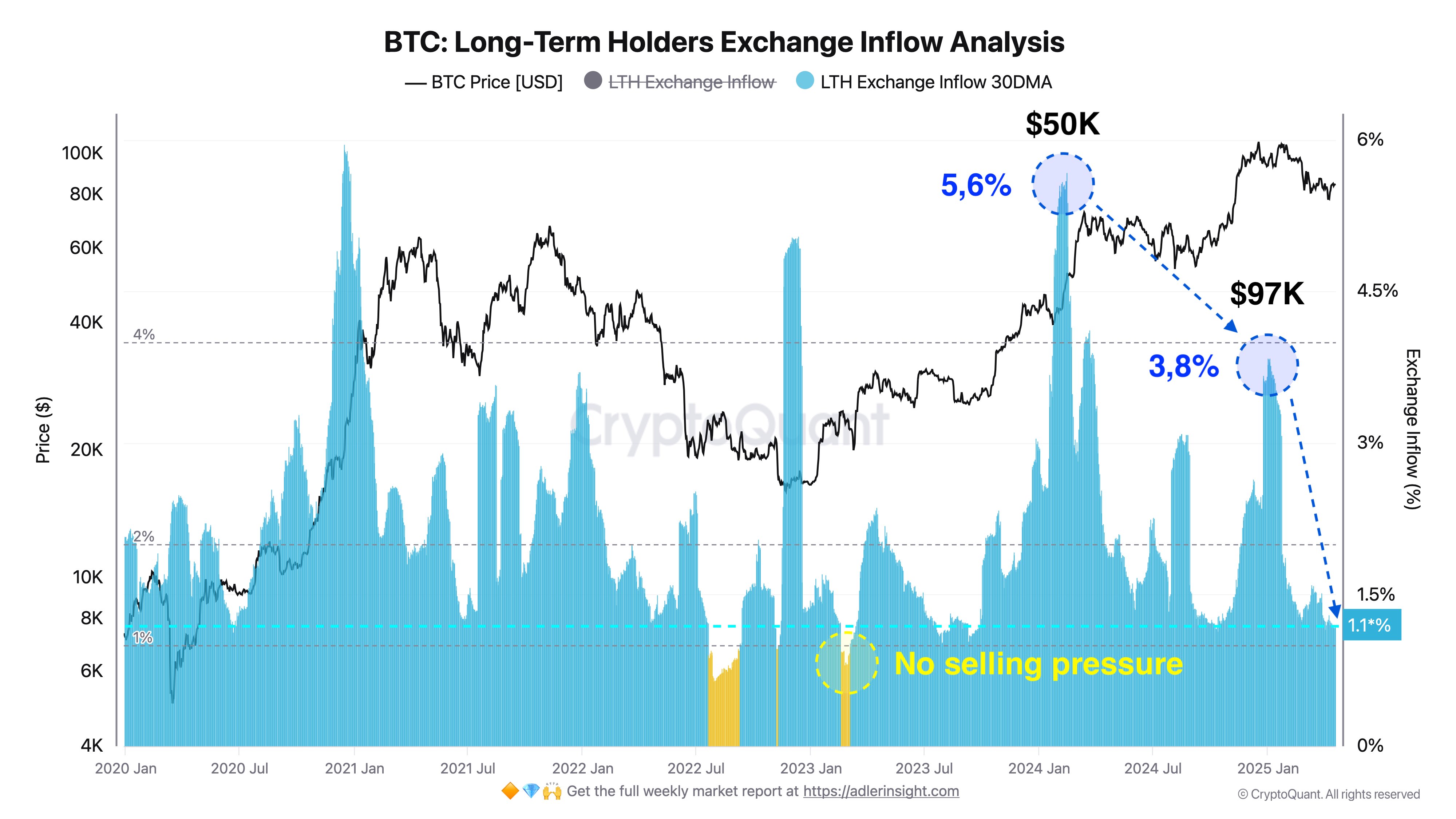

Using data on the chain of Cryptoquant, the famous analyst states that pressure by their holders in the long run, that is, a quantity of LTH property on the stock exchanges, has reached the lowest point of 1.1 % during the past year. This development indicates that Bitcoin LTH now chooses to stick to their origins instead of achieving profits.

Adler explains that the additional decrease in these Excination holdings to 1.0 % would indicate that there is no complete pressure of the sale pressure. It is worth noting that this development can encourage the entry of the new market and continuous accumulation, creating a strong upward momentum in the BTC market.

More importantly, Alder highlights that the majority of LTH Bitcoin entered the market at an average price of $ 25,000, since then, Cryptoquant recorded the highest LTH pressure pressure by 5.6 % at $ 50,000 in early 2024 and 3.8 % at 97,000 dollars in early 2025.

According to Adler, these two cases are likely to represent the basic stages of profit for long -term holders who intend to get out of the market. Therefore, the recovery is unlikely to sell selling pressure from this group of BTC investors in the short term, which supports the ups of the building where their holders are currently controlling the long -term in 77.5 % of the circulating bitcoin.

BTC price overview

At the time of this report, Bitcoin was trading at $ 85,226 after an increase of 0.36 % last day and a loss of 0.02 % last week. Both metrics only reflect the unification of the continuous market, as BTC continues the struggle to achieve a convincing price of the price exceeding $ 86,000.

Meanwhile, the performance of assets in the monthly chat now reflects a 1.97 % increase, indicating a possible reflection of the market correction. However, BTC still needs a stimulus in the strong market to ignite any sustainable prices. With the rise of the market of $ 1.67 trillion, Bitcoin is classified as the largest digital asset, controlling 62.9 % of the encryption market.

Distinctive image from Adobe Stock, the tradingview chart

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.